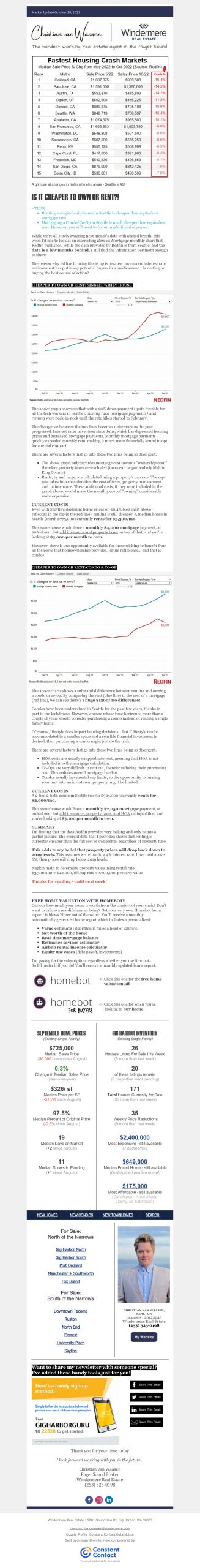

IS IT CHEAPER TO OWN OR RENT?!

~TLDR

- Renting a single-family house in Seattle is cheaper than equivalent mortgage cost.

- Mortgaging a Condo/Co-Op in Seattle is much cheaper than equivalent rent. However, you still need to factor in additional expenses.

While we’re all surely awaiting next month’s data with abated breath, this week I’d like to look at an interesting Rent vs Mortgage monthly chart that Redfin publishes. While the data provided by Redfin is from Seattle, and the data is a few months behind, I still find the information pertinent enough to share.

The reason why I’d like to bring this is up is because our current interest rate environment has put many potential buyers in a predicament… is renting or buying the best course of action?

CHEAPER TO OWN OR RENT: SINGLE FAMILY HOUSE

The above graph shows us that with a 20% down payment (quite feasible for all the tech workers in Seattle), owning (aka mortgage payments) and renting were neck-in-neck until the rate hikes started in February.

The divergence between the two lines becomes quite stark as the year progressed. Interest rates have risen since June, which has depressed housing prices and increased mortgage payments. Monthly mortgage payments quickly exceeded monthly rent, making it much more financially sound to opt for a rental contract.

There are several factors that go into these two lines being so divergent:

- The above graph only includes mortgage cost towards “ownership cost,” therefore property taxes are excluded (taxes can be particularly high in King County).

- Rents, by and large, are calculated using a property’s cap rate. The cap rate takes into consideration the cost of taxes, property management and maintenance. These additional costs, if they were included in the graph above, would make the monthly cost of “owning” considerably more expensive.

CURRENT COSTS

Even with Seattle’s declining home prices of -10.4% (see chart above – reflected in the dip in the red line), renting is still cheaper. A median house in Seattle (worth $775,000) currently rents for $3,500/mo.

This same house would have a monthly $4,000 mortgage payment, at 20% down. But add insurance and property taxes on top of that, and you’re looking at $5,000 per month to own.

However, there is one opportunity available for those wishing to benefit from all the perks that homeownership provides…drum roll please… and that is condos!

CHEAPER TO OWN OR RENT:CONDO & CO-OP

The above charts shows a substantial difference between renting and owning a condo or co-op. By comparing the rent (blue line) to the cost of a mortgage (red line), we can see there’s a huge $1200/mo difference!

Condos have been undervalued in Seattle for the past few years, thanks in part to the lockdowns. However, anyone whose time horizon is more than a couple of years should consider purchasing a condo instead of renting a single family home.

Of course, lifestyle does impact housing decisions… but if lifestyle can be accommodated in a smaller space and a sensible financial investment is desired, then purchasing a condo might just do the trick.

There are several factors that go into these two lines being so divergent.

- HOA costs are usually wrapped into rent, meaning that HOA is not included into the mortgage calculation.

- Co-Ops are very difficult to rent out, therefor reducing their purchasing cost. This reduces overall mortgage burden.

- Condos usually have rental cap limits, so the opportunity to turning your unit into an investment property might be limited.

CURRENT COSTS

A 2-bed 2-bath condo in Seattle (worth $395,000) currently rents for $2,600/mo.

This same house would have a monthly $2,050 mortgage payment, at 20% down. But add insurance, property taxes, and HOA on top of that, and you’re looking at $3,100 per month to own.

SUMMARY

I’m finding that the data Redfin provides very lacking and only paints a partial picture. The current data that I provided shows that renting is currently cheaper than the full cost of ownership, regardless of property type.

This adds to my belief that property prices will drop back down to 2019 levels. This assumes we return to a 4% interest rate. If we hold above 6%, then prices will drop below 2019 levels.

Napkin math to determine property value using rental rate:

$3,500 x 12 = $42,000/6% cap rate = $700,000 property value

Thanks for reading – until next week!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link