BUY WITH

CHRISTIAN

UNDER CONSTRUCTION - THIS SITE IS BEING UPDATED DAILY

Start here if this is your first time buying a home!

Once you've gone through these steps, you'll be as ready as a seasoned homeowner.

Welcome!

[0:00] INTRODUCTION. Hello and welcome everybody to my First-time Home Buyer’s Crash course for first-time home buyers looking to buy their first home. Sorry, that’s a working title.Hey! My name is Christian and I’m a real estate broker in Washington State. That’s the Washington STATE with bigfoot, not all of the political corruption... so just to distinguish between the two.

I work mainly in the Puget Sound region which is in Western Washington and primarily focus on Gig Harbor and Seattle which are my two hometowns. But I’ll go wherever duty takes me. Anyway, if you’d like to use me as your real estate agent, please contact me, you’ll find my contact information in the link below. I’d love to talk and start a conversation after this video.

HERE’S A HAPPY LITTLE LINK TO CONTACT ME

[0:53] WHO IS THIS FOR COURSE FOR? But enough of that for now, what are we going to be covering in this First-time Home Buyer Crash Course? Well, I’ve designed this home buyer crash course to be for those who are like, “I have no idea how to buy my first home. What’s the first step? What do I do? All I want to do is escape my parent’s basement! Or my cramped apartment building. I need a house! How do I get one?” Well, you’ve come to the right place. I’m not sure how you found this video. Hopefully you put something into Google or into the “YouTubes” maybe you found another video and it kinda linked and chained and now you’re here! Well, regardless how you found this video you’re in the right place.

[1.26] THE TLDW OF HOW TO BUY A HOUSE. Before we get into our first-time home buyer crash course let’s look at the home buying saga. And it looks like this: You have money, or you find someone who agrees to give you money, then you go looking for people who want money for their home, and if you go to them and say, “Hey is my money good enough for your home?” and they agree, then congratulations you’re a homeowner. Pretty simple right? Pretty boring right? You know what we need? Just like any good story, any good saga, it needs personal growth, character development, financial growth (oh, I like that one), it needs toughening up, it needs training, mentorship, and personal sacrifice. And when do those happen? Those happen in the set of prequels I’ve made. And they’re only missing one thing, and that’s you! I’ve made them so you can have a kick ass home buying saga. And lucky for you, they’re in this home buying crash course!

[2:37] So, let’s look at the storyboard for this home buyer crash course. Here are the 5 episodes that’ll take you from zero to home buying hero. Sorry for the cliche, but I think it gets the point across well that we can see here starting with our first episode.

[2:52] Ep1. The Introspection

- I’ll be asking you a series of questions to test your mettle, to find out if you're ready to make that personal sacrifice, to make that commitment, and to really find that determination that you’re ready to become a homeowner. Not everybody is ready to become a homeowner just yet.

- That’s why we’ll be looking at the pro’s and con’s of renting and buying. Because sometimes renting is the best option for you. So before we leap in and take on that huge financial responsibility of a mortgage, I want you to be ready, committed and willing to become a homeowner.

[3:34] Ep2. The Financial Growth

- In this episode we’ll be covering the two most important things in your life… at least according to a lender, and that’s your debt and income! Now if you're not sure what your debt and income are, don’t worry, that’s why I’m here, I’ll be showing you how to calculate those.

- And then we’ll be taking some basic ratios that lenders use to assess how risky you are. Because when they give you money, well, when they lend you money (they don’t give you money) they want to make sure that you pay them back.

- And then we’ll also be looking at steps, the financial growth side of things, how to decrease your debt, increase your income (oh, that’s good), and increase your credit. So, that’s what we’ll be covering in the financial growth episode.

[4:20] Ep3. The Personal Growth

- In this episode we’ll be taking the numbers we calculated last episode, plugging them into a calculator and seeing how much home you can really afford.

- Then I’ll be asking you: is this what you had in mind? Is it enough to buy a house in the area you’re looking in? Now’s the time to look at those steps we talked about in our last episode. The steps of how to reduce your debt, how to increase your income and how to increase your credit score.

- We can then tweak the numbers in the calculator and see how much more home you can buy. Is it worth taking those steps? Is it worth it to find that willpower and that drive inside of you? RIght now, you can see how simple it is to get rid of $500 worth of debt each month and how much that could impact your life.

[5:20] Ep4. The Training

- In this episode, before you tango with a lender, banker, or mortgage broker, we’ll first cover the various types of mortgages there are available to you. Different places have access to different mortgages so I want you to know all the ones you might qualify for.

- We’ll also cover all of the components that go into a mortgage such as: principle, interest, amortization, discount points, floating rate, and all the good stuff… I’m sorry if I lost you there, we’ll go through each individual one of those.

- We’ll also look at some of the first-time home buyer programs there are, at least in Washington State. I'm sorry if this isn’t specific to your state, but I’m sure your state has them as well. So you can just Google those. And if you don't need those… /for humorous effect/It means you’re paying all cash, lucky you/for humorous effect/.

[6:11] Ep5. The Mentor

- Oh, that’s me! In this episode we go over what my services are to you as a real estate agent, besides just letting you into property. This way you know you’ll be in great hands during your whole home buying saga and won't let you down like Gandalf does.

Anyway, that’s it for our prequel story board. Again, if you’re interested in working with me as a real estate agent, I’m a real person, with a real job and I work in Washington, you know bigfoot, my contact information is down below.

HERE’S A HAPPY LITTLE LINK TO CONTACT ME

Once you've completed this crash course, you'll be highly trained in:

- Knowing when you're ready to buy a house

- Knowing your debt and income and how to improve them

- Knowing how much house you can afford

- Knowing the most common types of mortgages as well as their components

- Knowing how working with a real estate agent like me benefits you

Are you ready for Episode 1?

First-time home buyer’s Episode 1 - Introspection

If the wordpress website isn't loading the YouTube links, the videos can be found here

Episode 1 - Part 1

Episode 1 - Part 2

[0:00] Intro. Oh we don't have that in our budget? Dang it. Alright, anyway then, we’ll just move into the intro. Hi! Welcome everyone. This is episode 1 of this crash course for first-time homebuyers looking to buy their first home. Yeah if that sounds like you, you’re in the right spot. But I do recommend you watch the previous video if you haven’t already where I introduce everything that will be covered in this series. If you’re too lazy to watch that video, let me quickly introduce myself.

[0:30] Hi, my name is Christian! Real quick again Hi, my name is Christian! I’m a real estate agent in Washington State, and I work in the Puget Sound region mainly in the cities of Gig Harbor and surrounding areas and Seattle and surrounding areas. Those are my two hometowns and the ones I know the best. So I can give you the best advice on those. If you’re not a first-time homebuyer, meaning you’ve done this at least once already, this will be a great refresher course for you then, and if not and you’re already an expert, then I’ll have videos just for you back in the main channel and if you’re looking to sell your house those videos are also in the main channel, so just click back and you’ll find them there. And if they’re not, they will be shortly.

[0:58] Contents of this Episode This first episode will cover two major topics. Our first major topic will be

- Are you financially and mentally prepared to become a homeowner? And if you’re not, don’t worry, the rest of the episodes are there for you as well. Don’t feel like if you’ve answered “no” to the questions I’ll be asking you, you’ll have to drop out. No, everything is here for educational reasons, and I want you to be there, to learn, to become an expert adult who is able to purchase their first home.

- Alright, the second topic is going to go over: When it’s best to remain a renter and when you should think about when it's best to be buying a house or becoming a homeowner. So those are our two big topics we’ll be going over in this episode.

[1:40] Before we begin, a word from our sponsor… me! Yeah! And I asked me, to ask you to please subscribe to this channel, we are going to cover a lot more than just first time home buyer videos. We’re also going to cover how to sell your home, how to become an investor, and eventually how to be a developer. Yeah! We’re going to be covering proformas and all that fun math. So I wanted to inform you that that’s at least that is the kind of content that will be coming out. And of course leave a comment down below and smash that thumbs up button. At least once because it’ll really help me with the YouTube algorithm and I’ll be so grateful. I’ll also make content just for you if you ask nicely! So leave a comment down below how to buy a home with zero down and I’ll make a video just for you! So show me some love and I’ll show some back. Alright, back to our regularly scheduled program.

