SEPTEMBER’S NUMBERS ARE IN – LET’S DIVE IN!

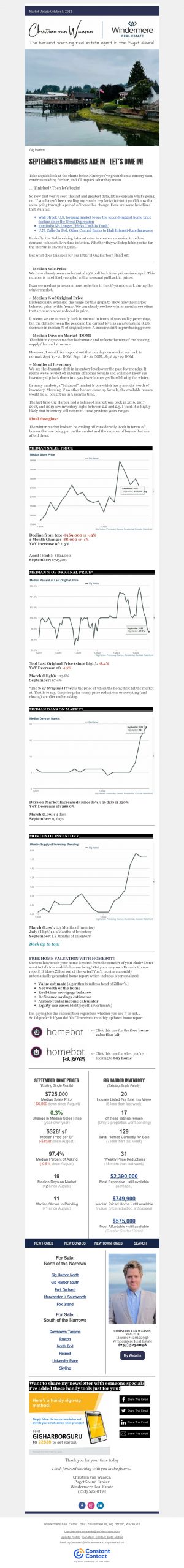

Take a quick look at the charts below. Once you’ve given them a cursory scan, continue reading further, and I’ll unpack what they mean.

…. Finished? Then let’s begin!

So now that you’ve seen the last and greatest data, let me explain what’s going on. If you haven’t been reading my emails regularly (tut-tut!) you’ll know that we’re going through a period of incredible change. Here are some headlines that stun me:

- Wall Street: U.S. housing market to see the second-biggest home price decline since the Great Depression

- Ray Dalio No Longer Thinks ‘Cash Is Trash’

- U.N. Calls On Fed, Other Central Banks to Halt Interest-Rate Increases

Basically, the Fed is raising interest rates to create a recession to reduce demand to hopefully reduce inflation. Whether they will stop hiking rates for the interim is anyone’s guess.

