PRICES LEVEL OUT

As we begin to enter our spring housing market we’re starting to see an interesting trend emerge. The sudden spike in interest rates are starting to weigh down the median priced housing market.

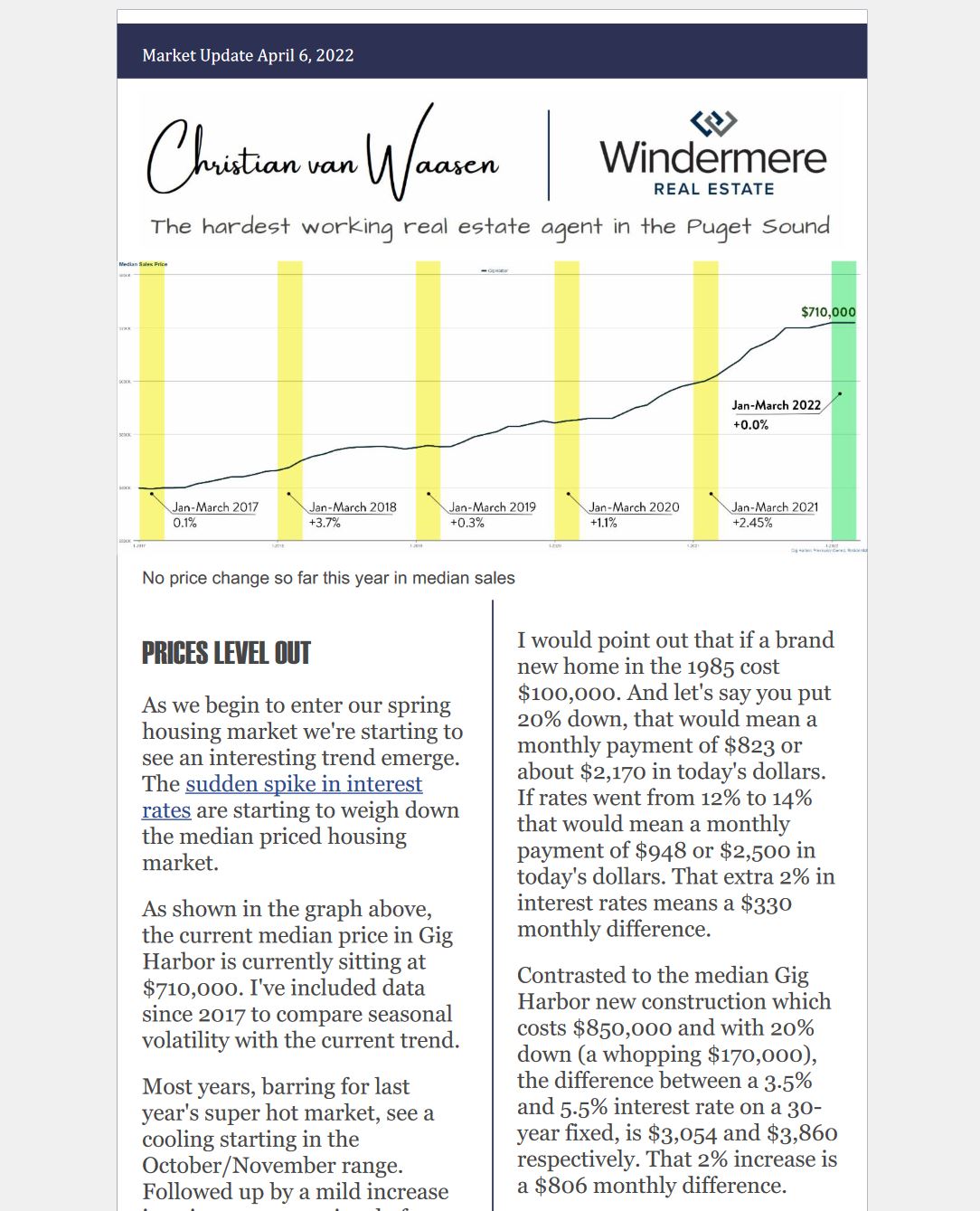

As shown in the graph above, the current median price in Gig Harbor is currently sitting at $710,000. I’ve included data since 2017 to compare seasonal volatility with the current trend.

Most years, barring for last year’s super hot market, see a cooling starting in the October/November range. Followed up by a mild increase in price movement just before the spring housing season.

I also looked back 10 years (not included in this email) and the only year median prices were depressed (or flat) between Jan-March was back in 2013. I‘ve also overlaid 10 years of prior interest rates for a 30-year fixed, and they seemingly had no impact on the price of Gig Harbor’s homes during this time.

Furthermore, I suspect that’s because homes were still relatively affordable in relation to most salaries. Since 2016 salaries up are 20%. The median home in Gig Harbor on the other hand is up 100% (from $350k to $700k).

Coupled with the fact that 4 out of 5 home buyers use some sort of financing, I think we’ve finally reached a point where even a minor increase in interest rates will have an over-weighted impacted on the average American’s housing budget.

I know, I know, I can hear the “back in my day we had 12% interest rates” from here.

I would point out that if a brand-new home in the 1985 cost $100,000. And let’s say you put 20% down, that would mean a monthly payment of $823 or about $2,170 in today’s dollars. If rates went from 12% to 14% that would mean a monthly payment of $948 or $2,500 in today’s dollars. That extra 2% in interest rates means a $330 monthly difference.

Contrasted to the median Gig Harbor new construction which costs $850,000 and with 20% down (a whopping $170,000), the difference between a 3.5% and 5.5% interest rate on a 30-year fixed, is $3,054 and $3,860 respectively. That 2% increase is a $806 monthly difference.

This is a large chunk out of anybody’s budget. If we should ever see 12% interest rates again, that same Gig Harbor home would cost $7000 per month.

WHAT WILL HAPPEN NEXT?

With consumer debt (non-housing) at an all-time high, compound-interest-rate student loans, and housing prices that are rapidly outpacing incomes, I’m not surprised that the sudden jolt interest rates have let some air out of the “median buyer” balloon.

I suspect we’ll continue to see prices flatten and consolidate in the median sales price range.

However, I’m still seeing a very competitive market for the +$1M buyers that will likely persist for the rest of the year.

Many of these buyers are all-cash because of the funds available from the sale of their out-of-state homes or because they have seen healthy growth in their stock portfolios that they’re using for their real estate needs.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link