[2:30] Alright, Episode 1 - Introspection. Introspection is defined as:

To be, or not to be: that is the question:

Whether 'tis nobler in the mind to suffer

The slings and arrows of outrageous fortune,

Or to take arms against a sea of troubles,

And by opposing end them? To die: to sleep;

No more; and by a sleep to say we end

The heart-ache and the thousand natural shocks

That flesh is heir to, 'tis a consummation

Devoutly to be wish'd. To die, to sleep;

To sleep: perchance to dream: ay, there's the rub;

Bad acting? Terrible accent? Well who wrote this anyway? It has nothing to do with real estate. Bill who? Well, tell Bill he’s fired! I’m fired? WHAT?!

TECHNICAL DIFFICULTIES PLEASE STAND BY

[3:46] OK, maybe not that much introspection is required, but a little bit of soul searching is recommended before buying a house. And why is that? Well, because most likely, you’re signing up for a 30 year fixed rate mortgage. Well, there's great things about that, but there's also the fact this is a huge financial burden. You’re essentially promising the lender that, “Hey I’m going to pay you back every month, on time, for the next 30 years.” Wow, that’s the most adult thing to do next to paying your own taxes and saving for your own retirement. So I won’t fault you if that sounds too scary and you want to remain Peter Pan for a little while longer. However, I do recommend that you work towards wanting to trade in your TInker Bell for Ka-Ching Ka-Chinger Bell.

Sorry, I’m gonna give you a few seconds for your eyes to roll back forward. Uh… there we go! Yeah, the reason I made that bad pun is because I’m trying out my new comedy standup routine… No, it’s a terrible segue into this point: and that’s that homeowners have 40 times the net worth of renters. /bad acting/ And I want my fellow millennials to get rich… /bad acting/ Oh my god, will he stop with the bad jokes? Ok, yes I promise… until next episode or the next joke .

[5:03] So what I hope is driving you to buy a house is not all the FOMO (or fear of missing out) that's going on out there right now. But it’s because you’re trying to make a financial savvy move. And you might ask yourself: “Well if it’s such a financially savvy move, why doesn’t everybody do it?” Well, the government did try to have everybody do it and they got close. They got to almost 70% of American’s into their own homes. And you know what happened? Was 2007-2008 and the collapse of the housing market happened. And that’s because the government said, “Lenders we want more people in houses, give them all loans, even if they can’t pay them.” And so they did, and the next thing that happened people didn’t pay their loans, they bit off more than they could chew, and boom the whole economy crashed… so I want to make sure you’re not GOING TO DOOM US ALL.

[5:43] The risk that you’re signing up for is that if you don’t pay off your mortgage, not only do you lose your home and everything you’ve been putting towards it. It also ruins your credit and credit follows you for seven years and most likely you won't be able to buy another home for 7 years (3 years with FHA). So, please take it into consideration. With that said, I will try to teach you as much as possible in this series of videos. However, experience is the best teacher after all, so some things you’ll just have to learn the hard way and trial-by-fire. But at least you'll know the trial-by-fire is coming so you’re not taken unaware. With that said, let's move on to buyer’s remorse.

[6:30] Because buyer’s remorse, especially with property, is very real and unlike an uncomfortable pair of shoes, with property you can’t exactly go back and get a refund. No, once that deed is in your name, it’s yours and you’re stuck with it unless you go around and sell it, but if you sell it too soon after buying it, you end up losing money. And on top of that, you’re being charged monthly for something you don't like. So I hope to prepare you with this video on things you should be looking for before you leap into a piece of property. Remorse comes in two flavors. The first is subjective; which is when you just personally don't like the property. It’s not defective or anything, it just doesn't match your lifestyle or taste. And then second, there’s objective remorse which is when it turns out it’s going to be too much of a financial burden on you to either repair it, or fix things, or the mortgage is just way more than you bargained for. You’re living paycheck to paycheck now and you thought you want to cap out and buy the best home (aka expensive) you can and now you are dreading that rainy day. And that’s the worst type of remorse really and that’s really the only remorse I can help you out with because I can’t really help you with your personal tastes… so let’s go over some ways to avoid that objective remorse and to get you well situated into becoming the expert home buyer to know exactly know what you’re in for. So, I’ll be asking you some questions.

[7:53] The 7 Question Exam

These questions come in the form of a grueling exam. Designed to test your mettle, your character, and your fortitude. Yep, we will be testing your financial preparedness, your willingness to make lifestyle sacrifices and your ability to make long term commitments. I’ll be asking you 7 questions and after every question I want you to answer: “yes” “no” or “maybe.” Then after each question I’ll be expanding on why your answer is so important. But before we begin, why don't you grab a pencil or a pen and a piece of paper. Yeah, we’ll begin then. Let the testing begin muahaha… Alright, it’s half past freckle, I think I’ve given you enough time.

1. [8:46] Do you have stable income?

- And to determine this, if you want to answer “yes’’ or “maybe,” let’s ask you first: Do you see yourself having stable income in the foreseeable future? And it’s hard to know really what the future holds, we don't have a crystal ball exactly, but you should at least feel comfortable that, “Yes, my future income is going to remain predictable.”

- And section questions, two parter here, is have you had stable income in the past? More precisely, have you had stable income for the past two years? Because that’s what lenders look at… they look into your past to determine your future. Oooh Oooh. So make sure you’ve had stable income for the past two years. And if you’re on commission, like I am, the lenders will average your last two tax returns to determine your income.

- And big major //butterflies// This question is more than, “If you are employed or not.” This also goes to: if you are thinking about starting a new career, or switching careers, or starting your own business. I know coming out of the pandemic, many people are thinking about leaving their employer. So think about how that is going to impact your ability to get a mortgage. Because if you don’t have stable income going forward, you’re going to lose your house, your credit history, and your ability to buy in the near future. So dont do anything stupid. If you’ve already done something in the recent past, like you’ve already started your business, you might have to wait a little bit to get your income level high enough to where you’ll qualify for a loan. So that’s just a little caveat I’d like to bring up before we move on to our second question.

2. [10:22] Do you have any cash saved for a down payment?

- Alright, the first one wasn’t so bad right? Okay, on to number two. Do you have any question saved up for your down payment? Yes? No? Maybe? Alright, I’ll level with you here, this is a little bit of a trick question. It’s more to test your character, because in all likelihood, you don't know how much you have to have to be saving towards a down payment in the first place. Like, how much house can you afford really? So it’s more to test your wherewithal to see if you’ve been saving towards something that is not quite tangible, but it’s something you really desire nevertheless.

- So, have you done that yet?

3. [10:55] Are you comfortable managing debt?

- Yes? No? Maybe?

- Well if you answered Yes, chances are you have been paying off your monthly debt obligations on time and using your available credit wisely. Congratulations! You probably have a high credit score.

- If you answered No or Maybe, it might mean you have some outstanding credit card bills due or you might be maxing out your monthly credit cards. If that’s the case you might have a lower credit score and you might not be ready to take on a mortgage, which is the biggest debt you’ll ever take. You have to pay off that debt monthly, otherwise they'll come take your house away (and that’s no fun.) So you have to shapen up a bit financially and get to at least a 700. And that means better interest rates will be available to you. A 740 is when the best interest rates are available to you, anything above is just like, “okay, congratulations, stop bragging”

- Now, if you’re in the position of trying to build your credit or your spouse is trying to build credit, or you don't even have any credit history; consider an Apple credit card, not only do you have an Apple product, it’s a great beginner credit card as it has relatively low requirements to apply for and it’s a good training card as long as you use it responsibly. So start with that, start building your credit, and then you can apply for a mortgage when you’re comfortable answering yes to this question.

4. [12:27]Do you have an emergency fund?

- Question number 4. Do you have an emergency fund? Yes you! Yes or no? Often mistaken as the, “this vacation is an emergency thank you very much!” fund, ah no, this is 3 to 6 months of living expenses set aside in case something goes wrong, like you get laid off or there’s a medical emergency.

