HEAR YE! HEAR YE!

More bad news about the housing market. The downtrend I have been writing about is here. I’d like to keep driving home this point, so you have plenty of time to situate yourself properly. To quote Tony Robbins, “Leaders anticipate, losers react.”

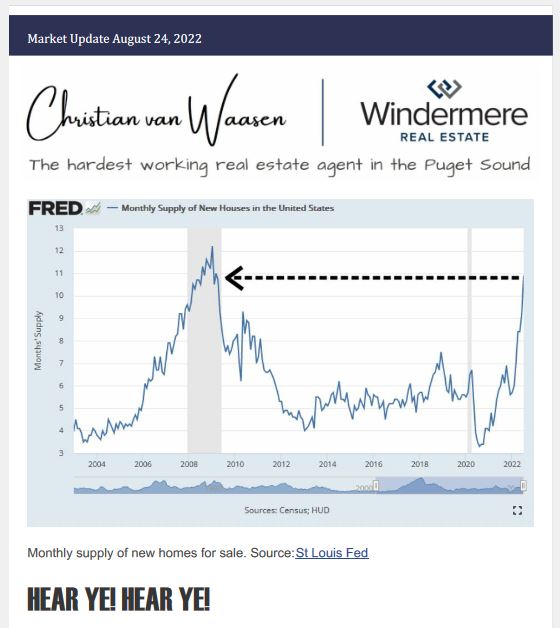

Here is the top statistic that spells trouble for the housing market:

New single family home sales fell 12.6% in July

- 575,000 (annualized) new homes were expected to be sold

- 511,000 (annualized) new homes have been actually sold

This is a big miss, and what’s worse that it’s the sixth time this year we’ve not

only seen a decline, but a miss in the forecast. This is the slowest pace in sales

since 2016. This has lead to:

- Construction slowdowns

- Increased cancelations

-

Mortgage applications plummet to a 22-year low

- Inventory skyrockets to 2008/2009 levels (see graph above)

Here’s the writing on the wall: Real estate prices will be negative, year-over-year, when we look back at this point in time in 2023. Now it’s just a matter of determining “by how much?”

The Cyclical pattern of Real Estate

The cyclical nature of real estate is very, very slow and follows a very simple pattern:

- Affordability gets impacted – either interest rates get raised and/or…

- Lending starts tightening – loan requirements change, making it harder to qualify

- Buyer demand gets removed

- Fewer buyers absorb less inventory, leading to a buildup in inventory

- Surplus inventory causes prices to get pushed lower

We are seeing this slowly play out now.

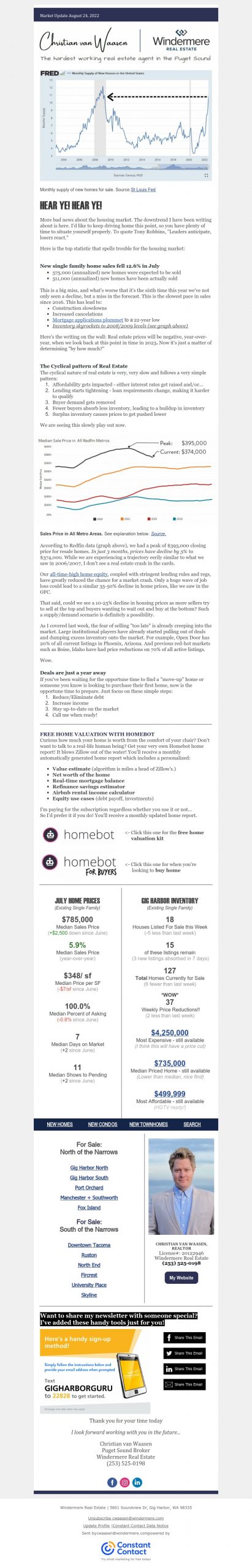

According to Redfin data (graph above), we had a peak of $395,000 closing price for resale homes. In just 3 months, prices have decline by 5% to $374,000. While we are experiencing a trajectory eerily similar to what we saw in 2006/2007, I don’t see a real estate crash in the cards.

Our all-time-high home equity, coupled with stringent lending rules and regs, have greatly reduced the chance for a market crash. Only a huge wave of job loss could lead to a similar 35-50% decline in home prices, like we saw in the GFC.

That said, could we see a 10-25% decline in housing prices as more sellers try to sell at the top and buyers wanting to wait out and buy at the bottom? Such a supply/demand scenario is definitely a possibility.

As I covered last week, the fear of selling “too late” is already creeping into the market. Large institutional players have already started pulling out of deals and dumping excess inventory onto the market. For example, Open Door has 20% of all current listings in Phoenix, Arizona. And previous red-hot markets such as Boise, Idaho have had price reductions on 70% of all active listings.

Wow.

Deals are just a year away

If you’ve been waiting for the opportune time to find a “move-up” home or someone you know is looking to purchase their first home, now is the opportune time to prepare. Just focus on these simple steps:

- Reduce/Eliminate debt

- Increase income

- Stay up-to-date on the market

- Call me when ready!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link