IS THE HOUSING MARKET CRACKING?

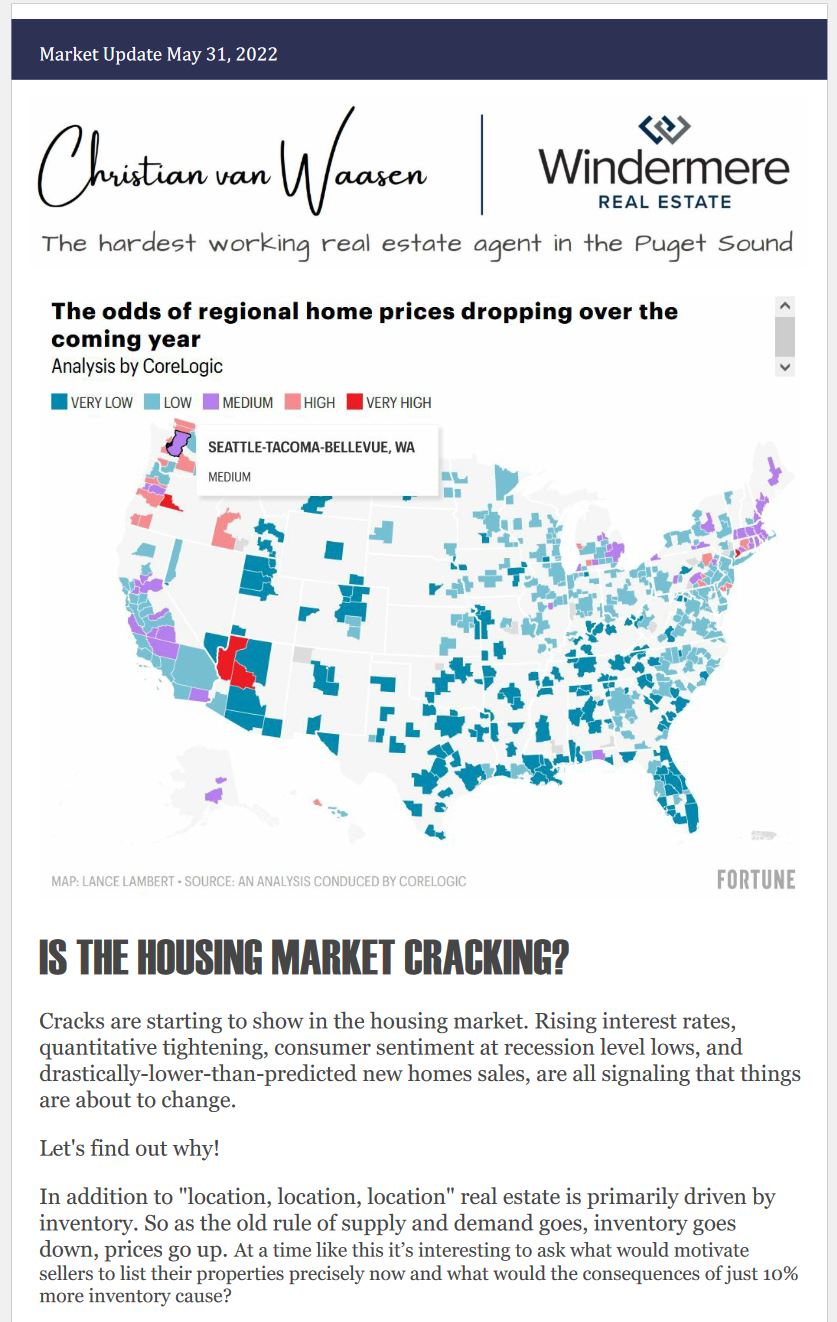

Cracks are starting to show in the housing market. Rising interest rates, quantitative tightening, consumer sentiment at recession level lows, and drastically-lower-than-predicted new homes sales, are all signaling that things are about to change.

Let’s find out why!

In addition to “location, location, location” real estate is primarily driven by inventory. So as the old rule of supply and demand goes, inventory goes down, prices go up. At a time like this it’s interesting to ask what would motivate sellers to list their properties precisely now and what would the consequences of just 10% more inventory cause?

FEAR RESPONSE

A point of concern is the amount of latent fear in the market. While this

sentiment is rather difficult to measure, it is the most single most determining factor to the outcome of this market.

The University of Michigan’s “Index of Consumer Sentiment” presents a data source that may help us understand some of the psychological underpinnings in this market. (see image for graph)

So far, the data doesn’t look too rosy for a healthy real estate market. Fearful homeowners and investors may react to prices coming down… and decide to sell “before it’s too late.”

Who would contribute to this selling pressure?

- Homeowners trying to time the market by selling will look to rent or downsize.

- Institutional owners or investors looking to cash-out so some they have some “dry powder” available for the next buying opportunity (almost 16% of single family homes are owned as investment properties). If an 10% of homes to go on the market, and we will end up with a completely different inventory dynamic.

NEW HOME SALES COULD SPELL TROUBLE

A leading indicator for the housing market is “new home sales.” Unlike “resale home sales” which get tracked only upon closing (usually 30 day lag), “new home sales” get tracked when they go under contract. Economic forecasts anticipated 750,000 new home sales. New home sales actually came in at 591,000! Not a single analyst anticipated this enormous 21.2% drop in new home sales.

George Ratiu, senior economist at Realtor.com, suggests that “… the rising cost of a new home is now pricing many people out of the market… The market for new homes is mirroring broader real estate trends, as rising inflation is taking a bigger chunk out of Americans’ paychecks, and surging borrowing costs are compressing homebuyers’ budgets.”

Current conditions include:

- 20-28% excess demand for homes

- Interest rates have risen nearly by 3%

- Rates will likely rise to 6% by September.

Just Interest rates alone, climbing to 6%, will eliminate the excess demand for and would return us to a balanced market. This is our “best case” scenario.

The best case scenario:

- Demand for houses would return to normal

- No fear response, aka selling at the “top of the market”

- Prices declining by 0 – 5%

Probable scenario:

- Demand for houses would return to normal

- Fear response causes excess inventory

- Prices declining by 10 – 25% (higher % depends on media coverage)

Worst case scenario:

- A 40% decline in prices

Fortunately, the worst case scenario is highly unlikely in today’s market!

Thanks for reading!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link