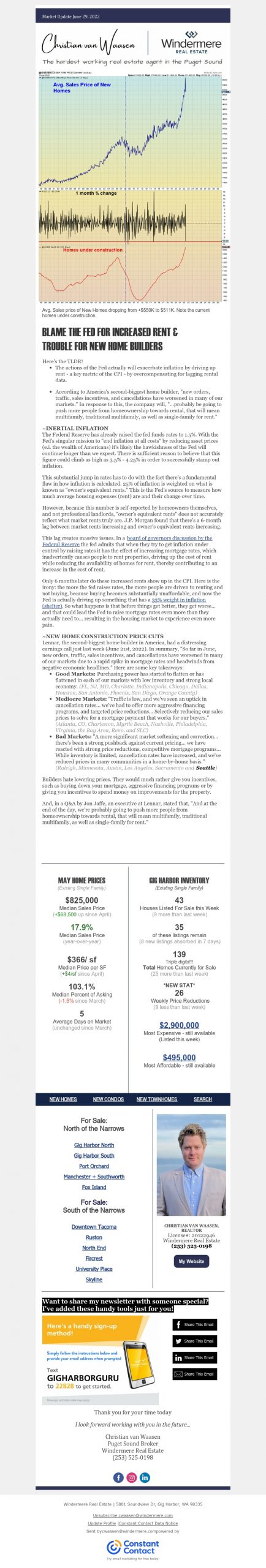

BLAME THE FED FOR INCREASED RENT & TROUBLE FOR NEW HOME BUILDERS

Here’s the TLDR!

- The actions of the Fed actually will exacerbate inflation by driving up rent – a key metric of the CPI – by overcompensating for lagging rental data.

- According to America’s second-biggest home builder, “new orders, traffic, sales incentives, and cancellations have worsened in many of our markets.” In response to this, the company will, “…probably be going to push more people from homeownership towards rental, that will mean multifamily, traditional multifamily, as well as single-family for rent.”

~INERTIAL INFLATION

The Federal Reserve has already raised the fed funds rates to 1.5%. With the Fed’s singular mission to “end inflation at all costs” by reducing asset prices (e.i. the wealth of Americans) it’s likely the hawkishness of the Fed will continue longer than we expect. There is sufficient reason to believe that this figure could climb as high as 3.5% – 4.25% in order to successfully stamp out inflation.

This substantial jump in rates has to do with the fact there’s a fundamental flaw in how inflation is calculated. 25% of inflation is weighted on what is known as “owner’s equivalent rents.” This is the Fed’s source to measure how much average housing expenses (rent) are and their change over time.

However, because this number is self-reported by homeowners themselves, and not professional landlords, “owner’s equivalent rents” does not accurately reflect what market rents truly are. J.P. Morgan found that there’s a 6-month lag between market rents increasing and owner’s equivalent rents increasing.

This lag creates massive issues. In a board of governors discussion by the Federal Reserve the fed admits that when they try to get inflation under control by raising rates it has the effect of increasing mortgage rates, which inadvertently causes people to rent properties, driving up the cost of rent while reducing the availability of homes for rent, thereby contributing to an increase in the cost of rent.

Only 6 months later do these increased rents show up in the CPI. Here is the irony: the more the fed raises rates, the more people are driven to renting and not buying, because buying becomes substantially unaffordable, and now the Fed is actually driving up something that has a 33% weight in inflation (shelter). So what happens is that before things get better, they get worse… and that could lead the Fed to raise mortgage rates even more than they actually need to… resulting in the housing market to experience even more pain.

~NEW HOME CONSTRUCTION PRICE CUTS

Lennar, the second-biggest home builder in America, had a distressing earnings call just last week (June 21st, 2022). In summary, “So far in June, new orders, traffic, sales incentives, and cancellations have worsened in many of our markets due to a rapid spike in mortgage rates and headwinds from negative economic headlines.” Here are some key takeaways:

- Good Markets: Purchasing power has started to flatten or has flattened in each of our markets with low inventory and strong local economy. (FL, NJ, MD, Charlotte, Indianapolis, Chicago, Dallas, Houston, San Antonio, Phoenix, San Diego, Orange County)

- Mediocre Markets: “Traffic is low, and we’ve seen an uptick in cancellation rates… we’ve had to offer more aggressive financing programs, and targeted price reductions… Selectively reducing our sales prices to solve for a mortgage payment that works for our buyers.” (Atlanta, CO, Charleston, Myrtle Beach, Nashville, Philadelphia, Virginia, the Bay Area, Reno, and SLC)

- Bad Markets: “A more significant market softening and correction… there’s been a strong pushback against current pricing… we have reacted with strong price reductions, competitive mortgage programs… While inventory is limited, cancellation rates have increased, and we’ve reduced prices in many communities in a home-by-home basis.” (Raleigh, Minnesota, Austin, Los Angeles, Sacramento and Seattle)

Builders hate lowering prices. They would much rather give you incentives, such as buying down your mortgage, aggressive financing programs or by giving you incentives to spend money on improvements for the property.

And, in a Q&A by Jon Jaffe, an executive at Lennar, stated that, “And at the end of the day, we’re probably going to push more people from homeownership towards rental, that will mean multifamily, traditional multifamily, as well as single-family for rent.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link