THE NEWEST HOUSING DATA IS IN!

Summer is here! And so are Gig Harbor’s newest housing stats. As expected, we are seeing a shift in the market with a mixed-bag of results. Gig Harbor’s data will probably prove to be less exciting as things slow down, whereas hot markets, such as Arizona and Florida, will likely experience a sudden – headline inducing – housing shift.

LATEST DATA WORTH NOTING:

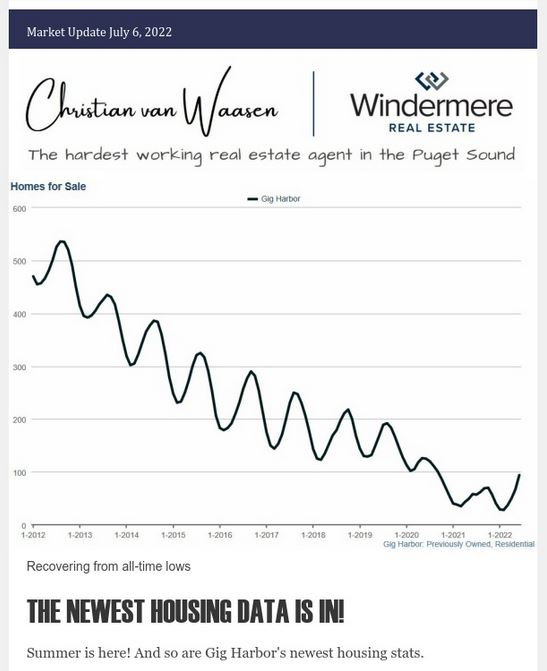

Homes for sale start to recover

This June, Gig Harbor had a total of 94 homes for sale (vs 58 last June). See graph above. While this increase was expected, both due to sellers trying to sell at the top of the market and life coming “back to normal,” we are still far from historical levels. Additional inventory will unlikely affect home prices in any substantial measure.

Showings per listing drops by 40%

The median listing receives 10 viewings before going pending. The amount of showings have fallen from March, during which the median listing received 17 showings. The drop in perspective buyers has been expected as asset prices have taken a hit and interest rates have taken their toll on buyer’s budgets

Days-on-market remain flat

Interestingly, even with additional inventory, the median house only remains on the market for 5 days. We’ve been experiencing this record low level since

March 2021. This goes to show that a well priced house in Gig Harbor still

attracts a serious crowd of buyers.

Median sales price reaches $835,000 – an all-time

A modest increase of $10,000 month-over-month (or roughly 1.5%) pushes Gig Harbor’s median sales prices to its all-time high. June’s seasonal price increase, coupled with buyers are still vying for homes in desirable Gig Harbor, is overcoming the falling home prices elsewhere (thus far).

Percent-over-asking is down from 104.5% to 102.1%

The amount of buyers still overbidding for a house is dropping. This coincides with waning competition. We’ll probably see July’s percent–over-asking above 100% – but I have a hunch this will be the last month, in the foreseeable future, where this occurs. Price cuts have also started to slow down. Last week, 26 price cuts took place, compared to the 17 this week. Sellers are starting to realize the market is slowing and are listing closer to what the market will support.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link