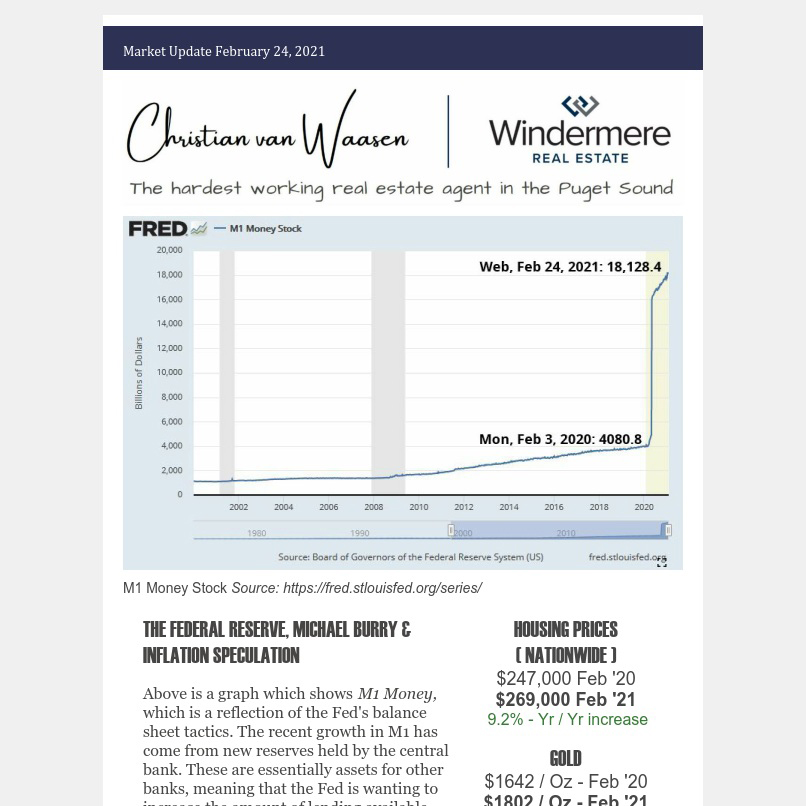

THE FEDERAL RESERVE, MICHAEL BURRY & INFLATION SPECULATION

Above is a graph which shows M1 Money, which is a reflection of the Fed’s balance sheet tactics. The recent growth in M1 has come from new reserves held by the central bank. These are essentially assets for other banks, meaning that the Fed is wanting to increase the amount of lending available.

The real life Big Short, Michael Burry recently tweeted to warn us of hyperinflation “…caused by trillions in stimulus to boost demand, causing supply chain and employee costs to skyrocket.” Super abundance of cheap money will undoubtedly reduce the purchase power of a dollar. Even Bank of America’s CIO has been warning that 2021 is the year where real inflation will eventually run amok.

While there are always doomsayers, it doesn’t hurt to protect yourself from inflation. In addition to taking a loan with a low rate, to the right are additional assets that can be easily bought to protect you during an inflationary period.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link