MORTGAGE RATES: SETTING THE STAGE FOR FUTURE HOUSING SHORTAGE

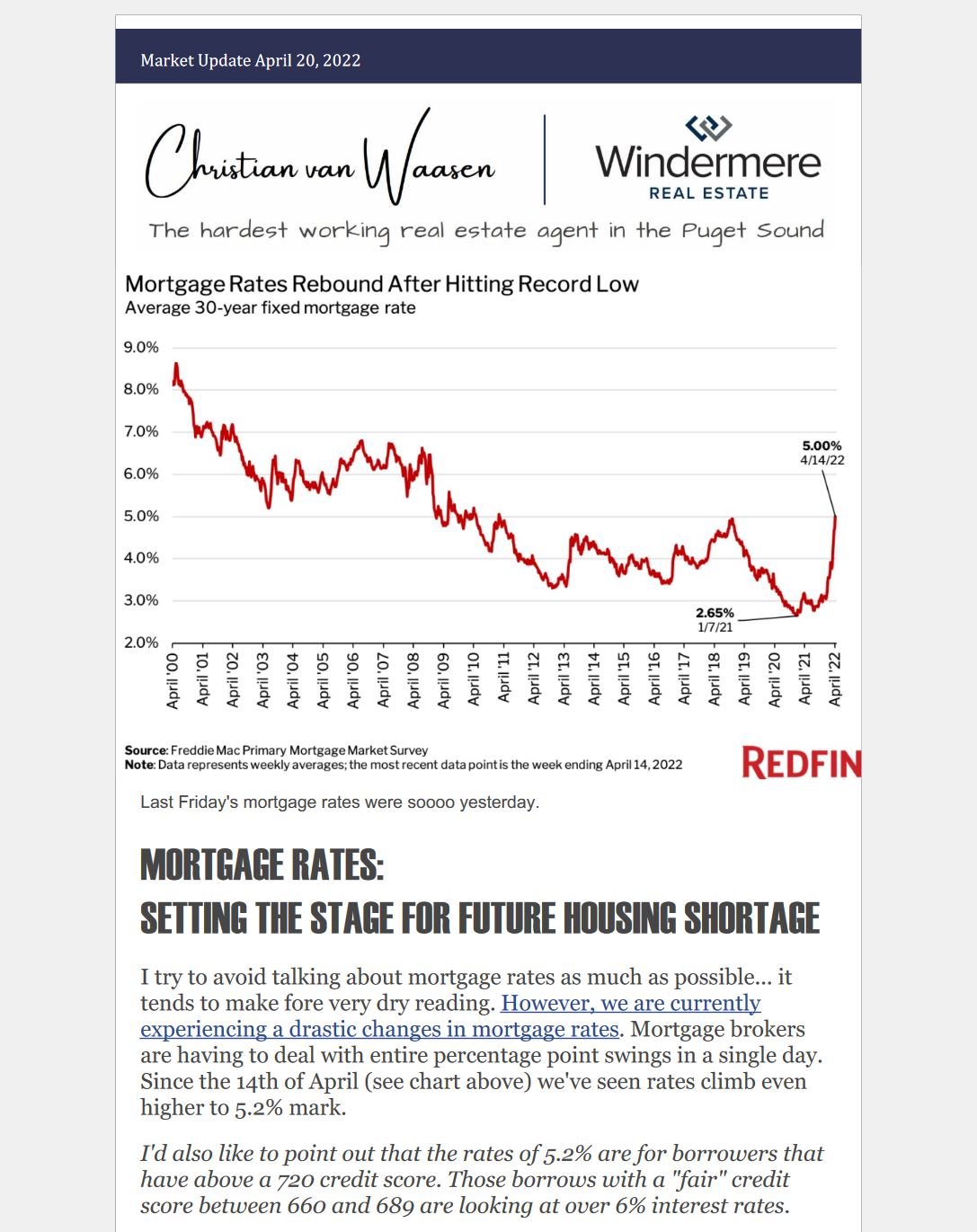

I try to avoid talking about mortgage rates as much as possible… it tends to make fore very dry reading. However, we are currently experiencing a drastic change in mortgage rates. Mortgage brokers are having to deal with entire percentage point swings in a single day. Since the 14th of April (see chart above) we’ve seen rates climb even higher to 5.2% mark.

I’d also like to point out that the rates of 5.2% are for borrowers that have above a 720 credit score. Those borrows with a “fair” credit score between 660 and 689 are looking at over 6% interest rates.

So the obvious point that I won’t be making today is that: borrowing is becoming more expensive for buyers, thereby increasing the monthly cost of housing and therefor suppressing houses prices.

The point that I do want to elaborate on: revolves around the fact that a lot of people scored a historical low interest rate on their 30-year fixed. Roughly half (51%) of homeowners with mortgages have locked in an interest rate of 4% or below.

If mortgage rates continue to rise (and they are expected to), will these homeowners that locked in their low rates be willing to (or can afford to) sell in the future? It used to be that the average American moved on average 7 years. We are now looking at a homeownership duration in the Seattle-Bellevue-Tacoma metro area of over 10 years! This trend will undoubtedly be even longer as mortgage rates continue to climb (and stay high) and people stay put.

What does this mean for the long term perspective in regard to our record low inventory? Well, not good news. About one-third (32%) of all homeowners—including those without mortgages—have a mortgage rate under 4%. This means we could see a third of homes essentially “taken off the market” due people not wanting to take on a new mortgage with a much higher interest rate.

This is setting the stage for housing to remain at incredibly low levels for at least the next decade. ~ Stay tuned to find out more.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link