EVERYONE’S FAVORITE NEWS TOPIC: MORTGAGE RATES!

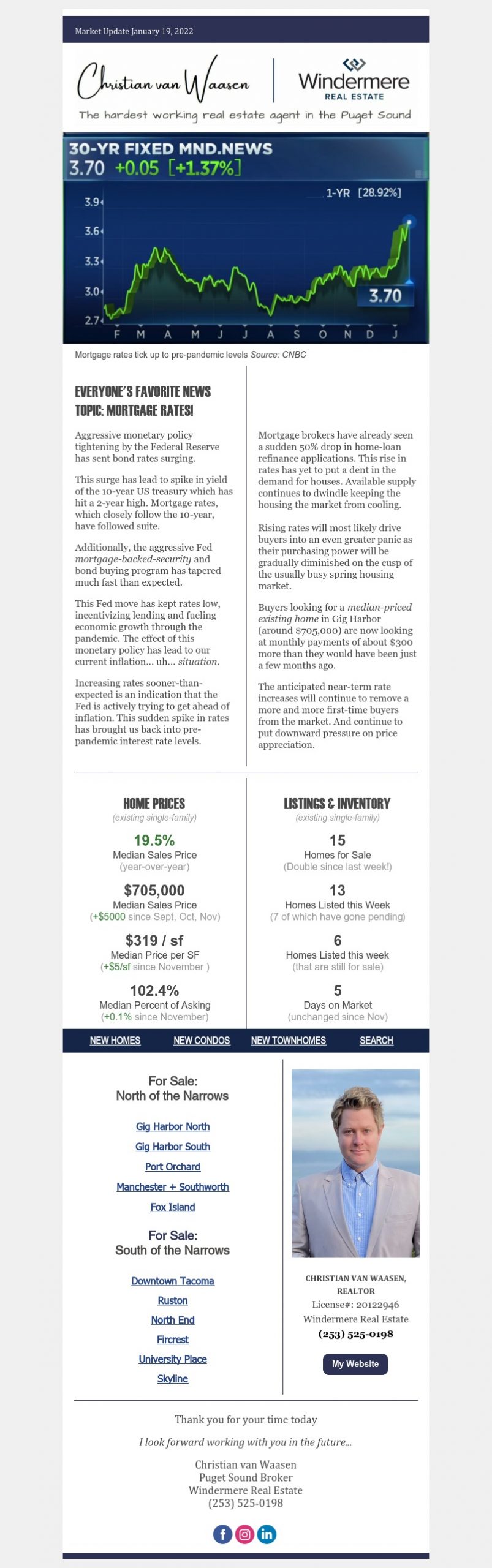

Aggressive monetary policy tightening by the Federal Reserve has sent bond rates surging.

This surge has lead to a spike in yield of the 10-year US treasury, which has hit a 2-year-high. Mortgage rates, which closely follow the 10-year, have followed suite. Additionally, the aggressive Fed mortgage-backed-security and bond buying program has tapered much faster than expected.

This Fed move has kept rates low, incentivizing lending and fueling economic growth through the pandemic. The effect of this monetary policy has led to our current inflation… uh… situation.

Increasing rates sooner-than-expected is an indication that the Fed is actively trying to get ahead of inflation. This sudden spike in rates has brought us back into pre-pandemic interest rate levels. Mortgage brokers have already seen a sudden 50% drop in home-loan refinance applications. This rise in rates has yet to put a dent in the demand for houses. Available supply continues to dwindle, keeping the housing the market from cooling.

Rising rates will most likely drive buyers into an even greater panic, as their purchasing power will be gradually diminished on the cusp of the usually busy spring housing market.

Buyers looking for a median-priced existing home in Gig Harbor (around $705,000) are now looking at monthly payments of about $300 more than they would have been just a few months ago. The anticipated near-term rate increases will continue to remove a more and more first-time buyers from the market. And continue to put downward pressure on price appreciation.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link