JEROME POWELL’S SENATE HEARING – KEY TAKEAWAYS

In today’s testimony, Jerome Powell said some interesting things regarding the Fed’s active role in reducing housing prices, that I would like to share with you.

~TLDR~

The Fed’s primary objective is to reduce demand:

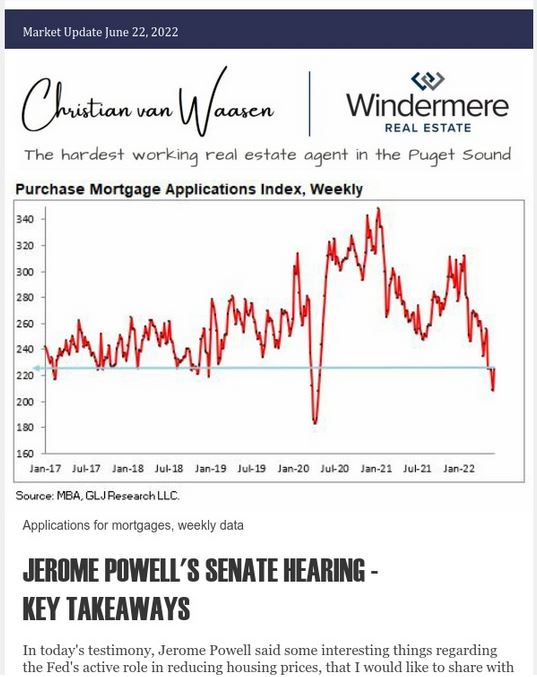

Reduce demand by increasing the cost of housing. Housing prices have been at unsustainable highs The Fed is considering selling their MBS at a loss. New mortgage applications are down, see graph above.

~End TLDR~

The Fed’s main objective is to reduce demand.

As stated by the Fed, because they are unable to reduce supply chain issues, all the Fed can do is reduce demand. So, what does this look like and mean for the housing market? Let’s start by looking at what Powell said about the current market.

Powell stated that the demand for homes is moving down “quite significantly.” Attempting to soften the impact of the current demand destruction, Powell suggested that prices might flatten instead of drop thanks to the low supply of inventory.

Additionally, the housing market is slowing down and additional rate hikes could, “…fairly quickly affect home prices.” Typically, there is a 6 to 9 month lag between a rate hike and prices coming down as a result. The fact that rates can fairly quickly affect home prices is worrisome. Let’s take a look at what steps the Fed is trying to take to reduce demand.

According to Jerome Powell:

Reduce demand by increasing the cost of housing.

Powell extrapolated today that “people are getting priced out” and that this is an intentional part of getting inflation under control. Jerome Powell is bluntly coming out and stating that pricing people out of the housing market by raising rates is his job.

Housing prices have been at unsustainable highs.

This opinion contradicts his other opinion that housing prices should flatten. It’s likely that the Powell is trying to instill a false sense of security, because how can housing prices, that are admittedly unsustainable, remain flat? I think we can safely assume that since the Fed is attempting to control inflation by pricing people out of the market, through increased cost of housing, prices will be forced to come down.

The Fed is considering selling their MBS at a loss.

Selling their Mortgage Backed Securities at a loss would mean that mortgage rates would climb even more*. Selling their MBS will depress the bond market even further. This means that there would be lower prices in the bond market…

… which would cause yields to raise…

… which correlate with higher mortgage rates…

… which correlates with more pressure on housing prices coming down…

… which Powell literally said his job was… to bring home prices down.

~Now we come to the point where the above graph become relevant.~

New Mortgage Applications Fall

Applications for home purchases are among the best leading indicators for the real estate market. Why? It tracks potential buyers getting ready to purchase property. Upon mortgage pre-approval, buyers have their rate locked in and are ready to start house hunting.

The Mortgage Bankers Association tracks the applications in their index (see above graph). While the above graph shows that applications were up 8.1% this week, it shows that we’re down -15.6% from a year ago. The bad news is that applications are back down to 5-year lows.

The good news is that people are still applying for mortgages.

*If the Fed didn’t sell, they would otherwise have to wait 15 to 30 years for the bonds to mature, unlike treasuries which can mature in 2 months, 3 years, etc.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link