IS THIS THE BEGINNING OF THE END?

No, probably not.

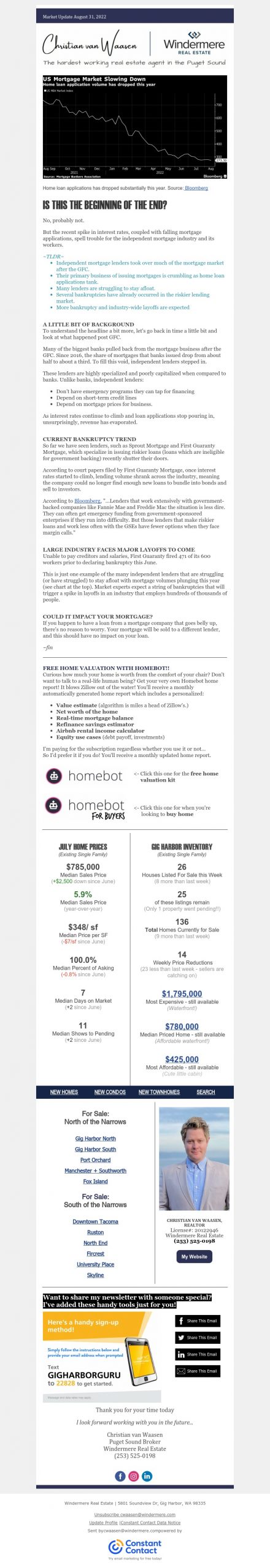

But the recent spike in interest rates, coupled with falling mortgage applications, spell trouble for the independent mortgage industry and its workers.

~TLDR~

- Independent mortgage lenders took over much of the mortgage market after the GFC.

- Their primary business of issuing mortgages is crumbling as home loan applications tank.

- Many lenders are struggling to stay afloat.

- Several bankruptcies have already occurred in the riskier lending market.

- More bankruptcy and industry-wide layoffs are expected

A LITTLE BIT OF BACKGROUND

To understand the headline a bit more, let’s go back in time a little bit and look at what happened post GFC.

Many of the biggest banks pulled back from the mortgage business after the GFC. Since 2016, the share of mortgages that banks issued drop from about half to about a third. To fill this void, independent lenders stepped in.

These lenders are highly specialized and poorly capitalized when compared to banks. Unlike banks, independent lenders:

- Don’t have emergency programs they can tap for financing

- Depend on short-term credit lines

- Depend on mortgage prices for business.

As interest rates continue to climb and loan applications stop pouring in, unsurprisingly, revenue has evaporated.

CURRENT BANKRUPTCY TREND

So far we have seen lenders, such as Sprout Mortgage and First Guaranty Mortgage, which specialize in issuing riskier loans (loans which are ineligible for government backing) recently shutter their doors.

According to court papers filed by First Guaranty Mortgage, once interest rates started to climb, lending volume shrank across the industry, meaning the company could no longer find enough new loans to bundle into bonds and sell to investors.

According to Bloomberg, “…Lenders that work extensively with government-backed companies like Fannie Mae and Freddie Mac the situation is less dire. They can often get emergency funding from government-sponsored enterprises if they run into difficulty. But those lenders that make riskier loans and work less often with the GSEs have fewer options when they face margin calls.”

LARGE INDUSTRY FACES MAJOR LAYOFFS TO COME

Unable to pay creditors and salaries, First Guaranty fired 471 of its 600 workers prior to declaring bankruptcy this June.

This is just one example of the many independent lenders that are struggling (or have struggled) to stay afloat with mortgage volumes plunging this year (see chart at the top). Market experts expect a string of bankruptcies that will trigger a spike in layoffs in an industry that employs hundreds of thousands of people.

COULD IT IMPACT YOUR MORTGAGE?

If you happen to have a loan from a mortgage company that goes belly up, there’s no reason to worry. Your mortgage will be sold to a different lender, and this should have no impact on your loan.

~fin

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link