- This is especially true for homeowners because on average they have to spend $3,200 a year on maintenance costs and an additional $1,600 on emergency repairs. There’s nothing worse than absolutely putting all your money into a house and you’re at $0 and then all of a sudden something goes wrong. And then you have to talk out more credit card debt and get deeper into the hole, because you couldn’t put aside money into an emergency fund.

- So! I want you to answer Yes before you apply for that mortgage.

5. [13:21]Do you know how much “home” you can afford per month?

- Yes? No? Maybe?

- If you answered “yes, you do know how much home you afford per month,’ congratulations, you can skip ahead.

- If you answered “No or Maybe” congratulations as well! Because you’re in the right spot, in a later episode we'll be using some calculators to exactly find out how much home you can currently qualify for.

- But since we’re not in that stage yet, why don;t we first use current rent to see how that impacts your budget. And kinda *finger in the air* how much home you can currently afford. You know, are you already stretched thin or can you afford more? So don’t worry if you answered No on this one, we’ll be answering this one together in a later episode.

6. [14:06]Are you willing to make lifestyle sacrifices?

- Almost there folks! Number 6. Are you willing to make lifestyle sacrifices?

- You know, besides the financial burden of a mortgage, there have to be some lifestyle sacrifices made when you get into your house.

- Either you have to learn to cook for yourself, meaning that you stop going out everyday or every weekend or you have to commute more. Or you have to spend your weekends maintaining your yard because it needs to be mowed, or blackberries keep growing, you name it! Things that you don’t like doing, but have to be done because now you’re a home owner.

- Another thing you have to consider before buying a home is starting a family or starting a business! You’ll have to decide where to put your life savings, or your capital, your time, and where’s all the money going for expenses? Is it going into your home or into the new business?

- Let me tell you from experience, this house that i’m sitting in right now, was a foreclosure and I put a lot of sweat equity into it. And it wasn’t my first rodeo either so I knew what I was doing for the most part, and I still decided to do it with an 8 month old… which was like *smack to the forehead.* I mean, come on, that was pretty stupid from my part, I wish someone would have told me, “You know you should go look for a house before your wife get’s pregant, that way you actually have sleep and you wont be forced to get that extra bedroom that you really need because you want to be able to sleep” Repairing in retrospect I should have bought a house before my wife was pregnant. How about that? Yeah…so try to do things ahead of time or you’ll have to strategically wait for the right time to continue moving forward.

7. [15:42] Do you want to stay in the same area long term?

- Last but not least! Question number 7. Do you want to stay in the same area long term? Pretty simple question, maybe a little bit arbitrary, so let’s say… 5 or more years? Now why 5? I’ll get into that a little bit later, but use that as a baseline. Have you considered raising a family? Have you considered retiring? Growing old? Will your job make you move? Have you explored the environment? The climate? The people?

- I know here in Western Washington we have something called the seasonal affective disorder and that’s when people move here and go, “Why is it so gray? It’s bleak. It’s constantly raining but not where I can actually get wet. I’m so sad, I’m depressed. Where’s my NBA team? Where’s Bigfoot? I don’t see the cast of Frasier or Gray’s Anatomy anywhere. Not filmed in Seattle? What? Now you have to make me learn hockey rules? Oh man!

- Yeah! Sometimes it’s best to rent in an area before deciding to buy

So, how did you do? Don't worry if you didn't get 7/7. Just keep watching and we'll get to 7/7 together

First-time home buyer’s Episode 1 Part 2

[0:04] Intro. Hi and welcome back to part two! Sorry for the interruption, it's just been difficult that time since you know… technical issues aside and unforeseen characters getting murdered and a terrible terrible letdown of an ending... Yeah! This is shaping up to be one of the better Game of Thrones episodes.

Part 1 was running a little bit long anyways so I was actually able to split this in half and add more into part 2 than I originally planned. So, I'm glad it happened. I'm glad there was a silver lining for more real estate content for you to enjoy. I hope you were able to use the lou got a refreshment and you're now ready and itching for more educational content... so let's get right into it!

[0:56] Buy vs Rent: The 5-Year Rule. I'd like to first begin this renting versus buying comparison by introducing the 5-year rule. What's the five-year rule? The 5-year rule is kind of a rule of thumb when it's financially beneficial to rent versus to buy. So, this is regardless of all other factors, this is just for monetary sense. Okay, renting is better for your budget if you're planning on spending less than five years in a single place. This means one single property, not a neighborhood, or a city, this is just the one property. Okay, more than five years? Better to buy! And why is that? Four factors:

-

-

- Holding costs. This means you're paying for all the maintenance, all the yard work, taxes, and everything that can go wrong with your house otherwise that be covered by a landlord.

- Front-ended Interest. Basically the very beginning [of a mortgage] is all interest. Meaning the money you're paying back to the lender, you're just throwing money to the fire. You're not making substantial principal payments that go into the equity of the house.

- Closing costs. Here in Washington we have an excise tax of almost two percent. So when you go to sell your house this goes straight to the state. On top of that you have commissions, closing costs, fees, and if you have a septic system, it costs about five hundred to a thousand dollars to get it pumped and inspected. So, you know, it's like “holy moly!” It starts adding up quickly.

- Slow but steady appreciation. Historically, housing prices have been rather stable and steady. They kept on track with inflation and it took about five years to build up equity that you can actually see substantial gain in the amount of money that you've accumulated in a property. Recently appreciation has been like this [exponential growth] rather than this [flat line], so this kind of makes the 5-year rule defunct, for the moment. That’s because you could already have positive equity in a house that you've only been living in for like two years.

-

[2:59] Fear the FOMO. But don't worry if you missed out. While there is a lot of fomo, you want to do things the right way. And for example, if you compare yourself to your friends, and your friends are like, “Dude look at my Zillow! It says I made $70,000 over the past year on my house!” But it turns out the house that they bought is the first house they got their offer accepted on... and they're quite not happy with the house... and now they have to think about selling because it's not working out for them, and now suddenly they have to pay 10% of the value of the house on selling costs. So if they made $70,000 and it's gonna cost them $40,000 to sell, they're only left with a $30,000 profit... assuming that they're in that house for more than two years. If not, they're gonna be paying short-term capital gains tax on that. So that’s something to consider. So if you think about it they're really not that much further ahead of you.

When it comes to houses you have to think in terms of hundreds of thousands and millions of dollars, because that's really how they impact net worth. Good investing advice states that, “best time to invest was yesterday the second best time to invest is today.” So, the best time to invest for you is right now. Just because you didn't invest in the past doesn’t mean you shouldn’t ever start. So start today and make the right choices today and you won't fall into these dumb traps that your friends are going to fall into. They’re going to be paying all these fees that they didn't know they have to pay. But I digress…

[4:15] 5 Reasons Renting is Better Than Buying. What I wanted to really say is that the 5-year rule does underpin the fact that renting is more financially responsible than buying in some situations. I'm going to cover these briefly. I know many of you are renters, so you have a lot of first-hand experience, so I'm not going to belabor the points. We'll blast right through them and perhaps even become aware of one you didn’t previously know and go “Oh! That's really a good one, maybe I should be doing that!” So, let's just cover them real quick and then we'll go into why buying is superior to renting.

Alright, now for the quick rundown:

-

-

-

-

- [4:44] The 5-year Rule. The first one we’ve already covered. That's the five year rule and that just says, “Hey, sometimes it actually makes more financial sense to rent than to buy because in the short term, if you're only planning on staying in an area for less than five years, you're actually coming out ahead by renting versus buying.”

- [5:00] Flexibility. Renting also allows you to remain flexible, which means if you don't like your neighbors or you don't like your neighborhood or you find out that the house or apartment you're renting doesn't have any insulation in the walls and it turns into a furnace for four months of the year… you can just leave as soon as your lease expires. Or you can terminate early and just get out of there. Super simple.

- [5:19] Shorter Commute. Commuting is also much simpler because there's so many apartments close to your work versus single family houses. And that's just a supply demand rule. So, if you're paying two thousand dollars for an apartment versus two thousand dollars for a single family house, chances are that single family house is much farther away from your work. Proximity to work plus all the amenities that cities provide: cafes bars, clubs, art galleries, the opera, etc, and all the other things that people actually enjoy when they're not working, is what makes renting an apartment so great.