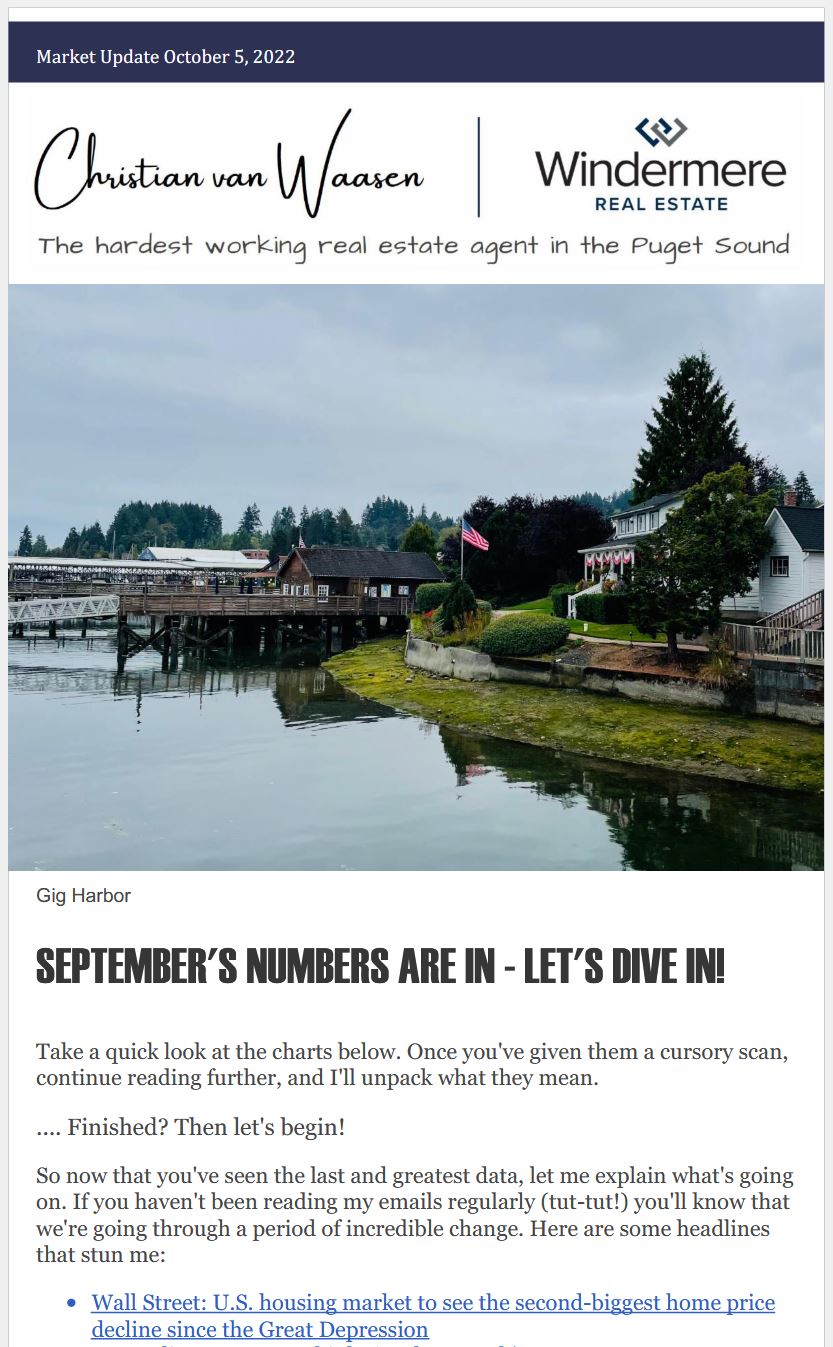

But what does this spell for our little ‘ol Gig Harbor? Read on:

~ Median Sale Price

We have already seen a substantial 19% pull back from prices since April. This number is most likely coupled with a seasonal pullback in prices.

I can see median prices continue to decline to the $650,000 mark during the winter market.

~ Median % of Original Price

I intentionally extended the range for this graph to show how the market behaved prior to this frenzy. We can clearly see how winter months see offers that are much more reduced in price.

It seems we are currently back to normal in terms of seasonality percentage, but the delta between the peak and the current level is an astonishing 8.2% decrease in median % of original price. A massive shift in purchasing power.

~ Median Days on Market (DOM)

The shift in days on market is dramatic and reflects the turn of the housing supply/demand structure.

However, I would like to point out that our days on market are back to normal: Sept ’17 – 21 DOM, Sept ’18 – 21 DOM, Sept ’19 – 19 DOM.

~ Months of Inventory

We see the dramatic shift in inventory levels over the past few months. It seems we’ve leveled off in terms of homes for sale and will most likely see inventory dip back down to 1.5 as fewer homes get listed during the winter.

In many markets, a “balanced” market is one which has 3 months worth of inventory. Meaning, if no other houses came up for sale, the available houses would be all bought up in 3 months time.

The last time Gig Harbor had a balanced market was back in 2016. 2017, 2018, and 2019 saw inventory highs between 2.2 and 2.5. I think it is highly likely that inventory will return to these previous years ranges.

Final thoughts:

The winter market looks to be cooling off considerably. Both in terms of houses that are being put on the market and the number of buyers that can afford them.

MEDIAN SALES PRICE_______________________________

Decline from top: -$169,000 or -19%

1-Month Change: -$8,000 or -1%

YoY Increase of: 0.3%

April (High): $894,000

September: $725,000

MEDIAN % OF ORIGINAL PRICE*________________________

% of Last Original Price (since high): -8.2%

YoY Decrease of: -4.5%

March (High): 105.6%

September: 97.4%

*The % of Original Price is the price at which the home first hit the market at. That is to say, the price prior to any price reductions or accepting (and closing) an offer under asking.

MEDIAN DAYS ON MARKET___________________________

Days on Market Increased (since low): 19 days or 320%

YoY Decrease of: 280.0%

March (Low): 4 days

September: 19 days

MONTHS OF INVENTORY_____________________________

March (Low): 0.3 Months of Inventory

July (High): 1.9 Months of Inventory

September: 1.8 Months of Inventory

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link