WHAT GOES UP…

The TLDR for this week’s email:

- Staff reductions at Redfin and Compass due to lack of work.

- Moody’s Analytics chief economist claims we are in a full-blown housing correction.

- Home prices appreciation has completely stalled to 0%

- The average 30-year mortgage rate has spiked from 3.1% to 6.28%.

- The typical new mortgage payment has spiked by a whopping 52%

Cracks in the real estate market are starting to widen. Yesterday, Redfin and Compass announced large staff reductions of 8% and 10% respectively. According to Redfin’s press release, “…with May demand 17% below expectations, we don’t have enough work for our agents and support staff.” These new developments in the housing market should come as no surprise. I’ve been writing about them for over a month now. But for number crunchers, like Moody’s Analytics chief economist, Mark Zandi, who’ve been patiently waiting for the data to roll in, the economic picture being painted for them isn’t very pretty. The abrupt shift in data has led Mr. Zandi to believe that we’ve entered a “full-blown ‘housing correction.'”

The jarring change of homes appreciating from a record 20.6% year-over-year rate to 0% is startling, and it has been forecasted by Moody’s Analytics, “…if a recession does materialize, a 5% nationwide home price drop—including a 15% to 20% drop in America’s most ‘overvalued’ regional housing markets is expected.”

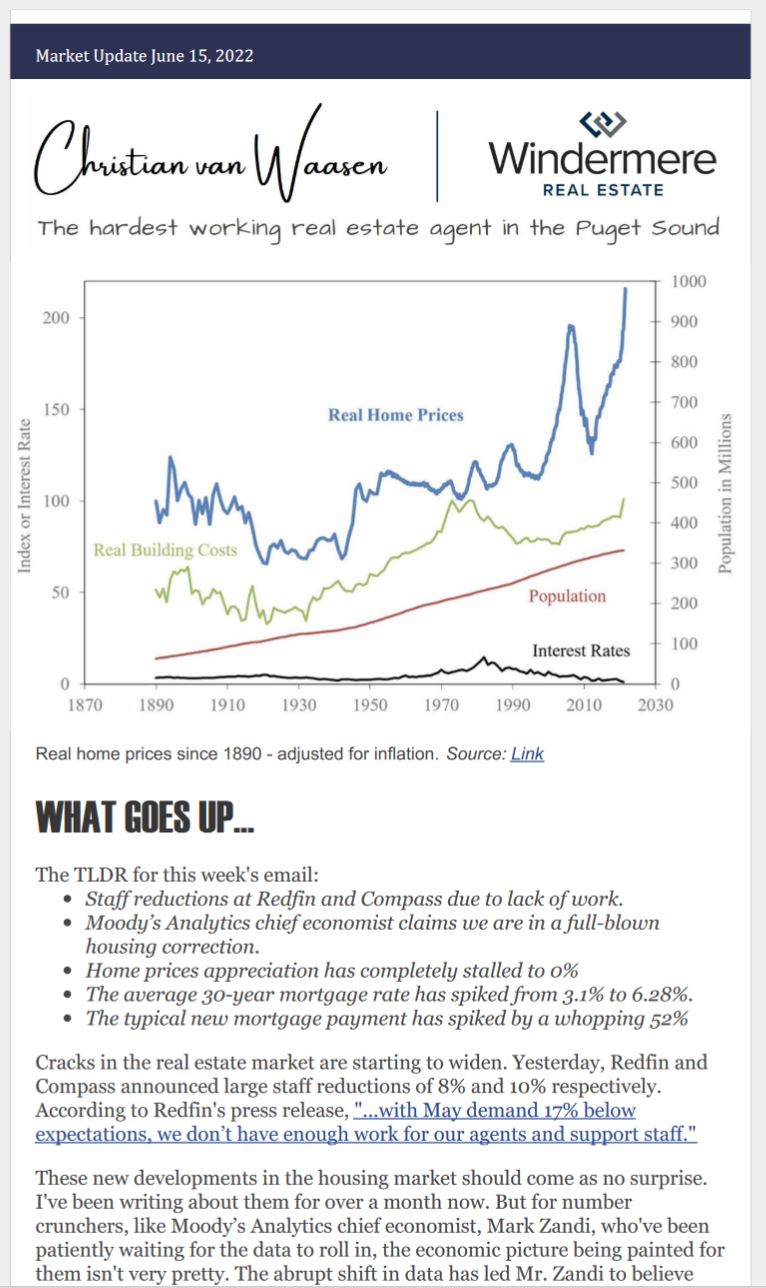

I’ve included a graph of Real Home Prices at the top of this email. The Real Home Price has been adjusted for inflation. Looking at the graph we can see that from the 1890s to the 1990s housing prices have remained rather stable. Except for the Great Depression, home values tend to hover around the 100% index mark. The recent “headline worthy” escalation in building costs appears minor in relation to home price growth.

Currently, we are sitting at the record level of Real Home Prices at over 200%. How much more “up” we can go is unknowable. But I would advise that buying now in hopes of seeing appreciation is a dangerous bet…

…because buyer demand is falling—fast. Sky-high home prices coupled with soaring mortgage rates are causing a fundamental shift in the market.

Over the past six months:

- The average 30-year mortgage rate has spiked from 3.1% to 6.28%.

- This is the biggest upward swing in mortgage rates since 1981.

- Mortgage rates are now at their highest level since 2008.

- While a 3.18% increase in mortgage rates might seem trivial, according to

- Zonda, a real estate research firm, over the past six months the typical new mortgage payment has spiked by a whopping 52%.

According to Moody’s Analytics:

- Bremerton-Silverdale-Port Orchard is overvalued by 48%

- Seattle-Bellevue-Tacoma is overvalued by 22%

- Olympia-Lacey-Tumwater is overvalued by 25%

I think we can infer that Gig Harbor is also overvalued by at least 20%.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link