- [5:47] No Maintenance/House Work. One of the best parts about renting is it requires no maintenance, no yard work. The moment you wake up the day is for you and you alone. You can spend it however you want. You don't have any other obligations that your house or your property is making you do. You can spend your time working. You can spend it exercising, reading books on self-improvement, or learning new hobbies. You can for example learn how to cook, you can learn how to sew, or you can spend your entire day mindlessly surfing the web…. and not doing anything with your life which is probably the worst reason to be renting in the big city. Really use this extra time that you have from renting, and throwing away all that money essentially into the garbage, use it wisely to improve your lot in life.

- [6:31] Cheap rent is available. The best excuse I can find for renting, besides the five-year rule, is that you can have a lot of roommates! Meaning you can really ratchet down that rent you're paying per month. You can go from $2000 to $400 by finding a lot more roommates, and as they say, the more the merrier... No, what I mean to say is, invest in a good set of earplugs and you'll thank me later. Remember, if you think by renting a swanky apartment you can show off to your friends and your family that you've made it, you're wrong. That is very antithetical to actually building wealth. At the end of the day, you're going to leave your apartment and you'll have nothing to show for it. So don't fall into that trap, okay? Try to think ahead. When you have a lot of roommates you're not really incentivized to spend a lot of your time in your room lollygagging around. No, you want to be out of the house and hopefully you'll spend that time in your office... and you'll spend time that time either working or thinking about ways that you can improve your side hustle, how to start your side hustle, or any other things that you could do to make more money. Additionally, if you live in a clown car of roommates, you're not going to want to spend that three to four thousand dollars on the new laptop because that sucker's gone real quick. So, you're gonna be cutting all your costs down to the bare essentials and on stuff that's not worth a lot. That's going to really benefit your pocketbook! Sometimes you have to take one step backwards to take three steps forwards and this goes for that as well because when you take that one step backward, by resigning yourself to a worse standard of living, you can actually leap ahead three to four steps because you can now save up for that nest egg really intensely... instead of slowly piecemealing it out over the course of the year and then all of a sudden *poof* you're only left with 10 grand.

-

-

-

Anecdote: My wife and I were making roughly $100,000, before taxes, in income. And we were able to, in the span of two years, save up a $100,000 that we used as a down payment for this house. We set aside 50% of our income and put it towards our nest egg. So, please take that consideration when you really think about how much you actually need to spend on yourself. Don't tell me it's not possible... If I can do it, you can do it, and I know you can.

[8:38] 5 Reasons Why Buying is Better. Okay, now we've covered all those awesome reasons why renting is so great, why would anybody want to buy? Well, while everybody has their own reasons, I think the most common driver is the need for more space and the need for more space usually comes from: having kids, wanting to start a family, or you want pets and you need more room a bigger yard, or you have hobbies, or you have an rv or you have a wood shop, or something else you can’t find room for in the city, or you just want privacy... you want a nice little green buffer around you and you don't want your neighbors looking into your bathroom window anymore. You can probably get something you're looking for in the suburbs, in the commuter belt (if you're not telecommuting to work now), for around the same price that you're renting an apartment for.

So, what else do you get for buying some property? I mean, besides extra elbow room? Well I'll tell you! We're going to explore five benefits of becoming a homeowner:

-

-

-

- [9:35] Pride of ownership. Owning a house has been part of the American dream before there's been an America really. Owning one's own home provides security as long as you maintain it, repair it, and pay all your bills on time. Nobody can kick you out of your own home. You're there and nobody can tell you otherwise. Additionally, all those payments you're making are a forced savings account. So, in the long term, you know 15 years 30 years (whatever your mortgage term is), you're going to own that home outright - 100% of the equity! And in the meantime, you're putting money into your own pocket in the form of principal. It also provides you that sense of accomplishment that owning an apartment just can't provide. And unlike an apartment, you can pass on your home to your heirs. This means all that equity that you built up over the years, you can pass to the next generation. All that money you paid to a landlord doesn't go anywhere. And while you own your home, nobody can tell you what you can or can't do inside or outside of it, barring any HOA covenants, but you know the whole reason you're going into places with an HOA is because it protects the property prices from anybody painting their house pink or parking a bunch of used old junky cars in their driveway. It's a give and take situation.

- [10:47] Hedge Against Inflation. If you get a 30-year fixed-rate mortgage, your principal plus interest is going to remain the same as it is today as it is 30 years from now. Okay, why is that so great? Well, can you imagine 30 years ago a candy bar was 5 cents and now it's 25 cents? That's a 500 inflation can you imagine if your mortgage was that candy bar? 500% increase? Holy moly! But in actuality, unlike that candy bad, your mortgage is at 5 cents today and it will be 5 cents 30 years from now. That's how it works. Similarly to inflation, rent goes up because of property appreciating and purchasing power of the dollar going down. Meaning they charge you more rent because the dollar is worth less, so it's not unheard of for rent to go up 4-6% every year. Some landlord groups are forming to protest local rental caps of 10 percent or more! I mean you'd feel it if your rent went from $2,000 to $2,200 in just one year.

- [11:49]Homeowners get tax advantages. In the past, you could really itemize your taxes and deduct your interest that you paid on your mortgage, any state and local income tax that you paid, and property tax. The government has now capped those so the interest you can now deduct is capped at $10,000, plus any taxes that you're paying on top of that. So itemizing doesn't make much sense anymore because the standard deduction has now been raised to $24,000 and most people don't exceed that amount in deductions. If you're one of the few homeowners that does itemize their taxes, and you can exceed the $24,000, you can actually get a tax advantage. But for the most of us, the real important bit is that you can actually take advantage of the capital gains exclusion, which is $250,000 for individuals and $500,000 for married couples (providing that you lived in the house for the last two of the five years). This means if you go to sell your house, and you have a profit, you don't have to pay the government anything provided it's below that capital gains exclusion bracket that you're in, which means when you go to buy your next home you can just roll that money - boom - right into the next house! No taxes paid! You get to climb that property ladder!

- [12:56] Property Appreciation. The greatest thing about becoming a homeowner is the fact that your home is an investment. And by getting a mortgage, you control 100% of the appreciation captured by that investment. Even by only owning as low as three percent... five percent… ten percent... twenty percent... whatever percent... you have one hundred percent control of your house's appreciation and while only controlling a fraction of how much you own. Wow! That is leverage! Let's put this leverage into a little bit of context. Let's say you have forty thousand dollars burning a hole in your pocket and you can decide between either keeping it in a bank account, that pays 2% interest, or you can put it towards the house. Let's go with the first option. If you put your $40,000 into bank account you'll make about 800 bucks in a year. On the other hand, if you put that money towards a down payment of a house, let's say it's 10% down (that means you're buying a $400,000 house), if that house appreciates by 2%, you're gonna be making $8,000 in appreciation. So $800 versus $8,000. Again, this is because you control 100% of the appreciation of that $400,000 house.

- [14:04] Building equity. Another awesome thing about becoming a homeowner is that you're building up equity through: appreciation and paying off your principal. This turns your house into something like a savings account. In fact, you can actually use that money just like any regular savings account, even before your home is entirely paid off.

-

-

-

- Do: You can use it for paying off high interest debt (such as credit cards) and convert it into a low interest mortgage debt.

- Do: Another awesome thing you can do with equity is... do what investors do. They use the money they've accumulated in their properties to buy more properties. Yes, you can actually take the money that you build up in your house and use it to buy your next, or first, investment property. Start becoming the next real estate mogul!

- Do: If you always dreamed about starting your own business - boom - Instant capital! Take money out at low interest rates and you can start your business. You don't have to get a hard money loan, personal loan, or try to find some venture capital. You can just tap into the equity house and start the next great money generating adventure!

