MATTHEW GARDNER’S Q4 2021 WESTERN WASHINGTON REPORT

Windermere’s chief economist, Matthew Gardner, just released his analysis of the Western Washington real estate market. You can of course read the full report via link above… or read the key takeaways I have compiled for you below.

❱❱ UNEMPLOYMENT DATA

The most recent data (November) shows the regional unemployment rate at a very respectable 3.3%, which is below the pre-pandemic low of 3.7%

❱❱ HOME SALES DOWN – BLAME INVENTORY

Year-over-year home sales were down more than 30%. This reflects the 5% drop we saw in homes sold in Q4 2021 vs Q4 2020.

The ratio of pending sales (demand) to active listings (supply) showed sales outpacing listings by a factor of 5.2. The market is supply starved and unfortunately, it’s unlikely enough homes will be listed this spring to satisfy demand.

❱❱ REGIONAL HOME PRICES

Home prices rose 15.1% compared to a year ago, with an average sale price of $711,008.

❱❱ DAYS ON MARKET… UP?

It took an average of 23 days for homes to sell in the final quarter of 2021. This was 8 fewer days than in the same quarter of 2020, but 6 more days than in the third quarter of last year.

Longer days on the market might suggest that things are starting to slow. Matthew Gardner believes this isn’t the case, he thinks buyers are being a little more selective before making offers, and many may be waiting in the hope that supply levels will improve in the spring.

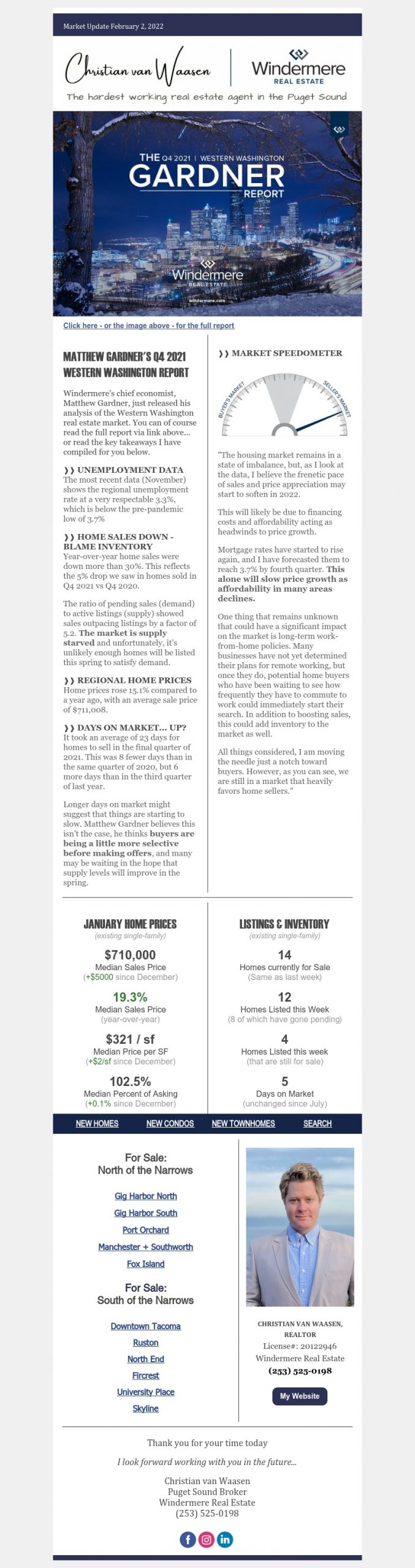

❱❱ MARKET SPEEDOMETER

“The housing market remains in a state of imbalance, but, as I look at the data, I believe the frenetic pace of sales and price appreciation may start to soften in 2022.

This will likely be due to financing costs and affordability acting as headwinds to price growth. Mortgage rates have started to rise again, and I have forecasted them to reach 3.7% by fourth quarter. This alone will slow price growth as affordability in many areas declines.

One thing that remains unknown that could have a significant impact on the market is long-term work-from-home policies. Many businesses have not yet determined their plans for remote working, but once they do, potential home buyers who have been waiting to see how frequently they have to commute to work could immediately start their search. In addition to boosting sales, this could add inventory to the market as well.

All things considered, I am moving the needle just a notch toward buyers. However, as you can see, we are still in a market that heavily favors home sellers.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link