WOW! NOT A WHOLE LOTTA CHANGE!

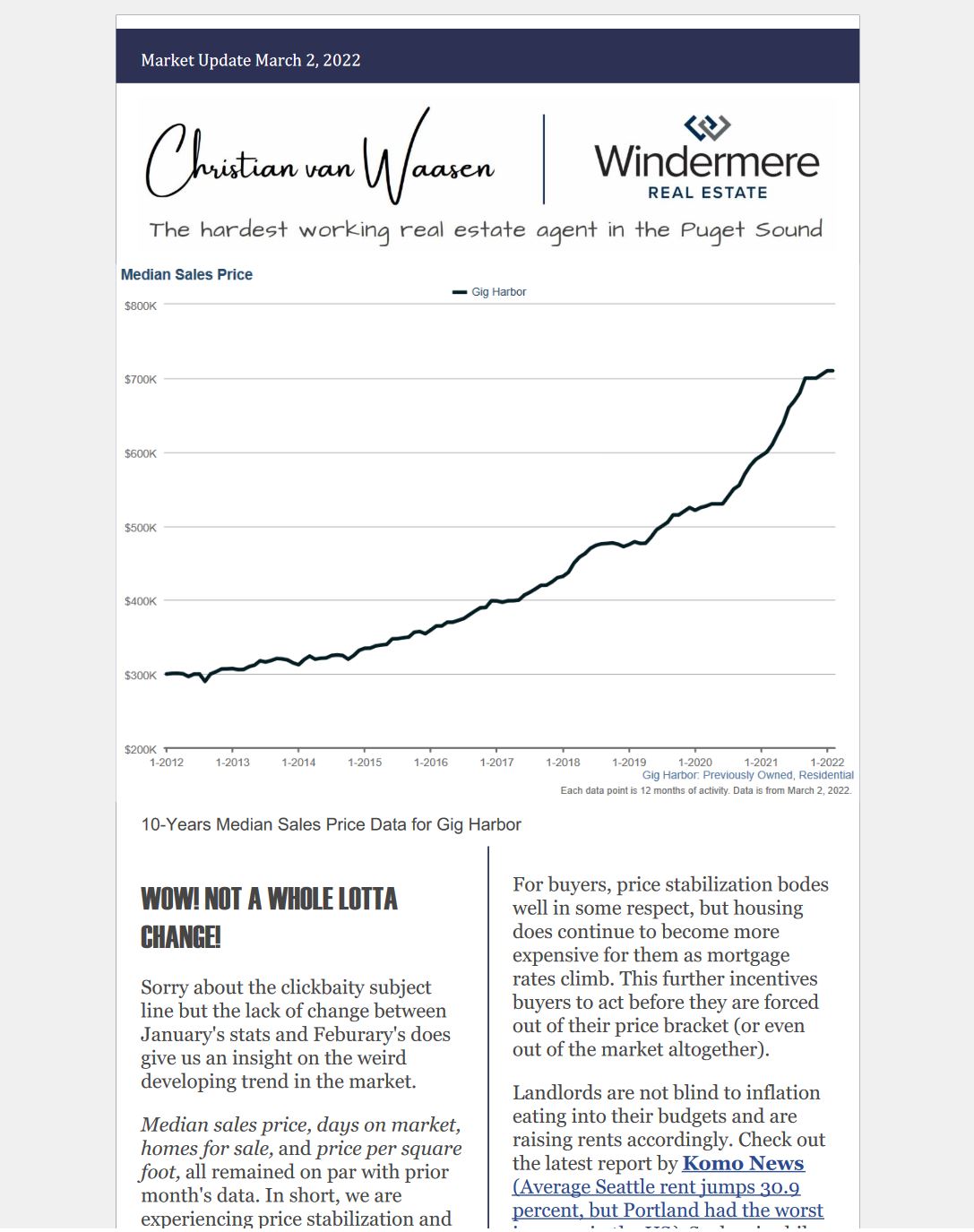

Sorry about the clickbaity subject line, but the lack of change between January’s stats and February’s does give us an insight on the weird developing trend in the market.

Median sales price, days on market, homes for sale, and price per square foot, all remained on par with prior month’s data. In short, we are experiencing price stabilization and at the same time record low-levels of inventory is selling at a record pace.

So what does this mean, and where are we going? Well, let’s gaze into my crystal ball and see.

Despite there still being a lot of cash waiting on the sidelines for a “inevitable” housing correction, I suspect (judging by the graph above) that such an event is highly unlikely – barring any economic collapse.

Here are some key factors to consider:

- Lenders have had tight regulations to follow when issuing mortgages

- New housing stock is being built too slowly

- The number of millennials entering the housing market keeps climbing.

Ok, so no coming catastrophe. What’s more pertinent to our current market condition is the “rising-faster-than-expected interest-rate” environment battling it out against demand. I expect the price stabilization trend that is developing to continue, at least for the interim.

For homeowners, stabilizing home prices in a high inflationary environment means they are getting gradually less and less for their homes in terms of purchasing power. This might justify prices to inch up month over month.

For buyers, price stabilization bodes well in some respect, but housing does continue to become more expensive for them as mortgage rates climb. This further incentives buyers to act before they are forced out of their price bracket (or even out of the market altogether).

Landlords are not blind to inflation eating into their budgets and are raising rents accordingly. Check out the latest report by Komo News (Average Seattle rent jumps 30.9 percent, but Portland had the worst increase in the US). Such price hikes are unsustainable, giving me further

credence that housing prices will taper off and hold to their current level.

All in all, I see housing prices continue both slowly tick higher and at the same time wobble up and down as buyers and sellers grapple with the changing economic and financial landscape.

Curious about how prices differ in and around Gig Harbor?

Here’s some insight!

GH South – 98335

$780,250

(Median Sales Price in Feb)

GH North – 98332

$770,000

(Median Sales Price in Feb)

Fox Island – 98332

$962,250

(Median Sales Price in Feb)

North KP – 98329

$452,000

(Median Sales Price in Feb)

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link