- Don't: What you shouldn't do, and i'll just throw it out there because a lot of people fall into this trap, is that they use their equity to buy stupid stuff. Especially things such as: ATVs, jet skis, a new car, or the, “my neighbor bought something fancy and new, so I need to buy it too.” During the 2008 housing market collapse most of the people at least here in Gig Harbor, that got foreclosed on, were actually rich people! They leveraged their house to buy stuff to compete with their neighbors. And what happened? Housing values went down and all of a sudden they owed so much more than their house was worth and they defaulted. Long story short, they ended up with a bunch of stupid toys that depreciate in value, and there they are: “rich” and homeless. So don't be one of those people. But that story is for a different day.

-

-

-

-

[15.47] How to Cheat the 5-year Rule: Want to cheat the five year rule? You do that by becoming a landlord. Yes, if you have to leave the property that you just bought, and you don't want to lose any money by selling it, you can just rent it out and have somebody else pay your mortgage! Voila, it's taken care of and in 30 years time, you'll never have to worry about making another mortgage payment again…. as long as you have good steady reliable tenants in your house. In fact, this is an investing strategy. You can apply for a new mortgage and do this every year. I'll go through all of this stuff in greater detail in my investing course.

But first, this is the first time home buyer course so I'm not going to get into all the nitty-gritty details. I'm just throwing it out there to let you know that okay it's not the end of the world if you buy a house you don't like or your job makes you move. Just go rent it out yourself or pay 20% to a property management company if you don't like being a landlord yourself. Simple.

Building Wealth: My favorite thing as a real estate agent is actually helping other people build Wealth. I mean that's really my passion is making money. When I think of what I like to do when I'm bored... I like to make money. Once you adopt that investor mindset, like I did, it actually becomes fun to not spend money and turn your money into more money! I’ve actually turned this into a passion: helping other people make money. So I get paid for helping you make money! That's a great win-win scenario isn't it? I'm even doing this [YouTube] for free so you don't have to pay for it!

Millennial Woes: I especially love helping my fellow millennials get into that wealth creation pipeline. That's because our generation got the absolute short straw. Not only did we graduate in the middle of recession (I graduated in 2009 and my uh the college speaker is essentially uh good luck guys you won't be able to find a job just you know just sit tight and just like suck a lemon until things recover) on top of that we're burdened by student debt and then only to find our bachelor's degrees were no longer worth anything... they just flooded the market with degrees. We did “what was right.” Our parents said get a degree to stand out and you need it to get a job. Then all of a sudden everybody has one [a degree]. Now to get a job you need work experience, and if you don't, then you need a master's degree or phd. This means more student debt and more time wasted not making any money. On top of that have you seen all the prices go for everything? Things have gone up like 400%. It's like housing, education, insurance, healthcare…. wages... No, not wages. Definitely not. Wages are stagnant. We're expected to pay all this money and of course we can't build any wealth.

This is why I'm so passionate about other ways to make money. Because otherwise you can be treading water for the rest of your life. It's hard enough putting money into your retirement fund as it is right now. In fact I'i'm going to show you a graph right now. It's going to compare millennial wealth versus boomers. Here you can see the difference between boomer wealth and millennial. By the time they were age 35 boomers, already owned 21% of US household wealth. Millennials on the other hand only own 3% at the same age of 35. So I’ve taken it upon myself to help my fellow millennials with this youtube channel or with my own personal work with you.

So let’s get through the first time home buyer’s course first, because after all, you're still looking to buy your first home. And I know, talking about investing is a little bit out there, but if you get into the mindset this is just the first start of your investing career, you will know that the sky's the limit. So, if you're ready to start your journey, get on to the next episode and I'll see you there again.

Step 2: Number Crunching

Content includes: Income-to-debt, lenders and you

**Spoiler alert: I'm going to spend a good deal of time going through the "money bit" of real estate. It's the most important part of the transaction. Simple as: no money, no house. Therefore, I feel it is well worth my time to give you a solid foundation before you meet with a lender. With that said, let us proceed.

Unlike those online cooking recipes, I'm going to cut right to the chase. We will being by looking at your Debt-to-Income (DTI) ratio. Lenders look two different forms of DTI, the Front-end and Back-end ratios (more on that below), when determining how much money (if any) they will lend you. Lenders look at your promised long-term incoming and promised out-going monies, otherwise known as your:

- Gross income is the money you make before taxes and deductions.

- Long-term debt is debt you'll be continuing to pay for 10 months or more

And here are some examples of long-term debt:

- Car loan

- Student loan

- Credit card debt

- Personal loans

- Child support

- Divorce settlements (alimony)

- PITI Payments (housing expenses)

- Rent

It's pretty easy to calculate your own DTI, simply take your long-term debt and divide it by your gross income.

If you haven't already, I also highly recommend starting a budget since you'll be researching those numbers anyway. There are many apps that allow you to track your spending and plan a budget. I recommend using Mint - it's a great app and free to boot! Ok, chop chop, lets get to it!

Once you have your numbers

NOTE: Just before you read any further - remember, these are house-hold numbers. If you're married you'll need to combine both spouses' information. If you're single or an unmarried couple you'll just use your individual numbers.

Since I can't see your screen I'll just take a guess at the numbers on your end. Let's say you're paying $1,600 in rent, $100 toward your credit cards interest, and $300 toward student loans. Your monthly debt payments come to $2,000 total.

Now for your gross income. Again, since I can't see your screen I'll just take a guess. Let's say your employer is paying you $6,700 per month before taxes and deductions. (If you are a 1099 worker, this will be the average of your last two years of net income)

This means that your Debt-to-Income Ratio ($2,000 / $6,000 = 0.333) is equal to 33.3%

OK, so what does this all mean?

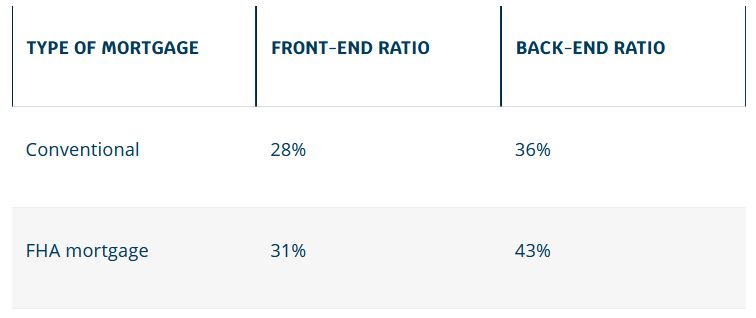

This is where the 28/36/43% Debt-to-Income (DTI) Ratios come into play. These are specific DTI barometers that lenders look at to see how much debt you can take on and still be approved for a mortgage.

The 28% Rule - Total Housing Expenses aka Front End Ratio. Your future housing expenses shouldn't be more than 28% of your gross income. Meaning, if taking out a mortgage would cause you to spend more than 28% of your gross income on housing expenses, the lender would unlikely lend you for the full amount you're looking for. Housing expenses can be categorized as PITI: monthly principal, interest, property taxes, and insurance payments. If you are moving to a place with Home Owners dues, income them here as well. Example: If we know our income of $6,000/mo we can find out our maximum allowable PITI expenses ($6,000 x 28%) are $1,680.

The 36% Rule - Total Debt aka Back End Ratio. This your total "allowable" debt. Meaning, if taking out a mortgage would make you spend more than 36% of your gross income on total monthly debt payments, the lender would unlikely lend you for the full amount you're looking for. This includes the above total housing expenses (PITI) plus any additional debts mentioned in the bullet points above. Example: If you gross $6,000 per month, 36% of that would be $2,160. This means if your PITI has already spoken for is $1,680 of the total allowable of $2,160 then all you are left with is $480 for all other debt obligations (car payments, student loans, etc).

**side note: 28% and 36% are not fixed percentages. Most lenders can accommodate you here and there but it'll come in paying a little bit more per month. However, there is a limit to how much debt you can take on and still qualify for a Qualified Mortgage. and that is the: The 43% Rule - Highest DTI. This is the highest ratio a borrower can have and still get a Qualified Mortgage. Simply put, you qualify for mortgages that aren’t predatory.

If you some of my help CLICK ME

So let us get that debt into shape and our credit score polished!

Here's some advice to improve your credit score!

- If you're one of the few that doesn't have credit built already. Start by opening up an Apple credit card and pay it off every month!

- Pay your bills on time

- Keep your credit card balances as low as possible

- Keep current credit cards open. Closing a card can lower you available credit and your score.

