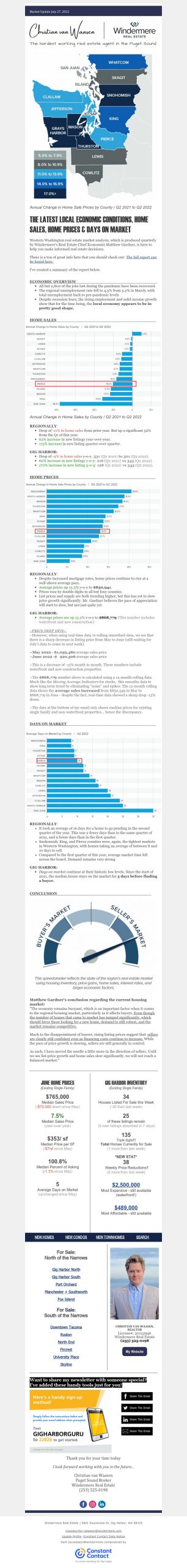

THE LATEST LOCAL ECONOMIC CONDITIONS, HOME SALES, HOME PRICES & DAYS ON MARKET

Western Washington real estate market analysis, which is produced quarterly by Windermere’s Real Estate Chief Economist Matthew Gardner, is here to help you make informed real estate decisions.

There is a ton of great info here that you should check out: The full report can be found here.

I’ve created a summary of the report below:

ECONOMIC OVERVIEW

- All but 2,800 of the jobs lost during the pandemic have been recovered.

- The regional unemployment rate fell to 4.5% from 5.2% in March, with total unemployment back to pre-pandemic levels

- Despite recession fears, the rising employment and solid income growth show that for the time being, the local economy appears to be in pretty good shape.

HOME SALES

REGIONALLY:

-

- Drop of -11% in home sales from prior year. But up a significant 52% from the Q1 of this year.

- 62% increase in new listings year-over-year.

- 175% increase in new listing quarter-over-quarter.

GIG HARBOR:

-

- Drop of -9% in home sales y-o-y. 331 (Q2 2021) to 301 (Q2 2022).

- 60% increase in new listings y-o-y: 216 (Q2 2021) vs 343 (Q2 2022).

- 170% increase in new listing q-o-q: 128 (Q1 2022) vs 343 (Q2 2022).

HOME PRICES

REGIONALLY:

-

- Despite increased mortgage rates, home prices continue to rise at a well-above-average pace.

- Average prices up 13.3% y-o-y to $830,941.

- Prices rose by double digits in all but four counties.

- List prices and supply are both trending higher, but this has yet to slow price growth significantly. Mr. Gardner believes the pace of appreciation will start to slow, but not just quite yet.

GIG HARBOR:

-

- Average prices are up 13.2% y-o-y to $868,779 (This number includes waterfront and new construction)

~PRICE DEEP DIVE~

~When using real-time data vs rolling-smoothed-data, we see that there is a sharp decrease in listing price from May to June (still waiting for July’s data to come in next week):

~May 2022 – $1,059,480 average sales price

~June 2022 -$ 920,506 average sales price

~This is a decrease of -13% month to month. These numbers include waterfront and new construction properties.

~The $868,779 number above is calculated using a 12-month rolling data. Much like the Moving Average Indicators for stocks, this smooths data to show long term trend by eliminating “noise” and spikes. The 12-month rolling data shows the average sales increased from $850,549 in May to $868,779 in June – despite the fact, real-time data showed a sharp drop -13% down.

~The data at the bottom of my email only shows median prices for existing single family and non-waterfront properties… hence the discrepancy.

DAYS ON MARKET

REGIONALLY:

-

- It took an average of 16 days for a home to go pending in the second quarter of the year. This was 2 fewer days than in the same quarter of 2021, and 9 fewer days than in the first quarter.

- Snohomish, King, and Pierce counties were, again, the tightest markets in Western Washington, with homes taking an average of between 8 and 10 days to sell.

- Compared to the first quarter of this year, average market time fell across the board. Demand remains very strong

GIG HARBOR:

-

- Days on market continue at their historic low levels. Since the start of 2021, the median house stays on the market for 5 days before finding a buyer.

CONCLUSION

Matthew Gardner’s conclusion regarding the current housing market:

“The economy remains buoyant, which is an important factor when it comes to the regional housing market, particularly as it affects buyers. Even though the number of homes that came to market has jumped significantly, which should favor those looking for a new home, demand is still robust, and the market remains competitive.

Much to the disappointment of buyers, rising listing prices suggest that sellers are clearly still confident even as financing costs continue to increase. While the pace of price growth is slowing, sellers are still generally in control. As such, I have moved the needle a little more in the direction of sellers. Until we see list-price growth and home sales slow significantly, we will not reach a balanced market.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link