HOW WILL CONFLICT IN EASTERN EUROPE IMPACT OUR HOUSING MARKET?

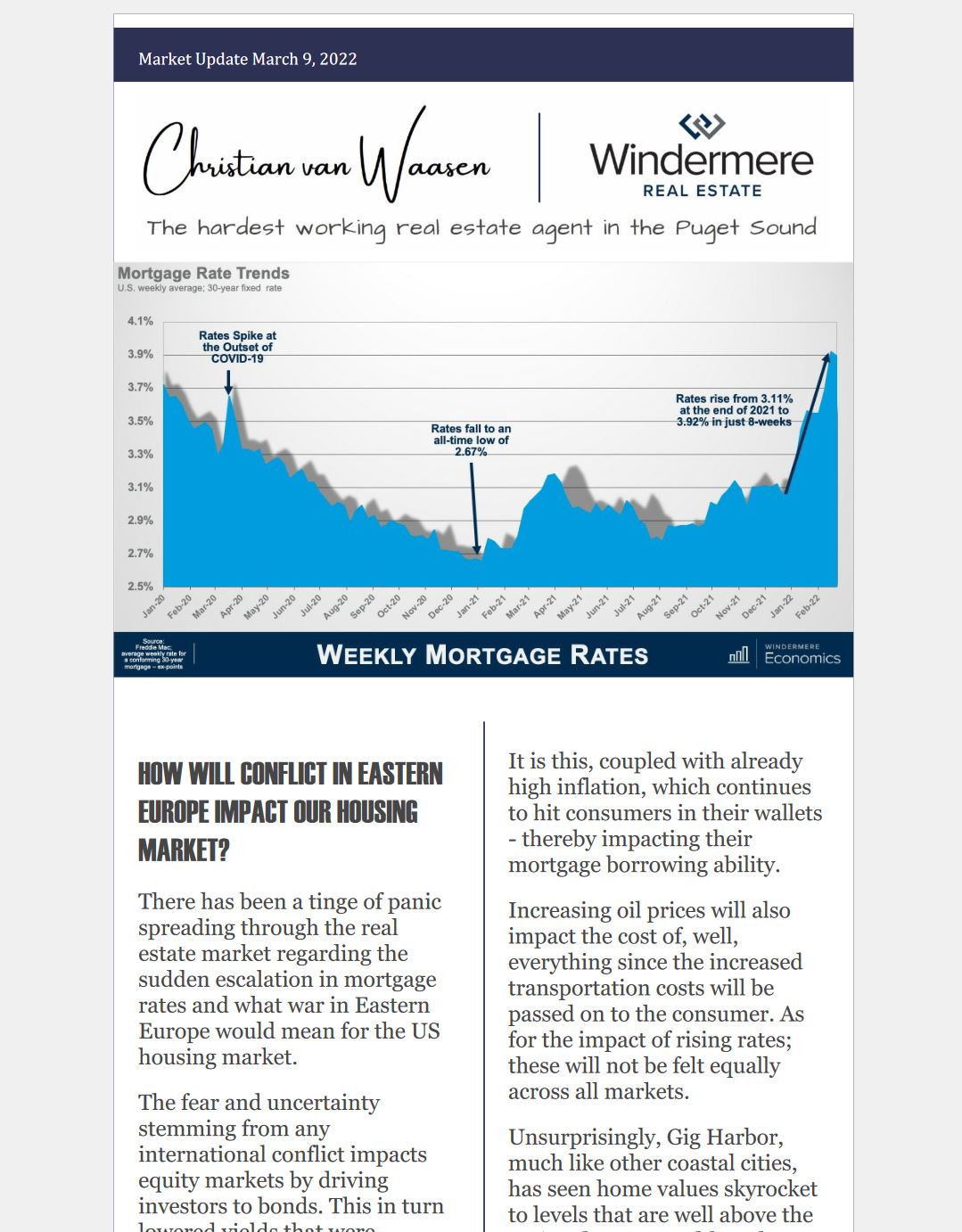

There has been a tinge of panic spreading through the real estate market regarding the sudden escalation in mortgage rates and what war in Eastern Europe would mean for the US housing market.

The fear and uncertainty stemming from any international conflict impacts equity markets by driving investors to bonds. This in turn lowered yields that were skyrocketing due to both Quantitative Easing ending and inflation.

It is highly unlikely rates will go back down to where they were at the start of this year. But, at least for now, see headwinds to their previous pace.

And although the Ukraine situation is unlikely to have any significant impact – up or down – on mortgage rates, there are some indirect items which could negatively hit the housing market.

It’s no secret that the recent events have sent the stock market and the price of commodities (such as nickle, wheat, oil and potash) reeling.

Russia is the third-largest energy producer in the world, and an already tight global oil supply could get even tighter following newly announced financial sanctions on Russia. A barrel of oil has jumped by almost $20 to $108.52 a barrel since the start of the occupation, with no end in sight. Will we see current Los Angeles gas prices ($7.25/g) in Gig Harbor? Time will tell.

It is this, coupled with already high inflation, which continues to hit consumers in their wallets – thereby impacting their mortgage borrowing ability.

Increasing oil prices will also impact the cost of, well, everything since the increased transportation costs will be passed on to the consumer. As for the impact of rising rates; these will not be felt equally across all markets.

Unsurprisingly, Gig Harbor, much like other coastal cities, has seen home values skyrocket to levels that are well above the national average. Although incomes are generally higher in these markets, buyers in more expensive areas will feel more pain from higher financing costs than those looking to buy in markets priced closer to the national average.

Here’s an example of an average Gig Harbor home before and after vs national average.

$750,000 Gig Harbor home

20% down (no PMI)

@ 2.98% = $3,517 / mo

(Incl. loan + taxes + insurance)

@ 4.15% = $3,917 / mo

(Incl. loan + taxes + insurance)

That’s a $4,800 / year difference for the same house.

$310,000 US average home

20% down (no PMI)

@ 2.98% = $1,453 / mo

(Incl. loan + taxes + insurance)

@ 4.15% = $1,619 / mo

(Incl. loan + taxes + insurance)

That’s a $1,992 / year difference for the same house.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link