DIGITAL HOUSING CRASH!

TDLR – Digital land prices have plummeted over 85%

If you aren’t caught up to speed in the whole “metaworld” thing, it’s basically a gold rush to take part of the “next big thing.” The flagship metaverse projects, built on the Ethereum blockchain, are Sandbox and Decentraland.

These projects are virtual worlds in which you can play, build, and buy/sell plots of land (for real money). Thanks to blockchain technology, the ownership of property is recorded on a public ledger thereby making it possible to prove ownership and facilitating honest transactions.

These qualities of assurance allow speculators to throw around large sums of money for intangible assets. For example, Republic Realm, a digital asset investment firm, purchased a plot of land in/on Sandbox for $4.3 million back in November.[1]

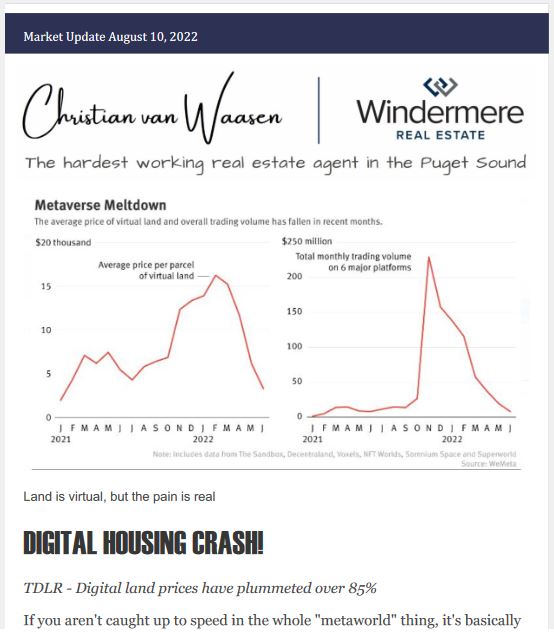

The chart above gives a clear picture of how prices soared at the beginning of the year and how they have ultimately corrected. “For instance, the average price of lands sold across Decentraland peaked at $37,238 in February 2022. But as of Aug. 1, their costs had dropped to an average of $5,163. Similarly, the Sandbox’s average sale price dropped from circa $35,500 in January to around $2,800 in August.”[2] Thus far, land sales have plunged 85%.

It’s too soon to tell whether prices are just simply mirroring the overall crash in crypto, or a permanent trend.

I believe that ultimately, only one project will survive… and it’ll be the one with the most celebrities “living” in it. The notion that one can potentially be virtually adjacent to a real life celebrity such as Snoop Dogg or Paris Hilton [3] is, and will be, a huge draw. These same exclusive celebrity qualities made Bored Ape Yacht Club NFT such a success.

While I can appreciate the technology behind this (and we will certainly see the adoption of this technology in regard to deeds and titles in the real world) it’s the scarcity and location in the real world that gives it intrinsic value. While virtual land can be made artificially scarce, a new project can always come along and simply “make” more.

Even thought I do invest in crypto, I would stay far away from this digital asset class, even if prices have indeed corrected.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link