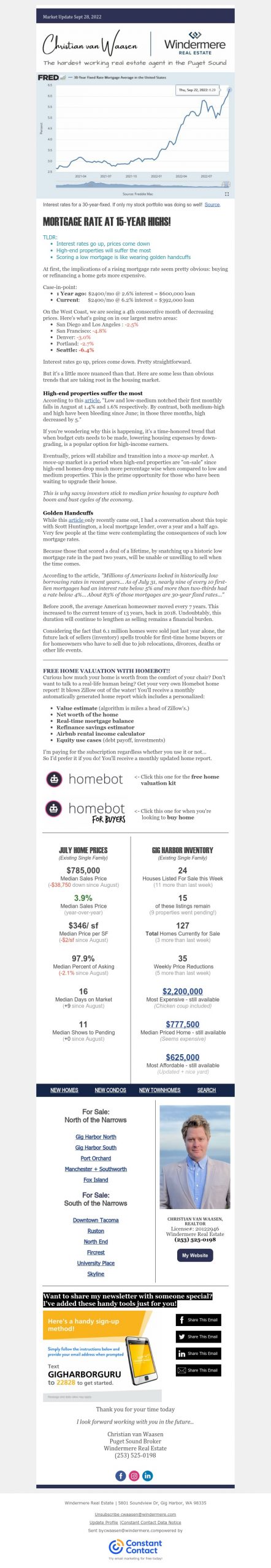

MORTGAGE RATE AT 15-YEAR HIGHS!

TLDR:

- Interest rates go up, prices come down

- High-end properties will suffer the most

- Scoring a low mortgage is like wearing golden handcuffs

At first, the implications of a rising mortgage rate seem pretty obvious: buying or refinancing a home gets more expensive.

Case-in-point:

- 1 Year ago: $2400/mo @ 2.6% interest = $600,000 loan

- Current: $2400/mo @ 6.2% interest = $392,000 loan

On the West Coast, we are seeing a 4th consecutive month of decreasing prices. Here’s what’s going on in our largest metro areas:

- San Diego and Los Angeles : -2.5%

- San Francisco: -4.8%

- Denver: -3.0%

- Portland: -2.7%

- Seattle: -6.4%

Interest rates go up, prices come down. Pretty straightforward. But it’s a little more nuanced than that. Here are some less than obvious trends that are taking root in the housing market.

High-end properties suffer the most

According to this article, “Low and low-medium notched their first monthly falls in August at 1.4% and 1.6% respectively. By contrast, both medium-high and high have been bleeding since June; in those three months, high decreased by 5.”

If you’re wondering why this is happening, it’s a time-honored trend that when budget cuts needs to be made, lowering housing expenses by down-grading, is a popular option for high-income earners.

Eventually, prices will stabilize and transition into a move-up market. A move-up market is a period when high-end properties are “on-sale” since high-end homes drop much more percentage wise when compared to low and medium properties. This is the prime opportunity for those who have been waiting to upgrade their house.

This is why savvy investors stick to median price housing to capture both boom and bust cycles of the economy.

Golden Handcuffs

While this article only recently came out, I had a conversation about this topic with Scott Huntington, a local mortgage lender, over a year and a half ago. Very few people at the time were contemplating the consequences of such low mortgage rates.

Because those that scored a deal of a lifetime, by snatching up a historic low mortgage rate in the past two years, will be unable or unwilling to sell when the time comes.

According to the article, “Millions of Americans locked in historically low borrowing rates in recent years… As of July 31, nearly nine of every 10 first-lien mortgages had an interest rate below 5% and more than two-thirds had a rate below 4%… About 83% of those mortgages are 30-year fixed rates…”

Before 2008, the average American homeowner moved every 7 years. This increased to the current tenure of 13 years, back in 2018. Undoubtably, this duration will continue to lengthen as selling remains a financial burden.

Considering the fact that 6.1 million homes were sold just last year alone, the future lack of sellers (inventory) spells trouble for first-time home buyers or for homeowners who have to sell due to job relocations, divorces, deaths or other life events.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link