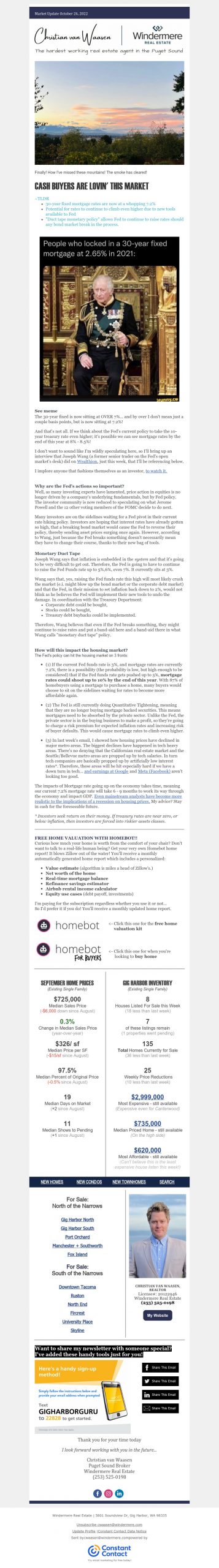

CASH BUYERS ARE LOVIN’ THIS MARKET

~TLDR

- 30-year fixed mortgage rates are now at a whopping 7.2%

- Potential for rates to continue to climb even higher due to new tools available to Fed

- “Duct tape monetary policy” allows Fed to continue to raise rates should any bond market break in the process.

See meme

The 30-year fixed is now sitting at OVER 7%… and by over I don’t mean just a couple basis points, but is now sitting at 7.2%!

And that’s not all. If we think about the Fed’s current policy to take the 10-year treasury rate even higher; it’s possible we can see mortgage rates by the end of this year at 8% – 8.5%!

I don’t want to sound like I’m wildly speculating here, so I’ll bring up an interview that Joseph Wang (a former senior trader on the Fed’s open market’s desk) did on Wealthion, just this week, that I’ll be referencing below. I implore anyone that fashions themselves as an investor, to watch it.

Why are the Fed’s actions so important?

Well, as many investing experts have lamented, price action in equities is no longer driven by a company’s underlying fundamentals, but by Fed policy. The investor community is now reduced to speculating on what Jerome Powell and the 12 other voting members of the FOMC decide to do next.

Many investors are on the sidelines waiting for a Fed pivot in their current rate hiking policy. Investors are hoping that interest rates have already gotten so high, that a breaking bond market would cause the Fed to reverse their policy, thereby sending asset prices surging once again. However, according to Wang, just because the Fed breaks something doesn’t necessarily mean they have to change their course, thanks to their new bag of tools.

Monetary Duct Tape

Joseph Wang says that inflation is embedded in the system and that it’s going to be very difficult to get out. Therefore, the Fed is going to have to continue to raise the Fed Funds rate up to 5%,6%, even 7%. It currently sits at 3%.

Wang says that, yes, raising the Fed funds rate this high will most likely crush the market (e.i. might blow up the bond market or the corporate debt market) and that the Fed, in their mission to set inflation back down to 2%, would not blink as he believes the Fed will implement their new tools to undo the damage. In coordination with the Treasury Department:

- Corporate debt could be bought,

- Stocks could be bought,

- Treasury debt buybacks could be implemented.

Therefore, Wang believes that even if the Fed breaks something, they might continue to raise rates and put a band-aid here and a band-aid there in what Wang calls “monetary duct tape” policy.

How will this impact the housing market?

The Fed’s policy can hit the housing market on 3 fronts:

- If the current Fed funds rate is 3%, and mortgage rates are currently 7.2%, there is a possibility (the probability is low, but high enough to be considered) that if the Fed funds rate gets pushed up to 5%, mortgage rates could shoot up to 10% by the end of this year. With 87% of homebuyers using a mortgage to purchase a home, many buyers would choose to sit on the sidelines

- The Fed is still currently doing Quantitative Tightening, meaning that they are no longer buying mortgage backed securities. This means mortgages need to be absorbed by the private sector. Unlike the Fed, the private sector is in the buying business to make a profit, so they’re going to charge a risk premium for expected inflation rates and increasing risk of buyer defaults. This would cause mortgage rates to climb even higher.

- In last week’s email, I showed how housing prices have declined in major metro areas. The biggest declines have happened in tech heavy areas. There’s no denying that the Californian real estate market and the Seattle/Bellevue metro areas are propped up by tech salaries. In turn tech companies are basically propped up by artificially low interest rates*. Therefore, these areas will be hit especially hard if we have a down turn in tech… and earnings at Google and Meta (Facebook) aren’t looking too good.

The impacts of Mortgage rate going up on the economy takes time, meaning our current 7.2% mortgage rate will take 6 – 9 months to work its way through the economy and impact GDP. Even mainstream analysts have become more realistic to the implications of a recession on housing prices. My advice? Stay in cash for the foreseeable future.

* Investors seek return on their money. If treasury rates are near zero, or below inflation, then investors are forced into riskier assets classes. .

.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link