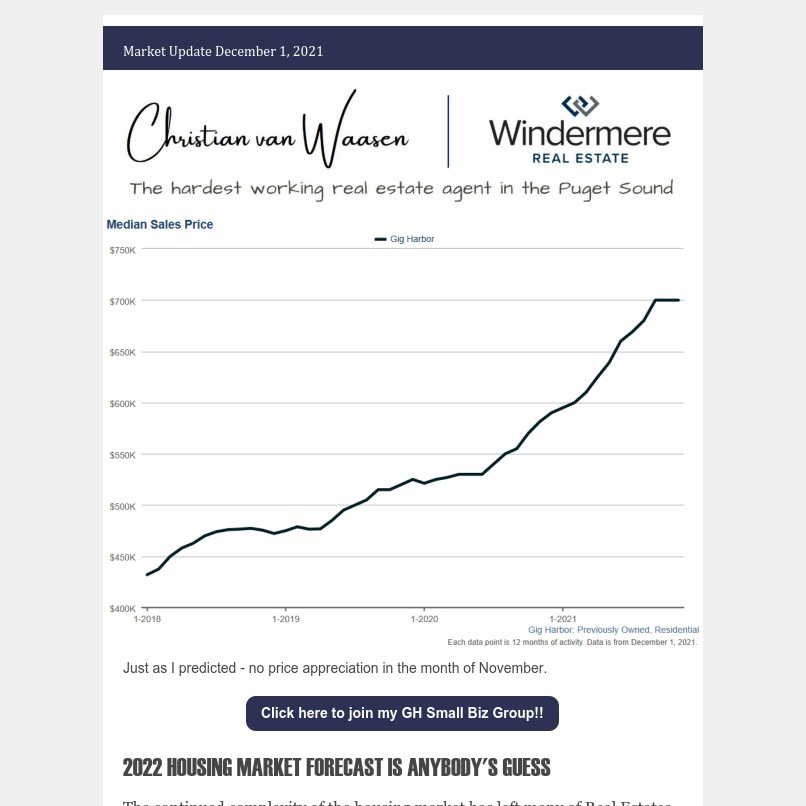

2022 HOUSING MARKET FORECAST IS ANYBODY’S GUESS

The continued complexity of the housing market has left many of Real Estates biggest players looking for answers. Once the beacon of security, predictability and slow-but-steady price appreciation (4.6% since 1980), housing has now become a wildcard thanks to the multitude headline worthy factors.

Since there is no industry consensuses, lets look at the four wildly differing forecasts available to us:

1. On the High Side Projections

Zillow: ▲ 13.6%

Goldman: ▲ 13.5%

Perspective: The largest 12-month price appreciation we saw prior to the 2008 housing crash was 14.1%.

Meaning: More and more buyers will be priced out of the housing market.

Why? Low housing supply plus a strong demand, especially from the first-time homebuyer millennials entering the market.

2. Middle-of-the-Road Projections

Fannie Mae: ▲ 7.9%

Freddie Mac: ▲ 7.0%

Perspective: Falling back closer to the historical average of 4.6% (since 1980).

Meaning: Housing will still be outpacing purchasing power. Mortgage rates will be need to remain low to allow first-time buyer to enter the market.

Why? Less frenzy to escape the cities, inflation helping pad prices, but a low enough supply to fuel competition.

3. Substantial Deceleration in Price Growth

Redfin: ▲ 3%

CoreLogic: ▲ 1.9%

Perspective: Less than historic appreciation, somewhat like a hangover from the COVID frenzy and downward pressure from mortgage rates

Meaning: Price growth getting stalled due to rising mortgage rates. Especially as the Fed is actively changing its policies.

Why? 30-year fixed rates are expected to climb from 3.1% to 3.5-3.6% by end of year 2022. This half-a-percentage change would cost an additional $50,000 more for a $500,000 30-year loan. Also, how will corporate America continue to support working from home? If we see a return to the office, this could push down demand for second homes and metropolis exurbs (such those around Seattle).

4. Price Reduction?!?!?

Mortgage Bankers Association: ▼ 2.5%

Perspective: Even higher interest rates predicted by Fannie Mae.

Meaning: Interest rates have a 1-to-10 rule of thumb. For every 1% of interest increase, housing prices reduce by 10%. MBA predicts that by Q4 of next year,

we’ll see 30-year fixed rates at 4%. Meaning almost a 1% increase in interest rates.

Why? Inflation will pressure Fed to increase interest rates slightly more than originally anticipated.

What do I think will happen locally?

We’ll probably see fluctuation between middle-of-the-road (during the spring season) and historic appreciation (during late summer and fall) as interest rates start weighing on buyers.

With our already high prices, a 5% increase in appreciation would mean big bucks for most buyers – especially when interest rates start climbing in to the high 3’s.

Thanks for reading. Hope you got some good value out of this!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link