RAY DALIO AND JEREMY GRANTHAM ON HOW THEY’RE SEEING THE WORLD RIGHT NOW

This email will be a little different that my standard real estate related content. I feel like I needed to share this information with you because it’s likely no one else is… including those in charge of your retirement accounts. If you have an hour to listen to financial musings, please watch the video (linked above). In case you’re short on time, then the TLDW contents of this email is just for you.

… And if you only have a few moments to spare, here is the quick n’ dirty in bullet point format:

- It appears we are going to transition from a 2000s tech bubble bursting into a 1970s stagflation environment.

- Inflation will remain a long term problem due to falling birthrates. Fewer workers = increased wages. Higher wages increase the cost of goods and services.

- Expect the cost of resources to continue to rise. Technology can no longer keep up.

- Cash is trash. So are bonds and debt.

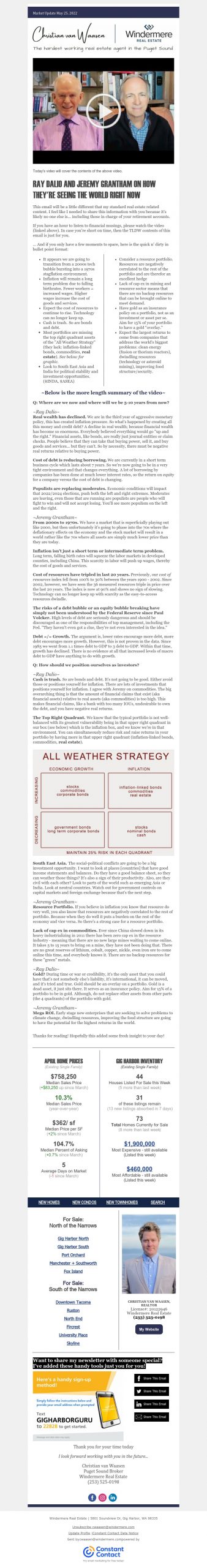

- Most portfolios are missing the top right quadrant assets of the “All Weather Strategy” (they lack: inflation-linked bonds, commodities, real estate). See below for graphic.

- Look to South East Asia and India for political stability and investment opportunities. ($INDA, $ASEA)

- Consider a resource portfolio. Resources are negatively correlated to the rest of the portfolio and are therefor an excellent hedge

- Lack of cap ex in mining and resource sector means that there are no backup resources that can be brought online to meet demand.

- Have gold as an insurance policy on a portfolio, not as an investment or asset per se. Aim for 15% of your portfolio to have a gold “overlay.”

- Expect the largest returns to come from companies that address the world’s biggest problems: clean energy (fusion or thorium reactors), dwindling resources (technology or asteroid mining), improving food structure/security.

~Below is the more length summary of the video~

Q: Where are we now and where will we be 5-10 years from now?

~Ray Dalio~

Real wealth has declined. We are in the third year of aggressive monetary policy, this has created inflation pressure. So what’s happened by creating all this money and credit debt? A decline in real wealth; because financial wealth has become so enormous. Everybody believed everything would go “up and the right.” Financial assets, like bonds, are really just journal entities or claim checks. People believe that they can take that buying power, sell it, and buy goods and services… but they can’t. So by necessity, there must be negative real returns relative to buying power.

Cost of debt is reducing borrowing. We are currently in a short term business cycle which lasts about 7 years. So we’re now going to be in a very tight environment and that changes everything. A lot of borrowing by companies has been done at much lower interest rates, so the return on equity for a company versus the cost of debt is changing.

Populists are replacing moderates. Economic conditions will impact that 2022/2024 elections, push both the left and right extremes. Moderates are leaving, even those that are running are populists are people who will fight to win and will not accept losing. You’ll see more populism on the left and the right.

~Jeremy Grantham~

From 2000s to 1970s. We have a market that is superficially playing out like 2000, but then unfortunately it’s going to phase into the 70s where the deflationary effects on the economy and the stock market will result in a world rather like the 70s where all assets are simply much lower price than they are today.

Inflation isn’t just a short term or intermediate term problem. Long term, falling birth rates will squeeze the labor markets in developed counties, including China. This scarcity in labor will push up wages, thereby the cost of goods and services.

Cost of resources have tripled in last 20 years. Previously, our cost of resources index fell from 100% to 30% between the years 1900 – 2002. Since 2002, however, we have seen the 36 measured resources triple in price over the last 20 years. The index is now at 90% and shows no sign of slowing. Technology can no longer keep up with scarcity as the easy-to-access resources dwindle.

The risks of a debt bubble or an equity bubble breaking have simply not been understood by the Federal Reserve since Paul Volcker. High levels of debt are seriously dangerous and should be discouraged as one of the responsibilities of top management, including the Fed. “They haven’t even got a clue, they’re not even interested in the idea.”

Debt =/= Growth. The argument is, lower rates encourage more debt, more debt encourages more growth. However, this is not proven in the data. Since 1985 we went from 1.1 times debt to GDP to 3 debt to GDP. Within that time, growth has declined. There is no evidence at all that increased levels of macro debt to GDP have anything to do with growth.

Q: How should we position ourselves as investors?

~Ray Dalio~

Cash is trash. So are bonds and debt. It’s not going to be good. Either avoid those or positions yourself for inflation. There are lots of investments that positions yourself for inflation. I agree with Jeremy on commodities. The big overarching thing is that the amount of financial claims that exist (aka financial assets) relative to real assets (aka commodities) is too high. This makes financial claims, like a bank with too many IOUs, undesirable to own the debt, and you have negative real returns.

The Top Right Quadrant. We know that the typical portfolio is not well-balanced with its greatest vulnerability being in that upper right quadrant in our box (see below) which is the inflation box, and we know we’re in that environment. You can simultaneously reduce risk and raise returns in your portfolio by having more in that upper right quadrant (inflation-linked bonds, commodities, real estate).

South East Asia. The social-political conflicts are going to be a big investment opportunity. I want to look at places [countries] that have good income statements and balances. Do they have a good balance sheet, so they can weather those things? It’s also a sign of their productivity. Also, are they civil with each other? Look to parts of the world such as emerging Asia or India. Look at neutral countries. Watch out for government controls on capital markets and foreign exchange because that’s the next step.

~Jeremy Grantham~

Resource Portfolio. If you believe in inflation, you know that resource do very well, you also know that resources are negatively correlated to the rest of portfolio. Because when they do well it puts a burden on the rest of the economy and vice versa. So there’s a strong case for a resource portfolio.

Lack of cap ex in commodities. Ever since China slowed down in its heavy industrializing in 2011 there has been zero cap ex in the resource industry – meaning that there are no new large mines waiting to come online. It takes 5 to 15 years to bring on a mine, they have not been doing that. There are no great reserves of lithium, cobalt, copper, nickle, even iron ore to come online this time, and everybody knows it. There are no backup resources for these “green” metals.

~Ray Dalio~

Gold? During time or war or credibility, it’s the only asset that you could have that’s not somebody else’s liability, it’s international, it can be moved, and it’s tried and true. Gold should be an overlay on a portfolio. Gold is a dead asset, it just sits there. It serves as an insurance policy. Aim for 15% of a portfolio to be in gold. Although, do not replace other assets from other parts (the 4 quadrants) of the portfolio with gold.

~Jeremy Grantham~

Mega ROI. Early stage new enterprises that are seeking to solve problems to climate change, dwindling resources, improving the food structure are going to have the potential for the highest returns in the world.

Thanks for reading! Hopefully this added some fresh insight to your day!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link