UNDERSTANDING NFTS

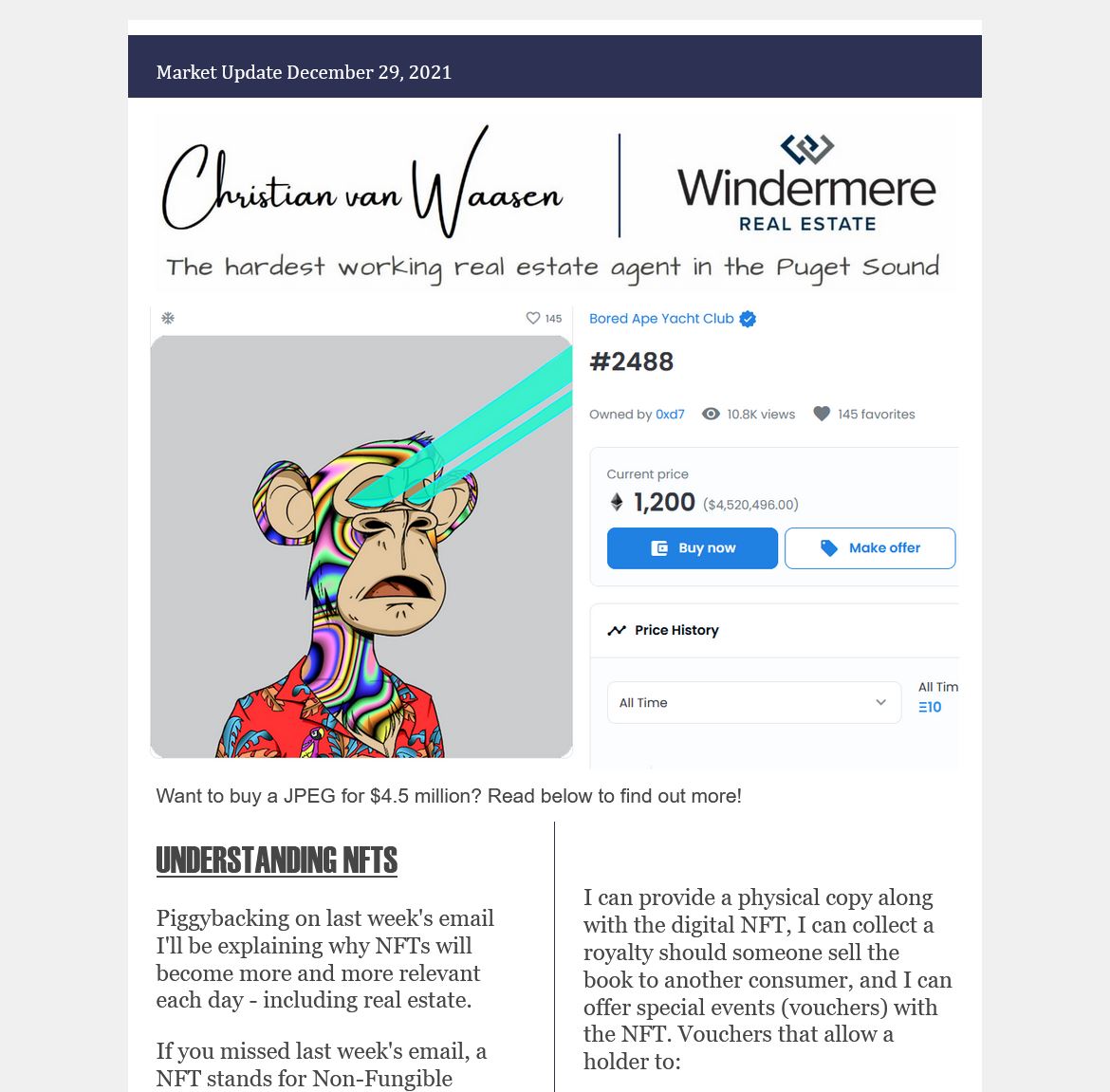

Piggybacking on last week’s email I’ll be explaining why NFTs will become more and more relevant each day – including real estate. If you missed last week’s email, a NFT stands for Non-Fungible Token. This token is digital piece of content that cannot be duplicated because it has a unique ID associated with it. Think of it as a certificate of authenticity. Currently, the most prevalent use for NFTs is selling and buying digital art (*cough* speculation). Two of the most high profile NFTs are CryptoPunks and Bored Ape Yacht Club. You too can be an owner of a Bored Ape jpeg for a mere $1.3 million. (Yes, there are cheaper ones, and yes, there are more expensive ones). Rapper and Producer Jay-Z bought his CyperPunk NFT for $126,000 which he uses for his twitter profile.

WHY ARE THEY SO EXPENSIVE?

Who in their right mind would spend this much money on something as stupid as a JPEG? It’s not even tangible! Well, human nature is to blame for this one. Why do people spend extravagant sums of money on “overpriced junk” such as jewelry, rolexs, BMWs, Rembrandts? NFTs are just a digital extension of this real world “flexing.” This, coupled with the rampant speculation, flipping, and quick profits, has lead to what harks back to the tulip mania of 1636. And I would say it’s safe to assume that a similar event will occur with the vast majority (+98%) of projects in this first wave of NFTs failing.

SO WHY AM I BRINGING THIS UP?

If this is a flash-in-the-pan event, why even bother talking about it? The expression, “Don’t throw the baby out with the bath water,” comes to mind because the technology behind NFTs is what’s ground breaking. When creating an NFT, you can create multiple copies. Each with their own unique ID. This means in the future we will see things such as:

- Concert/Sporting Tickets

- Books

- Music

- Movies

You might be saying to yourself that all these things already exist online! But what’s currently missing is the ability to go directly from creator to consumer. NFTs allow removal of the middleman and allow you to control royalties (that you even can pass down to your heirs).

For example, if I write a book and sell it as an NFT on Opensea.oi, I don’t need a publisher. I don’t need Amazon. And, the sky’s the limit to what I can include into my NFT!