- Check your credit report and dispute any errors that are hurting your score

AND HERE'S SOME SUPER ADVICE TO REDUCE YOUR DEBT!

- Remember that "budget" thing? This will help you pay off any loans early by getting a better picture of your spending. Do this by cutting out unnecessary expenses; essentials only! Start by seeing how much money you can contribute each month instead of just the minimum payment.

- Additional income. Ask for a raise, start a side hustle, change jobs. Get out of that comfort zone.

- No new debt or large expenses! These will burden your DTI or reduce the amount you can put down on your house

- Consolidate your debt!

- Pay off high-interest loans right away

- Recalculate your DTI every month until you're comfortable with the percentage.

- Ultimate debt hack: move in with your parents. You can set aside thousands in just a few months. While this doesn't sound like a glamours proposition, in the words of Gary Vee, Sometimes you have to a step backwards to take 3 steps forward.

Increasing you income

Sometimes there's no magic bullet to reduce your debt and you have already a decent credit score. In this case it might make sense to look at ways to increase you income. This subject will be less specific that the previous because while it might be easy to say, it's much harder to achieve. There are also cautionary elements to this because if you go more than 6 months without a job or your rely solely on 1099's versus W2, your income sporadic income might not be the best thing.

- Start a side hustle

- Change jobs

- Learn a new skill/trade

- Work an extra hour a (show up 30 min earlier and leave 30 later) to become that irreplaceable employee, work overtime, or prove that you deserve that promotion.

There are are lots of youtube videos on these subject so I wont belabor the point. It's not a guarantee but well worth the consideration.

OK! that was lot to take in. When you feel comfortable with your DTI (this might take a little time) it's time to proceed to the next step.

Next is Step 3 : How much house can I afford?

Step 3: How much house can I afford?

Content includes: How much house can you afford?

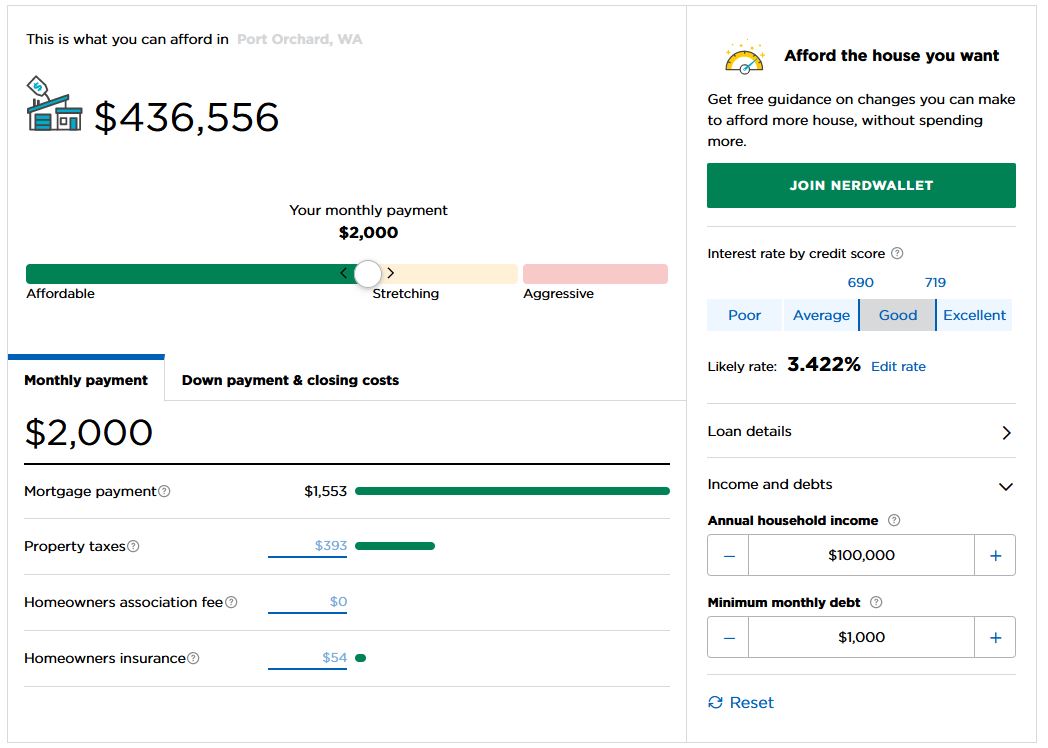

Next we'll explore how to ballpark our house budget. Visit this website so we can go through the numbers together. You'll see something like this:

Start plugging in your own numbers; first, adjust the household income and monthly debt to reflect your own situation. Second; adjust the credit score. Third; enter the amount of money you'd would be using (or have available) for down-payment plus closing costs (you'll see the Mortgage Insurance appear if you plan on putting less than 20% down) and adjust the loan type (most likely a 30-year fixed rate).

Now lets look between the AFFORDABLE and STRETCHING slider. Remember the 36% and 43% from the previous step? Here we see those percentages in action. Remember, anything higher than 43% means you wont be eligible for a qualified mortgage.

Play with your input numbers to see how you can tweak your house price. What does going from "average" to "good" credit score. With that in mind, what would it take for you to change your financial situation?

- Could you reduce your debt?

- Increase your income?

- Increase you credit score?

- Ask your family to help with the down-payment?

Keep in mind, if this is your first house, it's OK for it to be less than ideal. At this point in time I want to help you build your equity. Therefore, first and foremost we need to get you in control of a leveraged asset in which you can quickly build equity and enjoy equity though appreciation. And together, you and I, will come up with a plan to help you climb that property ladder. With that in mind, lets look at several ways to get you into a house, even with little to none down-payment:

- Conventional loans go as low as 3% and FHA loans as low as 3.5%. Both of these will come with mortgage insurance. More on this later.

- See if you qualify for Washington State's down payment assistance program.

- Reduce the price of the house you are wanting to purchase. View this just as the beginning to your property portfolio.

- Take advantage of the 0% down USDA loan (more on this in the next section)

So that was a fun little exercise don't you think? But in the end, these are all hypothetical numbers. Take a quick breather and digest the information that was just presented.

- How do these numbers compare with what was in your head?

- Can you afford more or less house than you wanted?

- Are you comfortable with a monthly payment that high?

Once you feel comfortable with how your numbers are lining up and even perhaps made a budget to hit your goal; it's time for the next step, where I get into the riveting world of mortgages! Yay!

Mortgages are the next topic so buckle up!

Next is Step 4: Mortgages - Who, What, Where, When, Why and HOW MUCH?!?

Step 4: Mortgages - Who, What, Where, When, Why and HOW MUCH?!?

Content includes: Understanding your mortgage, Local Lender, and unless you'll be paying in all cash for a property, you'll be looking for a mortgage.

The Who?

A "mortgage" is basically a legal agreement by which a lender gives a loan to a home-buyer and once all the payments have been completed the lender no longer has a potential claim on a property. With a mortgage, the home-buyer has both legal and equitable title for the property, meaning they own rights on that property. In order for the lender to claim back title to a property, in the event of non-payment by the homeowner, the lender will have to go through a lengthy legal proceeding.

In Washington State, we have what's called a "Deed of Trust" versus a mortgage. This means that the title to a property is held by a third party, the "Trustee." Should the home-owner stop paying their mortgage, the lender can skip the lengthy court proceedings and simply ask the Trustee to sell the property. I will be using the term "mortgage" in lieu of "Deed of Trust" since mortgage is such a familiar term to most people.

In simple terms, payback what you owe, and then some, or else the bank will take your home away.

The What?

Part I: National Programs

Mortgages come in all shapes and sizes. However, since many of them aren't relevant to most home buyer's, I'll be limiting them to the most commonly used. Here is a short list of national programs available to first-time buyers:

- Conventional / Fixed rate - Most common mortgage type. Monthly payments don’t change. Requires mortgage insurance if down payment is less than 20%

- Adjustable Rate Mortgage (ARM) - First several years low fixed interest, then free to change. Not recommended unless planning to sell after only a few years of ownership.

- FHA Loans - Guaranteed by the federal government. Common loan for those with low down payments and credit score. Comes with mortgage insurance payments.

