GOLDMAN SACHS NOW REPORTING HUGE HOUSING CORRECTION IN SOME MARKETS!

For the TLDR, just read the bullet points.

Here is a quick synopsis for Goldman Sach’s Housing and Mortgage Monitor from Oct 6, 2022. While the pdf is behind a paywall, I have gone through the report and pulled out their 14 most important findings:

- Personal bankruptcies filings rates are at multi-decade lows

- Why this matters: This metric matters when it comes to the housing market because when individuals feel like they are so saturated in debt they have to file for bankruptcy, meaning having a market with more foreclosures.

- Financial obligations (including debt payments, lease payments, property taxes, and rents) relative to incomes are staying low by historical standards.

- Why this matters: Having a low financial obligation ratio is very good. The current ratio of debt-to-income is sitting at about 14.2%. However, it appears the ratio is increasing to pre-pandemic levels of 15%. Pre-2008 levels fluctuated between 17%-18%.

- Household debt-to-income ratios have started to elevate

- Why this matters: Current DTI ratio is hovering at 70%, but is climbing back to pre-pandemic levels to 76%. This is much lower than the early 2000s, which saw levels between 100%-110% DTI before the housing crash.

- FICO scores are coming down, but still far exceed GFC levels.

- Why this matters: FICO scores for many metro areas average around 740. This is far higher than the previous recession, which saw massive levels of debt and speculation, where the average credit score ranged between 660-680. This increase in creditworthiness means many homeowners are getting the best interest rates on their mortgages. Credit scores also represent the risk of the individual defaulting on their obligations.

- All price tiers have started to underperform in recent months

- Why this matters: All tiers of housing prices (Low Tier, Mid Tier and High Tier) have started to decline and are down 6-7% so far. So far this is by no means a crash, and we’re still far above pre-pandemic levels.

- Sequential house price appreciation is now at 6% annualized pace

- Why this matters: Annualized Month-over-Month House Price Appreciation has declined to pre-pandemic levels and are expected to go negative to reflect the decline in housing prices. During the pandemic, we saw Month-over-Month Appreciation fluctuate between 15-25%.

- Share of young adults living with parents remains elevated at multi-decade highs

- Why this matters: 33% of 18-34 year olds are living with parents. This remains close to pandemic highs. This stunts the growth of “new household formations.” Prior to 2008, the historic average sat at 28%. There is a potential surplus of new homebuyers that might take advantage of a decline in home prices and lead to the housing market bouncing back faster than expected.

- Why this matters: 33% of 18-34 year olds are living with parents. This remains close to pandemic highs. This stunts the growth of “new household formations.” Prior to 2008, the historic average sat at 28%. There is a potential surplus of new homebuyers that might take advantage of a decline in home prices and lead to the housing market bouncing back faster than expected.

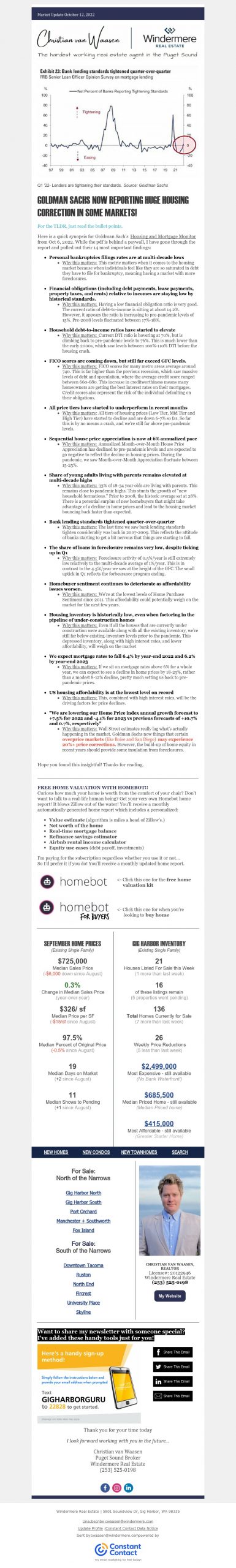

- Bank lending standards tightened quarter-over-quarter

- Why this matters: The last time we saw bank lending standards tighten considerably was back in 2007-2009. This reflects the attitude of banks starting to get a bit nervous that things are starting to fall.

- The share of loans in foreclosure remains very low, despite ticking up in Q1

- Why this matters: Foreclosure activity of 0.5%/year is still extremely low relatively to the multi-decade average of 1%/year. This is in contrast to the 4.5%/year we saw at the height of the GFC. The small uptick in Q1 reflects the forbearance program ending.

- Homebuyer sentiment continues to deteriorate as affordability issues worsen.

- Why this matters: We’re at the lowest levels of Home Purchase Sentiment since 2011. This affordability could potentially weigh on the market for the next few years.

- Housing inventory is historically low, even when factoring in the pipeline of under-construction homes

- Why this matters: Even if all the houses that are currently under construction were available along with all the existing inventory, we’re still far below existing-inventory levels prior to the pandemic. This depressed inventory, along with high interest rates, and lower affordability, will weigh on the market.

- We expect mortgage rates to fall 6.4% by year-end 2022 and 6.2% by year-end 2023

- Why this matters: If we sit on mortgage rates above 6% for a whole year, we can expect to see a decline in home prices by 18-25%, rather than a modest 8-12% decline, pretty much setting us back to pre-pandemic prices.

- US housing affordability is at the lowest level on record

- Why this matters: This, combined with high interest rates, will be the driving factors for price declines.

- “We are lowering our Home Price index annual growth forecast to +7.5% for 2022 and -4.1% for 2023 vs previous forecasts of +10.7% and 0.7%, respectively”

- Why this matters: Wall Street estimates really lag what’s actually happening in the market. Goldman Sachs now things that certain overprice markets (like Boise and San Diego) may experience 20%+ price corrections. However, the build-up of home equity in recent years should provide some insulation from foreclosures.

Hope you found this insightful! Thanks for reading.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link