Q2 2021 – REGIONAL REPORT

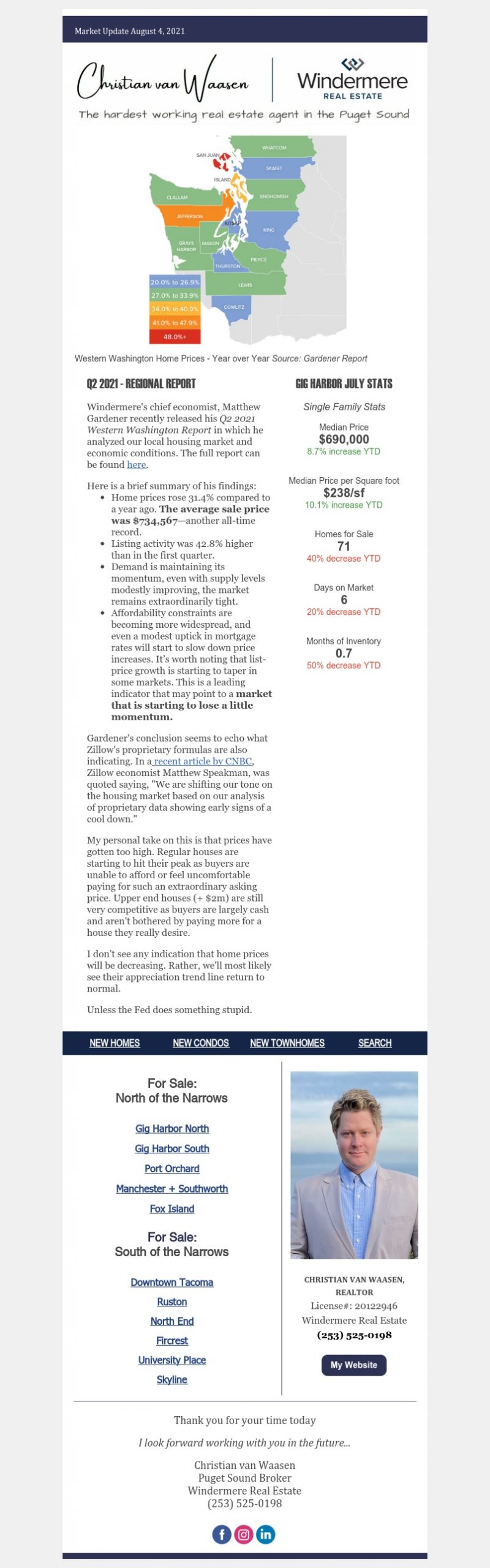

Windermere’s chief economist, Matthew Gardener recently released his Q2 2021 Western Washington Report in which he analyzed our local housing market and economic conditions. The full report can be found here.

Here is a brief summary of his findings:

- Home prices rose 31.4% compared to a year ago. The average sale price was $734,567—another all-time record.

- Listing activity was 42.8% higher than in the first quarter.

- Demand is maintaining its momentum, even with supply levels modestly improving, the market remains extraordinarily tight.

- Affordability constraints are becoming more widespread, and even a modest uptick in mortgage rates will start to slow down price increases. It’s worth noting that list-price growth is starting to taper in some markets. This is a leading indicator that may point to a market that is starting to lose a little momentum.

Gardener’s conclusion seems to echo what Zillow’s proprietary formulas are also indicating. In a recent article by CNBC, Zillow economist Matthew Speakman, was quoted saying, “We are shifting our tone on the housing market based on our analysis of proprietary data showing early signs of a cool down.”

My personal take on this is that prices have gotten too high. Regular houses are starting to hit their peak as buyers are unable to afford or feel uncomfortable paying for such an extraordinary asking price. Upper end houses (+ $2m) are still very competitive as buyers are largely cash and aren’t bothered by paying more for a house they really desire.

I don’t see any indication that home prices will be decreasing. Rather, we’ll most likely see their appreciation trend line return to normal.

Unless the Fed does something stupid.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link