INVESTORS THROW IN THE TOWEL

TDLR~

- Federal Reserve says buyers are better off waiting for a “reset” in housing

- Very little gain left in housing for investors. Investors pulling back from home purchases over the last 4 months.

- Investors pulling out of deals and accepting low offers to get rid of inventory.

- 8% of all active listings have had price cuts.

- New listings priced 0.84% lower month-over-month.

- Thinking about buying, or know someone who is? Get yourself/them ready!

- I’m giving you over a year’s heads up!

INVESTOR SENTIMENT

After the 2008 great financial crisis, some of the first buyers back in the market were institutional buyers. Back in 2012, Warren Buffett famously said that if he could, he would buy as many single family homes as possible. Being a famous value investor, Buffet’s primary strategy is to buy assets below market value.

However, today you have the opposite of that. There’s not a lot of untapped value left in houses. In fact, you have the chair of the Federal Reserve telling home buyers they’re better off pausing and waiting for a reset before buying. Specifically, to wait for the Federal Reserve to do their work and to bring housing and credit availability to appropriate levels.

Housing and credit availability are important metrics to investors and institutions, which they us as buy/sell signals when determining real estate valuations. By watching when investors start getting back into the market, we can infer that real estate valuations have reached their floor and opportunity is to be had. Similarly, when these players stop purchasing property, we should take heed as well.

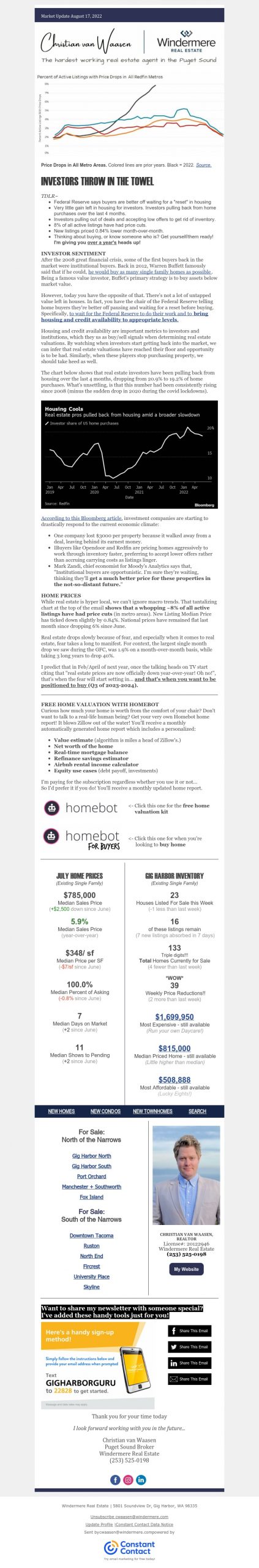

The chart below shows that real estate investors have been pulling back from housing over the last 4 months, dropping from 20.9% to 19.2% of home purchases. What’s unsettling, is that this number had been consistently rising since 2008 (minus the sudden drop in 2020 during the covid lockdowns). According to this Bloomberg article, investment companies are starting to drastically respond to the current economic climate:

- One company lost $3000 per property because it walked away from a deal, leaving behind its earnest money.

- IBuyers like Opendoor and Redfin are pricing homes aggressively to work through inventory faster, preferring to accept lower offers rather than accruing carrying costs as listings linger.

- Mark Zandi, chief economist for Moody’s Analytics says that, “Institutional buyers are opportunistic. I’m sure they’re waiting, thinking they’ll get a much better price for these properties in the not-so-distant future.“

HOME PRICES

While real estate is hyper local, we can’t ignore macro trends. That tantalizing chart at the top of the email shows that a whopping ~8% of all active listings have had price cuts (in metro areas). New Listing Median Price has ticked down slightly by 0.84%. National prices have remained flat last month since dropping 6% since June.

Real estate drops slowly because of fear, and especially when it comes to real estate, fear takes a long to manifest. For context, the largest single month drop we saw during the GFC, was 1.9% on a month-over-month basis, while taking 3 long years to drop 40%.

I predict that in Feb/April of next year, once the talking heads on TV start citing that “real estate prices are now officially down year-over-year! Oh, no!”, that’s when the fear will start setting in… and that’s when you want to be positioned to buy (Q3 of 2023-2024)

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link