- VA loans - Available to veterans. No down payment and no mortgage insurance.

- USDA loan - In certain rural parts of Washington it is possible to buy a house with a USDA loan. No down payment or mortgage insurance required. Income restricts. Here is a map for location eligibility.

National programs: Conventional / Fixed rate and FHA loan. Here is an excellent article that I suggest you read to get a better understanding. If you are in a hurry here is a quick summary:

- Conventional / Fixed rate - Higher credit score required, as low as 3% down payments, Private Mortgage Insurance can be canceled.

- FHA Loans - Available to those with lower credit scores. If your credit score is above 580 you qualify for 3.5% down payment. Comes with Mortgage Insurance payments over the life of the loan. Can only be canceled with a refinance. Recent college grads can count two years of university towards their employment history, this is great when you have just started your first job. A co-signer on the loan doesn't have to reside on the property, meaning Mom and/or Dad wont be living in the room next to you.

- *FHA 203K Rehab loan - Great for buying fixer-upper. Allows for cost of renovations to be part of mortgage rather than out of pocket. All repairs need to be complete 6-months after closing.

It's also important to know that conventional mortgages are more strict when it comes to DTI requirements. Remember those numbers you previously crunched? This chart shows the allowable DTI Front-end (housing) and Back-end (total debt) ratios for a conventional and FHA mortgage. Gut check: which one do you think you will qualify for?

Part II: State Programs

Washington State also has a host of programs if you haven't owned a home in more than three years. It's a good idea to see if you qualify for any of them.

Here's some quick highlights:

- 30-year fixed-rate home loans

- Down payment assistance up to 4% of the mortgage amount

- available for single-family houses, condos, townhouses and manufactured homes.

Eligibility requirements:

- Home buyer education course for all those signing the deed of trust

- Annual household income cannot exceed $145,000

- Some down payment assistance programs are restricted to first-time home buyers

- If you haven't lived owned a home for more than three years you qualify as a first-time home buyer

- Specific areas are exempt from the first-time home buyers requirements

Here's a quick summary of the first-time home buyer loan programs available in Washington:

- Home Advantage Program for reduced-rate mortgages for first-time home buyers

- Home Advantage Down-payment Assistance: up to 5% of your loan amount in down payment assistance

- Home Advantage Down-payment Assistance - Needs Based programs: up to $10,000 in down payment assistance for qualifying borrowers.

- Opportunity Down-payment Assistance Loan Programs: down payment assistance for first-time home buyers up to $10,000.

- HomeChoice Down-payment Assistance Loan Program: down payment assistance up to $15,000 for those living with disabilities.

- Veterans Down-payment Assistance Loan Program: down payment assistance for current or former military personnel up to $10,000.

With so many programs available to get you into a home its highly advisable to have a conversation with a lender sooner than later. This brings up my next point.

The Where?

So where do you get a mortgage? You've probably heard of the Wells Fargo, Chase, and Bank of America. But this it is not recommended to go through these major institutions. First of all, they are cumbersome and slow. Second, they have poor customer service, Third, lack local knowledge of forms and contracts, and most importantly don't even participate in the state first-time home buyers programs we just went over! Local lenders are far more responsive to clients, transparent and will spend the time educating about what's the best option for you. They also have a reputation to uphold. If they don't preform, we'll stop recommending them. Real Estate Agents, such as myself, will recommend you the lenders that have proven themselves time and time again enough to earn our trust. Lenders are instrumental to the real estate deal, again the money thing, so make sure we know they can be counted on during crunch time.

The Why?

OK, obviously the "Why" is you need money and they have it. But for this question I'd like to make the "Why" rather bit more about the lender's side of things. So for this reason, the "why" is more like: Why should we give you a loan and why should we trust that you'll pay it back? Now that you know where to get a hold of a good lender, they will ask you to supply them with some basic information about your financial picture.

- Pre-Qualification (Good): Remember all that stuff you did to find out your DTI? Well, they will ask for those very things: debt, income, and assets. This process is called the "per-qualification" step and is completely reliant the information provided by you. This process is usually done over the phone or online.

- Pre-Approval (Better): This requires the lender to actually start doing some digging. You must complete the lender's official mortgage application and submit any required documentation (usually tax returns and pay stubs). They will also run a credit check on you to see how well you've been paying off your debts for the last 7 years. Depending on the lender they might charge you a fee for this process. Here you will be provided an estimated loan amount and estimated interest rate.

- Underwritten Pre-Approval (Best): Here an underwriter will be personally going through all your files and will be the one to determine if your loan will be approved. It's the most time intensive and is therefore the most difficult of the three to get. They will check documents for accuracy, have final say over your financial worthiness. Once this process is done, all you need is a property address, clear title, and an accepted offer. Sellers prefer this level due to the commitment the lender is showing, giving confidence to the seller that the deal will close. Additionally, you might be able to close in as few as 21 days, making your offer stand out from all the others.

The HOW MUCH?

Your mortgage is primarily made up of Principal and Interest paid over the term of the mortgage. The total amount of these two will remained fixed for the duration of the mortgage. However, the weight of each will change after each payment. Interest will be weighted heavily in the beginning while principal will be weighted heavily towards the tail end of the mortgage. So you might be asking, "If they're combined why should I care? What's the difference between Principal and Interest?" Well here's a basic definition of the two:

- Principal: This is the amount you borrowed from a lender to purchase a property. Example: if you've agreed to buy a house for $600,000 and your down-payment is $100,000, then your principal loan amount is $500,000.

- Interest: This is what the lender charges you for them loaning you money. It's what everybody talks about when interest rates are rising. I won't get into minutiae of inflation, present value and future value, but it's very important once we get onto the topic of investing later on.

It'll make sense when we look at this amortization graph below. On a $500,000 mortgage, after on year, you would have paid a combined total of $29,079 in principal and interest, but of that you would have only paid $8,616 in principal. Paying principal means you are accumulating equity in a property. And there's still $491,384 in principal that needs to be paid off before the house is truly yours.

At year 24, you'll have paid as much in interest as in principal. (Roughly $350,000 into each bucket) with $154,000 principal remaining. At the 30 year mark, you'll have paid back the full principal of $500,000, plus and additional $372,370 in interest. While $872,370 seems like a lot for a $500,000 loan, if you were to hold on to the house for 30 years and it only ever appreciated at the low rate of 2% per year, your $500,000 would be worth $905,860. You'd come almost $33,500 on top.

I skipped the topic of interest rates in the above graph to keep the example simple. But there's a correlation in the housing market between interest rate and housing prices. For every 1% that interest rates go up, housing prices decrease by 10%. The inverse is also true. Why is this? Because as interest rates rise, the cost of borrowing goes up tremendously. The difference in "Interest Paid" between a 2.75% and 3.75% interest rate loan on the same $500,000 mortgage mentioned above is almost a whopping $100,000 over the life of the loan.

Bonus Round: PMI

I've mentioned Private Mortgage insurance or PMI several times. It's a way of lenders insurance themselves in the event that someone stops paying since they added less than 20% of their own money to the deal.Therefore, the lenders see you as a risk and will charge you additional interest points in addition to tacking on Private Mortgage Insurance (PMI) fees to your monthly payment. This PMI is eventually canceled when your equity in the property reaches 20%. If you want the cheapest mortgage, have a credit score above 740 and put at least 20% down.

As you can see this stuff can get pretty complicated and there are a variety of paths available to you depending on your financial situation. Therefore I highly recommend you again to talk to a lender.

Next is Step 5: What does working with a real estate agent get me?

Step 5: What does working with a Real Estate agent get me?

Content includes: Buyer representation and FAQs

Before we get into the fun bit, I would like to first go over the basics of what I do as a Buyer's Representative so you'll be completely informed of my services and what I do before we meet.

What is Buyer Representation?

It simply means a contractual relationship between the buyer and his or her broker in the finding and purchase of their home. We also call this concept Agency. Agency defines your legal rights in dealing with a real estate broker. I will be providing you with a pamphlet entitled, LINK: The Law of Real Estate Agency. This pamphlet summarizes the Agency Law for the Washington State.

How does it work?

