NEW LISTING! + WILL PROPERTY INVESTING BECOME

A THING OF THE PAST?

Be prepared to see my name on Soundview for the next few weeks! I’ve got a brand-new listing coming online shortly after this email is sent. Below are the specs in case you know someone who’s interested in living close

to downtown Gig Harbor:

Address: 6760 Weather Glass Ln, Gig Harbor, WA 98335

List Price: $725,000

List Date: 9/21

Features:

- Stories: 1

- Style: Rambler

- Beds: 2

- Baths: 2

- Size: 1,605 SF

- Heating: Forced Air

- Cooling: Yes

- Parking: 1 Attached garage space

- Lot: 4,425 SF

- Amenities: Clubhouse, Pool

- HOA Dues: $275/mo

Pre-inspection showed it is in great condition. I’ll be there this Saturday at my open house from 11-2 if you’d like to stop by for a visit. Here’s the property website if you’d like to see some photos.

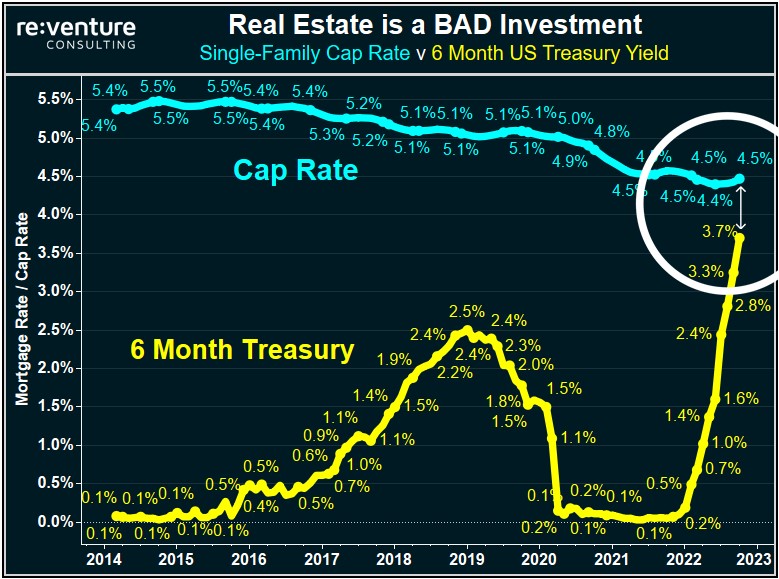

Take a look at the chart below to glimpse into the future of single-family real estate investing.

Let me quickly explain the importance of this chart. For the uninitiated, the Cap Rate on real estate is for all intents and purposes the “dividend yield” of property. The graph shows how cap rates for single family homes have decreased over time, and how the fed adjusting rates is making the 6-month treasury yield surge.

What’s happening to cap rates?

Overall cap rates are decreasing. We can assume that properties have been

getting more expensive and the rental income hasn’t kept up. Example:

$500,000 house -> $2,500/mo rental income = 6% cap rate

…1 year later…

$600,000 house -> $2,500/mo rental income = 5% cap rate

This simple example doesn’t include vacancy rates or operating expenses – both of which would reduce the cap rate. You can play with the cap rate calculation here.

If we assume that property prices decrease from here on in, and rental rates remain the same, we could see cap rates naturally return to 5-6% range within just a couple of years.

What’s happening now?

However, two years is a long time to park your money in a property that is increasingly becoming a risky asset. Decreasing home valuations, constant maintenance, property management fees, property taxes, capital expenditures and vacancy rates will quickly erode any income generated from a property.

While the magical attributes of owning property from a tax perspective is still there for mom-and-pop landlords, Wall Street doesn’t necessarily see it the same way, and they have to listen to their shareholders.

Why risk parking considerable capital on a risky asset whose return is almost equal to a risk-free 6-month treasury bond? Why don’t we (royal “we”) sell our portfolio of homes that are currently at their height in value and park that money in a risk-free treasury?

Wouldn’t you?

The above chart is already dated. The current 6-month treasury yield is already 3.85% … and we’re now waiting for confirmation that another rate hike is coming. Wow.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link