NEWS BEFORE IT’S NEWS

This is the first time in the last four years that we have seen a year-over-year increase of more than one percent of active listings with price drops. This is called an inflection point. It doesn’t mean it’s going to sustain, it just happens to be one of those early signs.

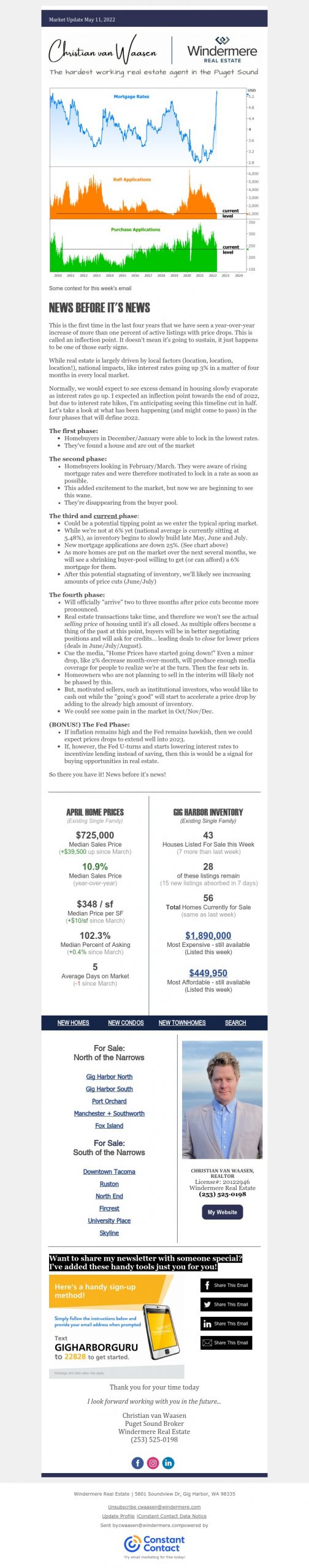

While real estate is largely driven by local factors (location, location, location!), national impacts, like interest rates going up 3% in a matter of four months in every local market.

Normally, we would expect to see excess demand in housing slowly evaporate as interest rates go up. I expected an inflection point towards the end of 2022, but due to interest rate hikes, I’m anticipating seeing this timeline cut in half. Let’s take a look at what has been happening (and might come to pass) in the four phases that will define 2022.

The first phase:

- Homebuyers in December/January were able to lock in the lowest rates.

- They’ve found a house and are out of the market

The second phase:

- Homebuyers looking in February/March. They were aware of rising mortgage rates and were therefore motivated to lock in a rate as soon as possible.

- This added excitement to the market, but now we are beginning to see this wane.

- They’re disappearing from the buyer pool.

The third and current phase:

- Could be a potential tipping point as we enter the typical spring market.

- While we’re not at 6% yet (national average is currently sitting at 5.48%), as inventory begins to slowly build late May, June and July.

- New mortgage applications are down 25%. (See chart above)

- As more homes are put on the market over the next several months, we will see a shrinking buyer-pool willing to get (or can afford) a 6% mortgage for them.

- After this potential stagnating of inventory, we’ll likely see increasing amounts of price cuts (June/July)

The fourth phase:

- Will officially “arrive” two to three months after price cuts become more pronounced.

- Real estate transactions take time, and therefore we won’t see the actual selling price of housing until it’s all closed. As multiple offers become a thing of the past at this point, buyers will be in better negotiating positions and will ask for credits… leading deals to close for lower prices (deals in June/July/August).

- Cue the media, “Home Prices have started going down!” Even a minor drop, like 2% decrease month-over-month, will produce enough media coverage for people to realize we’re at the turn. Then the fear sets in.

- Homeowners who are not planning to sell in the interim will likely not be phased by this.

- But, motivated sellers, such as institutional investors, who would like to cash out while the “going’s good” will start to accelerate a price drop by adding to the already high amount of inventory.

- We could see some pain in the market in Oct/Nov/Dec.

(BONUS!) The Fed Phase:

- If inflation remains high and the Fed remains hawkish, then we could expect prices drops to extend well into 2023.

- If, however, the Fed U-turns and starts lowering interest rates to incentivize lending instead of saving, then this is would be a signal for buying opportunities in real estate.

So there you have it! News before it’s news!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link