There is a seller's side and a buyer's side of every real estate transaction. As your broker, I will represent you, the buyer. We will sign a Buy Agency Agreement with each other, a contract that solidified our relationship and defines my responsibilities to you and your responsibilities to me. I will negotiate on your behalf and use all my capabilities to ensure we find you the right home for the right price.

What are the benefits to you?

State Law requires that I treat you honestly and fairly. That I disclose all material facts known by me, to provide you with the Agency Law pamphlet, to be loyal to you - that I will not disclose any confidential information that you have shared with me, to advice you and to assist you in your home buying process.

My commitment to you goes beyond the State Law. As your buyer's broker, I will give you my loyalty and my commitment to your needs. You can trust me. I am working for you and we are a team. Each of us will have responsibilities to one another and each of us will communicate continuously throughout our relationship. I want the majority of my business to come from referrals. My commitment to you will express that. I want you to feel like I have done such as great job for you that you will refer me to your friends and family.

Are there any disadvantages to the buyer?

There really are none! Our contractual working relationship puts your interest first. You have hired me to be in your corner. We can be honest with each other and I will become your negotiator and teammate throughout our relationship. You are committed to me and I am committed to you.

Is it good for the seller?

Yes! Working with a buyer's agent is great for the seller. A buyer's agent is more prepared and has made sure their buyer is ready to go through with the purchase. A vetted, motivated, and educated buyer is what the seller is looking for. A buyer's broker represent only the buyer so the parties don't have to worry about misrepresentation.

Will it cost me extra?

No. The commission I get paid at the end of the day for successfully completing my job (I don't get paid until we find you a house) comes from the Seller's side. In fact both agents get paid from the seller's proceeds at the end of the sale. On the rare occasion there is a For Sale By Owner where agents aren't compensated, I we can talk about my fees then. For Sale by Owners end up selling their houses considerably under market value so that well makes up for my commission.

What if you are representing both me the buyer, and the seller in the purchase of my new home?

We call this Consensual Dual Agency. In this care I would have the written consent of both parties and a statement explaining my compensation. I would take no action that was adverse or detrimental to either party. I would be very careful not to disclose any information provided by either party to one another. I would disclose any conflicts of interest. I would adhere to all other elements of the Law of Real Estate Agency required by the State of Washington and my contractual relationship with you.

Helping you find and purchase a home is only one part of my job. I will also:

- Explain real estate principles, contracts and documents

- Refer you to a reputable lender that can assess your financial situations and pre-approve you for a loan

- Help you determine the types of neighborhoods that meet your needs

- Arrange tours of homes that meet you criteria

- provide you with details information about homes you're interest in

- Assist you in writing and negotiate a mutually accepted purchase and sale agreement

- Accompany you to your inspection

- Coordinate necessary steps after inspection

- Work with the escrow company to ensure all needed documents are in order and completed in a timely manner.

Whew! That was a lot of info! But the good news is that you graduated "First-time home owners" boot camp.

Next: Proceed to the Home Buyer's Guide!

If you are a seasoned home buyer or have just completed my First-time Home Buyer's Guide, start here!

I've outlined these steps to give you insight of how we will work together to buy your new home

Welcome!

So you've decided your ready to buy some property?

Well you've come to the right place.

My website and videos are geared to those that want to be proactive in their home buying. The ability to have me repeat a point, skip ahead, and try-before-you-buy me allow me to help you to become an awesomely well-informed consumer and more importantly - a future friend. I hope before we even begin with your very own home search I will have won your trust and have proven myself as knowledgeable, capable, and competent to you.

Already feeling bold? Here's a link to contact me today!

Are you willing to put your trust in a complete stranger?

This undoubtedly a pretty tall order and also why in Real Estate most of our business comes from referrals from past client and friends. A referral is more than just a recommendation, it is a transfer of trust in the biggest investment of most people's lives. So when a real estate agent is referred by someone, they must be pretty certain in the agent's ability to preform, otherwise they might end up with egg on their face.

However, not all folks have friends or family they can ask for trustworthy real estate agent, perhaps a terrible experience the last time made them distrust all agents? Or perhaps they have recently moved, or are preparing to move, from California or Texas to Western Washington. How do they pick a trust worthy agent out of the hundred of strangers?

My answer to this question is this step-by-step guide into getting you into your home. I hope I can educate, entertain and win your trust, all from the comfort of your couch.

Wondering we'll cover in the steps ahead?

It's my secret sauce on how I will be helping make you make good decisions. Here's a quick executive summary to what I cover in my Home Buyers Guide:

Step 1 - Greeting, meeting, and consultation - This is our first meeting where I will get the chance to ask you a bunch of questions to get to know you better and understand what type of property is right for you.

Step 2 - Getting pre-approved and becoming an Astute Buyer - Review there wisdoms to make ensure you'll be getting your mortgage as planned. After you meet with your lender of choice, our education process will continue with a second buyer consultation meeting. Here I will go share previously experience, come up with a game plan and prepare your expectations when it comes to the home buying process.

Step 3 - Viewing Properties - I will arm you with the know-how and print-outs to become an expert property hunter. I will inform you how I will ask you poignant questions to gauge your interest in the property and how we will be using a rolling top 3 to find find your favorite home.

Step 4 - Putting in an Offer - What are the components/forms to a potent contract?

Step 5 - Closing Process, Keys, Closing Costs and next steps

- Closing Process & Calendar

- Keys

- Closing costs

- Property review

- Outings

Step 7 - The Not so FAQs of home ownership of county living

Let's proceed to Step 1: Rent or Buy?

Step 1: Meeting, greeting, and consultation

Content includes: Our first meeting

Hello! Pleasure to meet you. My name is Christian and I'm an advisor and a problem solver. I help people do what they already want. Although I am in the sales business I'm not a salesmen, I'm a more of a consigliere for you and your family. Main sole purpose is to do what's in your best interest, and for me to know what's in your best interest I will be asking you a series of foundational questions. We will need to set about an hour aside for our meeting to give us a chance to talk about the market conditions, the buying process and give me an opportunity to ask a series of questions so I can help you find a home that matches your needs:

- The first series of questions will help me determine how to match your lifestyle to the house

- Would you tell me a bit about your and your household? (Children, Mom and/or Dad, Pets, etc)

- What does everyone do for work? (Where? Commuting? Working from home?)

- How about recreation? (Proximity to fun!)

- If I could wave a magic want and you could be anywhere, where would you be?

- The second series of questions will let me find out more about your Real Estate Experience

- Do you currently rent or own?

- How long have you lived there?

- If you own, how was the process of purchasing this home?

- What was the best part?

- What was the worst?

- How many homes have you owned?

- How long have you been looking for a home and what sources have you been using? (websites, open houses, other agents)

- Have you found any homes that you would like to buy?

- The third will test you if you've properly completed the prior steps in this guide, Financing

- What price range are you looking at?

- How did you arrive at that price and are you flexible?

- Have you met with a lender? If not, would you like my help?

- Do you need to sell your current home first?

- Is there anyone else that will be involved in the financing?

- Do you currently have funds for a down payment?

- The fourth series will let me determine your schedule

- When would you like to have this move completed?

- Why is this date important?

- If it takes longer, what impact will that have?

- If we fin d a home right away

- The fifth series will let me refine the search so the homes will best suit your needs

- What features do you like best about your current home? Least?

- What is your favorite room in a home? Why?

- How large a home would you like? Why?

- What style of home would you like?

- Is there a style you would NOT consider?

- How do you feel about buying a home that needs decorating and/or remodeling

- What are the three most important features you want in a home? Why?

- Do any of the following items affect your search?

- Hobbies

- Schools

- Furniture

- Pets

- Public Transportation

- Health Care

- Walkability

- Of all the thing you are trying accomplish with this move, what is the most important?

- Lastly I'll ask how we should best communicate

- Text? Talk? Email?

- Feel comfortable with e-signatures and digital forms?

- Frequency of communication?

- How often will you be able to look for houses?

Property Funnel Process (CURRENTLY ON HOLD - IN THIS MARKET SINCE THERE IS SUCH LITTLE INVENTORY AND PRICES ARE BANANAS)