WHERE ARE HOME PRICES GOING TO NEXT?

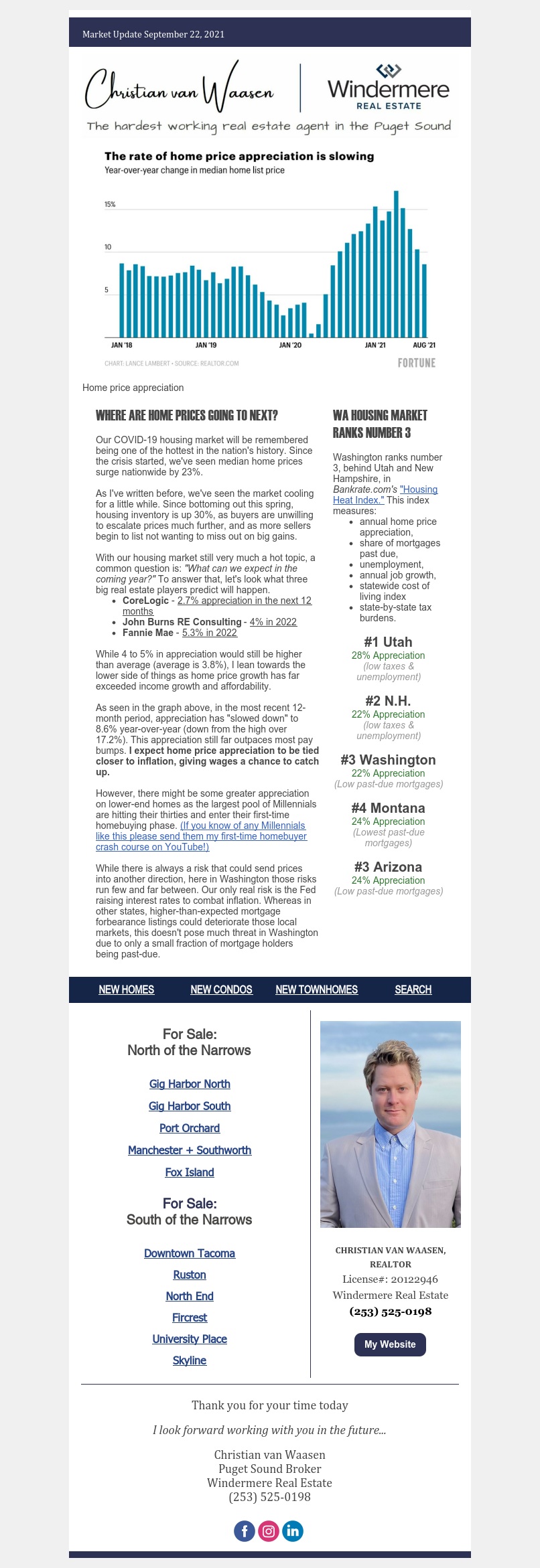

Our COVID-19 housing market will be remembered being one of the hottest in the nation’s history. Since the crisis started, we’ve seen median home prices surge nationwide by 23%.

As I’ve written before, we’ve seen the market cooling for a little while. Since bottoming out this spring, housing inventory is up 30%, as buyers are unwilling to escalate prices much further, and as more sellers begin to list not wanting to miss out on big gains.

With our housing market still very much a hot topic, a common question is: “What can we expect in the coming year?” To answer that, let’s look what three big real estate players predict will happen.

- CoreLogic – 2.7% appreciation in the next 12 months

- John Burns RE Consulting – 4% in 2022

- Fannie Mae – 5.3% in 2022

While 4 to 5% in appreciation would still be higher than average (average is 3.8%), I lean towards the lower side of things as home price growth has far exceeded income growth and affordability.

As seen in the graph above, in the most recent 12- month period, appreciation has “slowed down” to 8.6% year-over-year (down from the high over 17.2%). This appreciation still far outpaces most pay bumps. I expect home price appreciation to be tied closer to inflation, giving wages a chance to catch up.

However, there might be some greater appreciation on lower-end homes as the largest pool of Millennials are hitting their thirties and enter their first-time homebuying phase. (If you know of any Millennials like this please send them my first-time homebuyer crash course on YouTube!)

While there is always a risk that could send prices into another direction, here in Washington those risks run few and far between. Our only real risk is the Fed raising interest rates to combat inflation. Whereas in other states, higher-than-expected mortgage forbearance listings could deteriorate those local markets, this doesn’t pose much threat in Washington due to only a small fraction of mortgage holders being past-due.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link