I can provide a physical copy along with the digital NFT, I can collect a royalty should someone sell the book to another consumer, and I can offer special events (vouchers) with the NFT. Vouchers that allow a holder to:

- Spend a day with the author,

- Entrance to a writing seminar

taught by the author, - Shadow the author for a day

This way you incentive someone to buy your NFT as an investment in you and your career! Imagine having access to your favorite living author because they released an NFT way back when before their notoriety. Or you could sell your access to the author to someone else for “many dollars signs.”

This direct access to the end user will allow artists, photographers, writers, and creators to be able to make a living from their work. No longer will there be a gatekeeper preventing them from an audience. We’ve already seen this happening on the music front with Sound Cloud. Anyone musician can upload their music and have it heard across the globe.

REMOVAL OF THE MIDDLEMAN AND REAL ESTATE

Real estate, in its purest form, is a simply a piece of paper (a deed) that gives you authority over a physical piece of property. Can this deed be digital? You bet! Is it possible to never have title issues ever again because all title history is now logged on the blockchain? Yup! Will escrow never have to used because clicking a button will automatically swap currency for the deed? You betcha!

So really it’s only a matter of time before you can buy and sell without all the fees and commissions with a click of a button. In reality, however, real estate (to the chagrin of many venture capitalist backed companies) is more difficult to commodify than a burrito blanket on sold on Amazon for example. Few people could stomach buying a house site-unseen, unable to negotiate, unable to get into contract allowing you to do due diligence without worrying that it’ll get bought out from under you. Most importantly, it’s hard to take the people and emotion out of real estate.

Therefore, I’m having trouble picturing the role of a real estate agent being assumed by a digital exchange. However, I do see Title and Escrow becoming eventually

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link