PIMCO vs PIMCO

I recently read an interesting article that you might have come across as well. In it, one of the top dogs at Pimco claims that “we’re in the final innings of the real estate market,” while other analysts at Pimco expect only a slowdown of home-price growth.

If the name “Pimco” doesn’t ring a bell, they are an investment management firm rivaling the likes of Vanguard – and, more likely than not, are part of your investment portfolio.

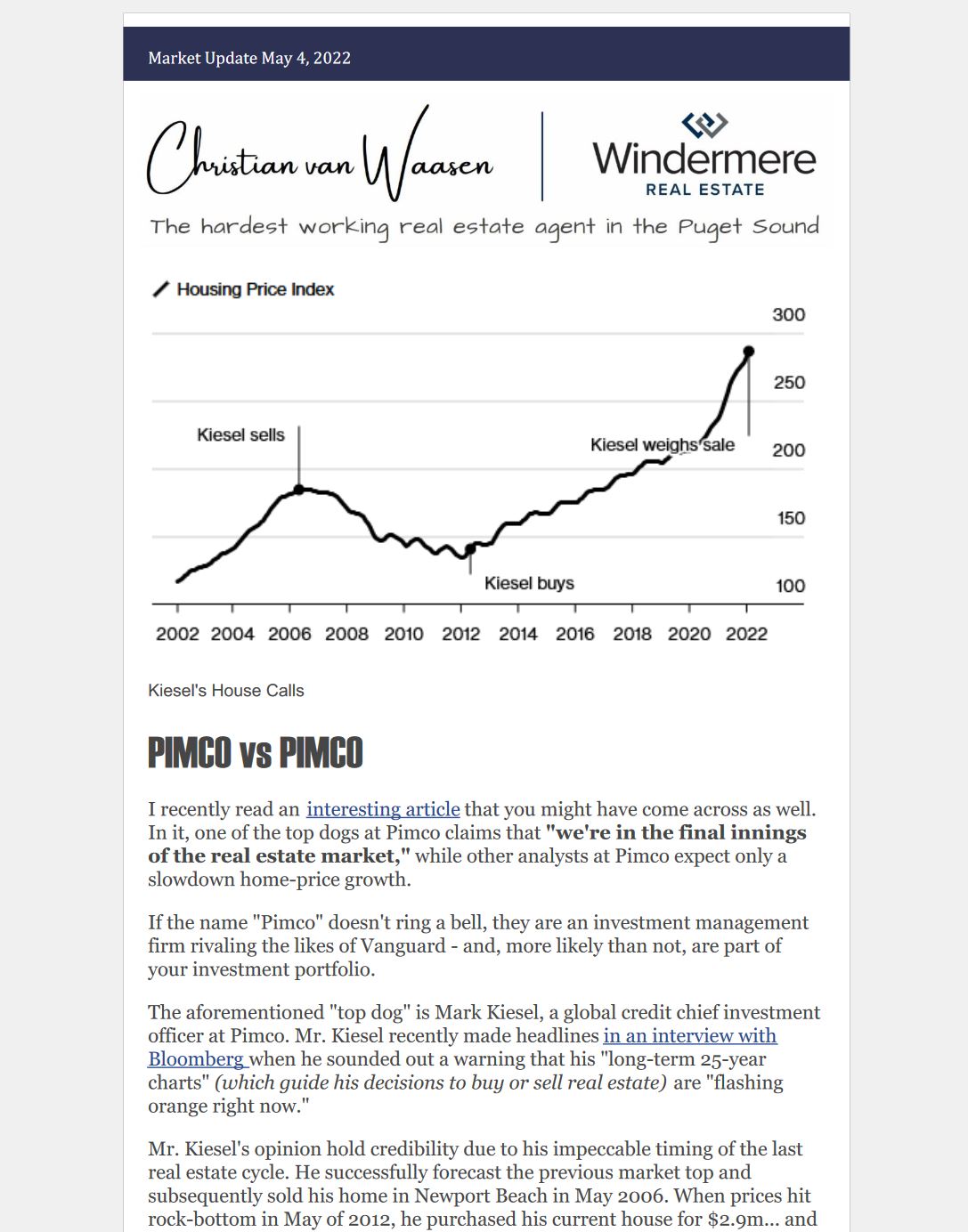

The aforementioned “top dog” is Mark Kiesel, a global credit chief investment officer at Pimco. Mr. Kiesel recently made headlines in an interview with Bloomberg when he sounded out a warning that his “long-term 25-year charts” (which guide his decisions to buy or sell real estate) are “flashing orange right now.”

Mr. Kiesel’s opinion hold credibility due to his impeccable timing of the last real estate cycle. He successfully forecast the previous market top and subsequently sold his home in Newport Beach in May 2006. When prices hit rock-bottom in May 2012, he purchased his current house for $2.9m… and is now considering selling it.

Mr. Kiesel views his home as a substantial investment, one that has doubled over the last 10 years. He suggests that buying a home in today’s market wouldn’t net more than a 2% return.

Kiesel’s stance differs from that of the company he works for. The analysts at Pimco believe that this time the housing cycle is different – thanks to the inventory shortage and the fact that the vast majority of borrowers are deleveraged.

Pimco analysts expect that as home affordability will continue to drop as interest rates continue to rise will not lead to a housing bust, but instead slow price growth and ultimately home sales. A slowing of home sales would allow housing inventory to recover and returning us to a balanced market. Other economists agree, expecting homes sales to drop by 20% or more in the coming months.

Thankfully, they’re still orange and not flashing red. There are still plenty of other economic factors that are currently playing out that will have to play out.

The Bottom line:

I think what Mr. Kiesel is proposing is to sell his soon-to-be under-preforming asset class in favor of an out-preforming asset class. For him, homeownership is simply a weighted opportunity cost analysis. Surely, he can find a better asset class that will preform better than 2% annually.

I’d venture to guess that the majority of homeowners don’t view their homes in the same light. They’d rather own their homes, regardless if renting could be potentially more profitable. I’d also venture to guess that most people wouldn’t shoulder the risk of gambling/investing their largest asset on equity plays on the cusp of a recession.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link