STAGFLATION VS INFLATION: CAN YOU SPOT THE DIFFERENCE?

While many people disagree to the extent future inflation, certain hedge funds have, well, hedged their bets that we might experience similar stagflation that took place during the 1970-80s. Even Bank of American Global Research analysts declared in a recent note that, “stagflation is here.”

First of all, what is stagflation? It is:

- An inflationary period (prices of goods increases)

- When economic output decreases (production of goods and services declines)

- Increase unemployment

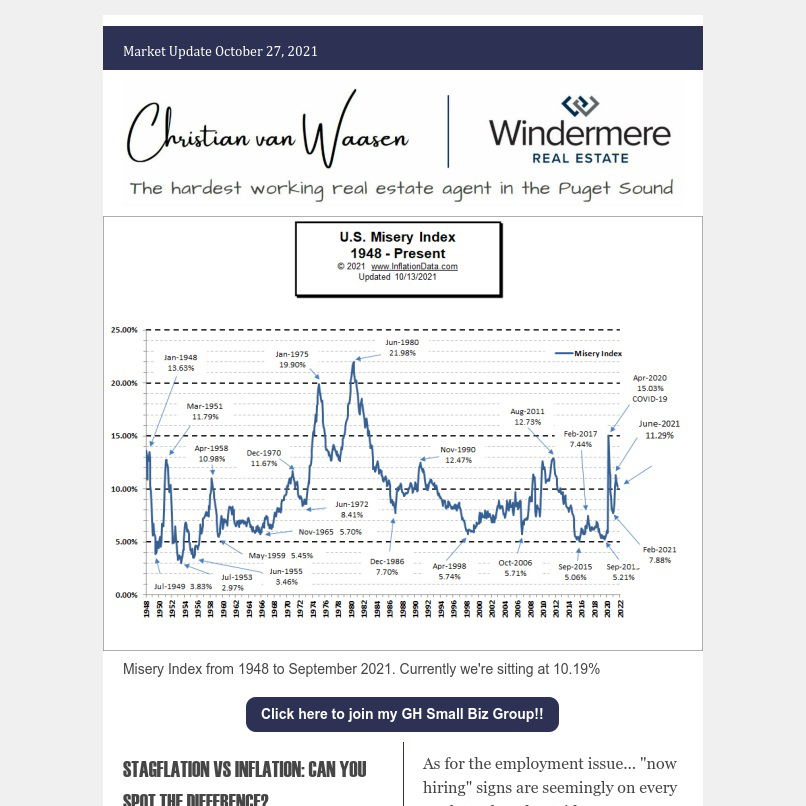

The advent of stagflation, a phenomenon that was once thought theoretically impossible, lead to the creation of the misery index. If you’ve never heard of this index, it is released by the Bureau of Labor Statistics which calculates the US inflation rate and the US unemployment rate. See the graph above. While the spikes in this year’s data are still fluctuating, it can be noted that we’re around the same level of misery we experienced from 2006-2012 (~10%).

What would drive stagflation? Well the first two points seem to meeting the criteria. We are already seeing increased cost of goods and our Thanksgiving will be the most expensive one in the history of the holiday.

Oil and natural gas have increased substantially in price this year. Rent is going up in double digits in many metropolitan areas. While energy costs and rent seem removed from “goods or services,” these escalating costs translate directly to increased cost of production, shipping costs, and reduction discretionary spending (due to increased spending on housing and energy costs).

As for the employment issue… “now hiring” signs are seemingly on every work truck and outside every restaurant. Surely this makes unemployment seems like a non-issue? Well the first issue with this is these jobs are directed towards a trade (plumber, HVAC, roofer, etc) or are otherwise categorized as “unskilled” work. These jobs will unlikely to attract recent college graduates or professionals who are increasingly sick of work. The subreddit of r/antiwork has seen a surge in users as a record breaking amount of Americans are quitting work. This is becoming less of an unemployment issue and more of a refusal to work issue.

While we’re still in a period of uncertainty, and it’s too soon to infer any long term trends, the best protection one can take is to become informed of a breadth of possibilities and outcomes. Luck favors the prepared after all. While protecting your financial well-being, be it from stagflation or inflation, is essentially the same (see last week’s email), stagflation is much harder to address from a political and monetary policy standpoint. With an uncertain economic climate and new stains on the middle class, political upheaval will surely follow.

PRIOR EMAIL TOPIC TRACKER:

More inflation chatter:

- Twitter’s Jack Dorsey predicts worldwide hyperinflation Cathie Wood disputes Jack’s prediction

Evergrande Crisis Watch:

- The crisis is spreading. Other Chinese developers are defaulting or wobbling

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link