HO HO HO – MERRY MISERY-MAS?

No, I’m not talking about your credit card statement after a online shopping spree. Today I’m going to quickly covering the Misery Index again.

If you don’t recall this index from a previous email, it’s a measure of the nation’s economic misery which is calculated by summing up unemployment and inflation. Basically, it’s statistical information that presents the economic distress felt by everyday people.

What comes to a surprise is that the index is sitting at 11.2, a level similar to the indices during economic recessions. Which is odd because the S&P 500 has reached record highs, wage growth is accelerating, and jobless claims have fallen to the lowest levels since 1969.

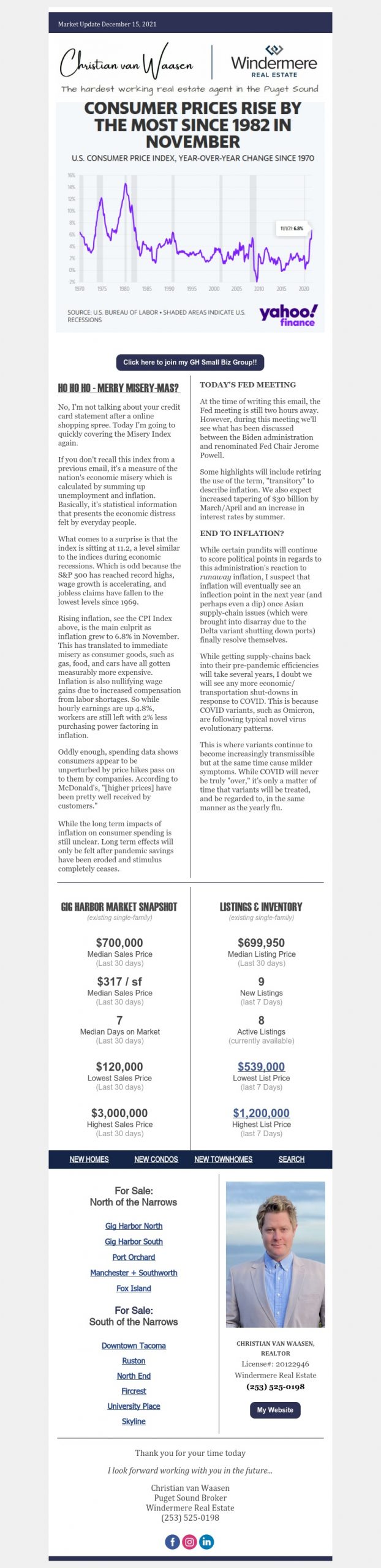

Rising inflation, see the CPI Index above, is the main culprit as inflation grew to 6.8% in November. This has translated to immediate misery as consumer goods, such as gas, food, and cars have all gotten measurably more expensive. Inflation is also nullifying wage gains due to increased compensation from labor shortages. So while hourly earnings are up 4.8%, workers are still left with 2% less purchasing power factoring in inflation.

Oddly enough, spending data shows consumers appear to be unperturbed by price hikes pass on to them by companies. According to McDonald’s, “[higher prices] have been pretty well received by customers.”

While the long term impacts of inflation on consumer spending is still unclear. Long term effects will only be felt after pandemic savings have been eroded and stimulus completely ceases.

TODAY’S FED MEETING

At the time of writing this email, the Fed meeting is still two hours away. However, during this meeting we’ll see what has been discussed between the Biden administration and renominated Fed Chair Jerome Powell.

Some highlights will include retiring the use of the term, “transitory” to describe inflation. We also expect increased tapering of $30 billion by March/April and an increase in interest rates by summer.

END TO INFLATION?

While certain pundits will continue to score political points in regards to this administration’s reaction to runaway inflation, I suspect that inflation will eventually see an inflection point in the next year (and perhaps even a dip) once Asian supply-chain issues (which were brought into disarray due to the Delta variant shutting down ports) finally resolve themselves.

While getting supply-chains back into their pre-pandemic efficiencies will take several years, I doubt we will see any more economic/transportation shut-downs in response to COVID. This is because COVID variants, such as Omicron, are following typical novel virus evolutionary patterns.

This is where variants continue to become increasingly transmissible but at the same time cause milder symptoms. While COVID will never be truly “over,” it’s only a matter of time that variants will be treated, and be regarded to, in the same manner as the yearly flu.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link