RISING INTEREST RATES, INFLATION AND HOUSING PRICES

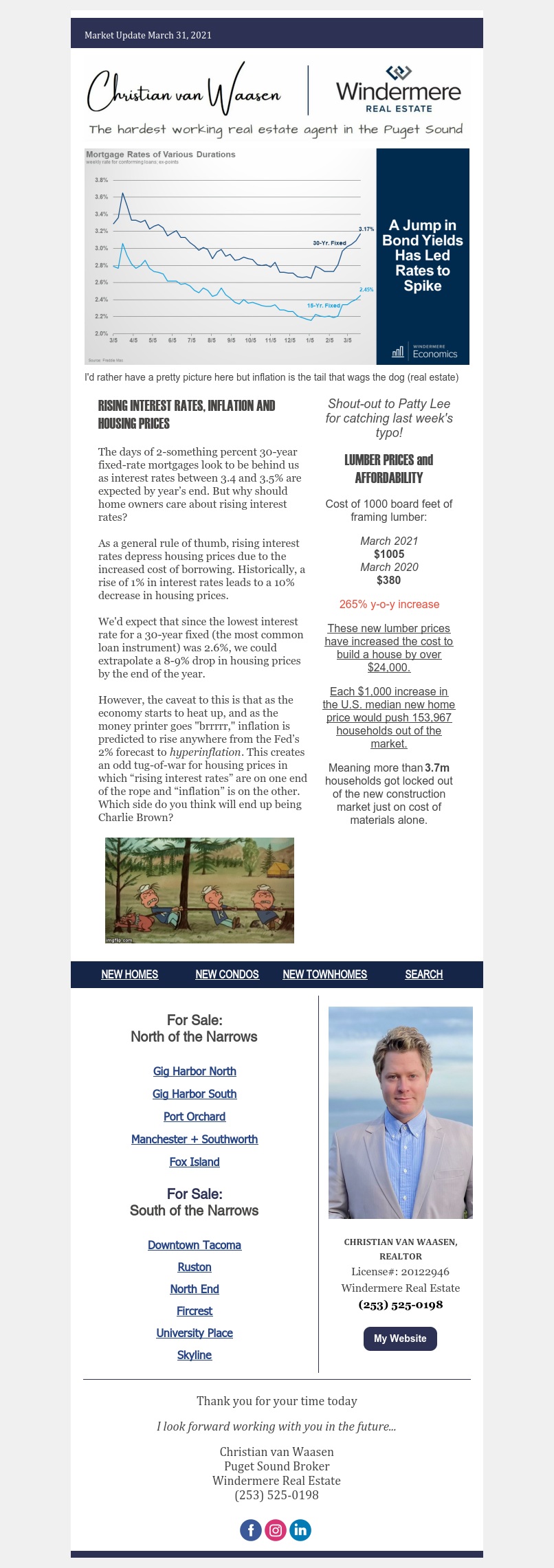

The days of 2-something percent 30-year fixed-rate mortgages look to be behind us as interest rates between 3.4 and 3.5% are expected by year’s end. But why should home owners care about rising interest rates?

As a general rule of thumb, rising interest rates depress housing prices due to the increased cost of borrowing. Historically, a rise of 1% in interest rates leads to a 10% decrease in housing prices.

We’d expect that since the lowest interest rate for a 30-year fixed (the most common loan instrument) was 2.6%, we could extrapolate a 8-9% drop in housing prices by the end of the year.

However, the caveat to this is that as the economy starts to heat up, and as the money printer goes “brrrrr,” inflation is predicted to rise anywhere from the Fed’s 2% forecast to hyperinflation. This creates an odd tug-of-war for housing prices in which “rising interest rates” are on one end of the rope and “inflation” is on the other. Which side do you think will end up being Charlie Brown?

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link